The process of PTCL privatization was initiated in November 2004, when Privatization Commission invited Expressions of Interest through advertisements in local and international newspapers. Early in January 2005, 18 companies registered their EOI (Expressions of Interest), out which 3 bidders qualified for the final bidding which held on June 18, 2006.

Consortium of Emirates Telecommunication Corporation (Etisalat) and Dubai Islamic Bank, Etisalat International Pakistan (EIP) gave the highest bid US $ 1.96 per share, equivalent to PKR 117.01 per share, which translates into US 2,598,960,000 (2.599 billion) or PKR 155,157,912,000.00.

Cabinet Committee on Privatization approved EIP offering the highest bid of US $ 1.96 per share, as the successful bidders. The price offered by China Mobile was US$1.409 billion and SingTel was US$1.167 billion. Thereafter the first installment of 10% of the bid price was paid and the SPA (Share Purchase Agreement) was signed on June 30 2005.

The SPA lapsed and legally terminated in September, 2005 as EIP could not pay the balance amount within the prescribed period.

However the interesting observation is that Government of Pakistan did not grab the earnest money of US 40 million dollars. Instead series of meetings were held between EIP and GOP officials in February/March 2006 and pressure for additional concession and modification of earlier agreement was exerted. As a result, various concessions and changes in first agreed SPA & SA were signed between Pakistani Government and EIP on 12.03.2006 and the management of PTCL (including its group Companies, i.e., PTML and Paknet) were transferred to EIP.

Signing of SPA and SA was not in accordance with the terms and condition of public offering given through advertisement and competitive bidding process as they were carried out secretly.

After having a close look up of agreed decision and after the termination of first SPA, it reveals that government of Pakistan gave significant direct benefits to the buyer immediately and the conferred financial benefit over the period of its operation. Major concession is that sale price staggered over a longer period. Against the accepted bid of US $ 2.599 billion, the EIP was allowed to make delayed upfront payment of US $ 1.4 billion including earnest money and first installment. Balance amount to be paid over nine semi annual installments in a “pay as you earn” model.

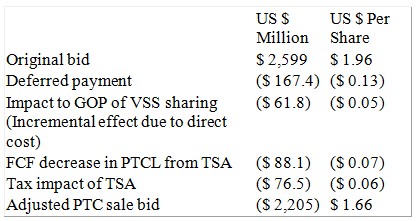

The impact of other concessions like sharing the burden of Golden Handshake scheme, which would be granted to only 20,000 employees, with government of Pakistan (mentioned in element 3 of Agreed Agreement) and allowing enhanced rate for payment of Technical Fee to the Etisalat, etc., have been worked out by the relevant authorities.

As per clause 7 of the decision made by Cabinet reveals following information

Difference between the original bid price and the adjusted bid price comes to US $ 394 million (or Rs. 23.64 billion) which was a sweet gift for Etisalat and a direct loss to the government exchequer.

Sale of 26 percent of PTCL shares was a matter of national concern. Reconsidered agreement involved compromises which would cost heavy harms towards the national asset. Impact of these concessions cannot be easily quantified but their financial nature indicates why the buyer negotiated so hard to get them.

Element number 2 in Annex-II of Sale Agreement says that to acquire 25% of the “A” shares (reserved shares) on the discretion of EIP wherein other telecom companies would not be allowed to participate in bidding of future shares of PTCL”

This concession grants un-competitive advantage to EIP for future purchase of 25% “A” Shares of PTCL in which no telecom company would be able to participate. EIP with its first right of refusal can easily manipulate the next bidding process to its advantage resulting in a very low bid price of additional 25% shares of PTCL. The transaction is therefore outcome of a process reflecting serious violation of law and gross irregularities with regard to sale of the highest profit-earning State-owned company.

Official response of government is that total amount receivable would still be US $ 2.599 billion without disclosing that this would not be in one go as originally envisaged but over a period of 5 years which reduces the effective price on the basis of present value analysis. EIP was given unique advantage for paying the remaining amount on “pay as you earn” model.

Permissions granted to EIP, after the purchase of 26 percent shares, to fully control the management, which is against the provisions of Companies Ordinance, 1984.

PTCL sources have confirmed that no Comprehensive Value Assessment was carried out before the sale of company’s share. Sources told that the value of assets was calculated from historical book instead of Market Value of Nation’s assets, which obviously counts the difference in billions of dollars.

The sale PTCL’s 26 percent shares can be closely related with Steel Mills of Pakistan case. It merits mentioning here that sale of Steel mills was declared void because numerous concessions had been granted after the bidder had been selected.

A CEO of cellular company while speaking to us said that the deal involves misjudgment of asset valuation. He further said that 26 percent shares of PTCL were handed over in only 2.6 billion dollars, which included PMTL (Ufone) and paknet as well. He was of a view that a very careful estimate suggests that Ufone worth more than US 6 billion dollars.

It is to be noted that a petition has been filled in Supreme Court, and is waiting for hearing, that challenges the sale of 26 percent shares of PTCL. Mr. Shaukat Aziz Siddiqui accused the sale of 26 percent shares as illegal, unprecedented, unlawful and of no legal effect. In the response to Presidential Reference against Chief Justice, Justice Mr. Iftekhar Chaudary, he had said that he was facing pressure over the PTCL’s privatization case as well.

After a deep look at final “Agreed Agreement” summary presented to Cabinet Committee on Privatization and the copy of petition filed in Supreme Court, one can depict the story as very confusing. Supreme Court of Pakistan may solve this ambiguity that why the Government of Pakistan gifted the most valuable asset of Pakistan to Etisalat, on all the conditions that were set by Etisalat.

Note: This story has been prepared while keeping in view the history events, and through following references. All facts and figures are carried from the references, which are as following,

Dawn

The News

The News

Telecompk.Net

Etisalat is the most monopolised company in the world , they suck every pint of blood from customers pocket, In uae the international calls and DSL is so expensive that one have to think 1000 times to spent on these..

Etisalat, even after getting these benefits, is proving burden on Pakistan.

These Arab investors are always Blah Blah! crows.

After getting these benefits, why were they showing concern over GOP giving license of 3G to any other company and their attitude towards Zong.

Parliament should help in dissolving deal with these corrupt mumuring Arabs!

..

And, Please Aamir don’t edit it again! Hun itna Hola haath rakhna vi changa nai, national interest vich-Kioun sahi hai na?

Sheikhs are greedy monkeys

i think the actual question is kay GoP ne Etisalat ko itna facilitate kyun kiya…in uae etisalat ki total monoply hai…and now in pakistan thay want to be a monopolist…and GoP is going to help them.

I m a student plz tell me that how many shares of ptcl company?

I wonder as to who is that CEO who calculated the value of $6 billion for Ufone? Can he explain the working behind these numbers to us because that will surely prove useful to everyone in the industry. I am sure your readers take your words as facts but i am challenging it so lets see how this so called CEO can prove his numbers in broader sense as to how he came out with $6 billion?

Finally , someone has started putting it all together. Excellent article.

As a rule of thumb, a national asset like PTCL which is an intelligence asset , should never be handed over to a foreign government.

This is an illegal sale, and should be reversed. The people of Pakistan should escape from the cluthes of Etisalat.

NH

These culprits had been selling the assets of Pakistan for years because after all they remain unpunished.

May Allah protect us(Pakistanis) against those bloddy elements of this country who are ready to sell each and every asset of our beloved country.

We expect a historical decision in this case from our judiciary like Steel mill case.Inshallah

Being a Loyal Pakistani i was wondering on first deal when GoP given Management & other shares to UAE guys,

We not given the department like PIA & Railway who are burdon on our heads but our Rulars are selling like PTCL, Steel Miles & other who are giving Profits.

No Doubt the CEO Walid Irshaid of PTCL is Very good Technology main & he know to Facilitate PTCL custoemrs with new Technologies but over all he is also employee of Etisalat.

This money is going from our pockets to basically that Sheikhs who has thousand of Oil Wells & earning million of rupees in tourism in Dubai in terms of Night clubs.

our Govt formula is that these Rich peoples will invest inside Pakistan & bring technology here R&D Level. But no once invested, Neither PTCL or Telenor. they are making there own infrastrutre to earn more in coming years. But no body even Huawei who is earning in Billions of Dollars from Paksitan Telecom bring any small R&D or Manufacturing plant!!!

We have to learn lesson from India. India is buying just G.SHDSL CPE from RAD (an Israeli) Company, but MROTEK is make deal with them & now these Modems are being manufacturered in Inda & they open there RAD India office & prodcuing locally, in this way indian getting job & prodcuing Telecom things locally.

But we bough million of ADSL CPE’s from all over the world but with this intrest that our business grow & we earn.

I am requesting trough this forum to Mr. Najib Ullah Malik (Sec. Telecom) to please work toward this theory & try to bring at least one R&D Level technology & Factory plants for Manufacturing bulk things like DSL Modems, USB stick, Wireless Modem & small LAN switches.

I am also from telecom market. I will be happy if we can assist any one.

Proud to be Pakistani.

This is Pakistan my freinds. Reports like these only cause increase in frustration to a patriotic common man, and for the so called elites of this country this is just there chance to grab and steele whatever they can and through whatever means they can that’s all. They are all same, and belongs to the same class of robbers, or rather should call them termites, eating the resources of this country for the past 62 years.

Sale of 26 percent shares of PTCL has turned out to be the most ambiguous financial deal ever carried out in national history. Important documents relating to the said deal, which include ‘Summary for the Cabinet Committee on Privatization of PTCL’ and the agreed ‘Agreement of PTCL’s Sale’, revealed shocking hidden truths of this sale out. It is wondered why the agreement pertaining conclusion and decisions were not made public, while they are of immense national interest.

The question is who made this deal Was it Privatisation commission or MoITT

Those who are involved in this huminous crime must be brought to book.