In my previous columns, I discussed the advertising industry and its relation with Telecom sector in detail. In this article my focal point will remain the banking sector and few of its ads. But before discussing the current banking situation, I want to overview previous few years regarding finances of Pakistan.

In previous regime, I mean Musharraf’s era, lots of new products evolved; like credit cards, ATMs, E- banking, small loans for common people and what not. We used to receive multiple calls a day from banks offering one or the other product. Tele sale representatives used make hundreds of calls daily to meet their targets. In short we had eight years of boom in banking sector with higher foreign reserves and stronger economy every month.

Instead of discussing rights and wrongs of that time, we need to focus on results.

Interest rates were as low as 9 or 10 % during that time. Even the Central Directorate of National Savings (CDNS) had come down to its lowest mark up of 11%; earlier on which was 18%. People withdrew their heavy amounts from banks and CDNS and invested millions in the property sectors; resultantly real estate industry touched new height of success, created plenty of jobs. We know that real estate industry boosts at least 10 other allied sectors. So during that era Bahria Town, Giga Mall, Emaar Pakistan and many other builders and developers were on the rise.

Apparently, from a layman’s viewpoint, policies then were business friendly, stability in the government and investors had the confidence to risk huge investment.

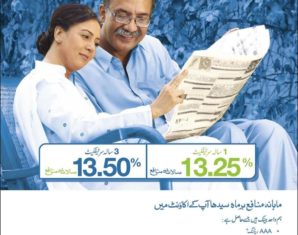

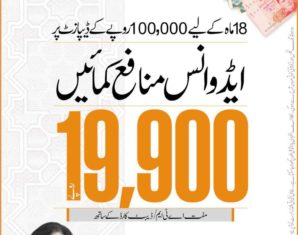

However, the situation has dramatically changed, as now banks are again hungry for funds. In the last few months or so, we have seen a new trend of advance profit in the banking sector. ABL, The Bank of Punjab, Atlas Bank have already announced the best possible advance profit for the customers who have money more than Rs. 50,000/- and want handsome profit immediately. ABL has offered Rs. 13,500, while Atlas Bank has offered 16,000 and last but not the least, The Bank of Punjab has offers Rs.19,900-advance profit for deposit of Rs. 100,000/- for a period of 18 months.

According to the resources, ABL who was the first bank to offer this unique profit has bagged over 5 Billion in one month. Atlas bank made one billion, however Bank of Punjab failed to capture the response in terms of finances, but it managed to get over one million calls from customers during the week launch of PEHLAY MUNAFA SCHEME.

Frankly speaking, The Bank of Punjab campaign was better with bigger impact. BOP’s print ads were wonderfully design with unique color scheme with one picture of happy man or women. The huge impact was made by the figure of Rs.18,900 while the other information was in lower font. This was the main reason behind tremendous response that Bank of Punjab got.

On the other hand, CDNS is also trying to attract more investment by increasing its profit rates on all the schemes with highest profit rate up to 17 % and biggest prize of 7.5 crore on the bond of Rs. 40,000. Although, CDNS has yet to announce their advance profit scheme, however, they are focusing on increasing profit rate which is now 3 times as of July 2008. Sources in the CDNS confirms that they will not launch any scheme like advance profit in near future. It is worth mentioning here that CDNS has huge investment of 1283 billion rupees and it has set a target of 150 billion for the current fiscal year.

It seems that we are forced to just put our money in the banks and enjoy the interest. There is no need to work or taking risk to invest money in any type of business. This will also lead to more foreign trade deficit, which is already worsening and crossing US$ 10 billion. Remember that this gap was 1 billion US dollar in 1994 and at that time US $ had a price value of Rs. 36.

According to the sources, this race of advance profit will be intensified in the near future and more banks will offer higher and advance profit like MCB, Bank -al-Falah, National Bank. So my advice for you people is to wait and see what is the highest bidder of your Rs. 100,000/- for 18 months?

Lets pray for our country, our economy and our future be in safe and secure with one and only dream of prosperity.

There are a couple of invalid points in the second last para:

a. Nobody “forces” a consumer to put his or her money in bank. Consumers make rational choices.

b. All investments have an inherent risk the same reason the return being offered is higher than normal

c. In essence banks work by attracting deposits and lending it to consumers or corporate which in return is used for expansion project or meeting working capital requirements. So higher deposits explicitly lead to higher capacity of banks to fuel economic growth. This has nothing to do with the trade deficeit as depicted above.

qome ko seed khila khila k bay gherat kia hua hai

Cool, very good article. I enjoy to read it. Good approach and market data. Cooool!

I like its