By Qasif Shahid, Head of Digital Banking at MCB

What mobile phones have done to landlines in this country is exactly what mobile wallets are about to do to bank accounts. Over the next 3 to 5 years, the numbers of mobile wallets will far surpass the good old bank accounts. Why?

Simple. Both landlines and bank accounts are privileges and will remain so. These are services and the infrastructure and the processes that power these services are anchored in the physical world. These utilities largely run on proprietary real world infrastructure such as the wired network, bank branches, ATMs, Point-Of-Sale (POS) networks, exchange-houses and so on. And to top this, the on-boarding and the application processing for these services also unfold within the physical value chain and which means that ‘time and space’ rules apply.

In most cases, actual forms are filled and transported from one location to another and sometimes to different cities before the data is manually put into various systems several hours, days and in certain cases weeks later.

The only way to cut through these time consuming, laborious and non-valued processes, it seems, is through knowing someone on the inside to help push the ‘physical file’ to the top of the processing heap.

On the other hand, the next generation mobile wallets (as they come into main stream existence which btw is about now) will run on wireless protocols and will not be privileges any more.

Think mobile phones of today; all you need is a valid ID card and the mobile phones are yours to have. So technically speaking all you would need is a functional mobile phone backed with an ID card and the mobile wallets will be yours to have. And if designed properly, this will happen without any work being done in the physical value chain almost mimicking the experience of making an e-commerce transaction on your smart phone through feeding in your particulars online.

Extending the same thinking into the near future, it won’t be farfetched to imagine mobile wallets that will be easier to own as opposed to applying for a brand new mobile phone connection in the first place. Why?

Simple. Owning a new mobile connection will still involve evoking parts of the physical value chain to execute. Think the SIM card and in some cases the handset that would need to be purchased as opposed to the wallet that resides in the cloud and is down loaded over the wireless internet in shape of a mobile app.

Let’s — for a moment — step out of the payment space and into what is been going on in the rest of the world. Immediately it becomes apparent that people today are behaving, living and spending their time in radically different ways than what they were doing just fifteen or twenty years ago.

We do not visit libraries, consult or print encyclopaedias any more. Fact based knowledge and curriculums have little value; it is about how these facts are put into context and concepts which really counts now as the rest we can just Google in real time. And we GOOGLE many times more than we ever visited libraries or consulted books.

We do not write letters anymore unless we are sending a legal notice to someone. Instead we write emails many times more than we ever thought about writing with pen and paper. Our emails get to the destination instantly as opposed to paper based communication and we expect and almost demand immediate responses to almost everything that we write today.

For most of us, news is now consumed in bit size pieces several times a day and newspapers have long seized to exist as chief sources of real time happenings that we as individuals are interested in. People today are making more connections with their friends and family in a single day as opposed to what they were earlier making in a year.

The point of all of this is to bring to notice how almost everything stands redefined in frequency or consumption as ‘change’ or ‘graduation’ is made from the physical value chain to the digital.

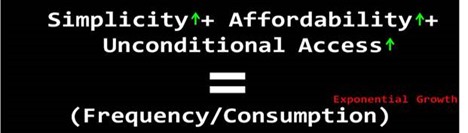

This occurs due to dramatic reduction in costs along with the services or the utilities becoming much simpler to operate and going real or near-time all at the same time as this transaction is made from physical to the digital. Have a look at the following equation to better understand the exponential growth impact of this digital transformation as it takes root in whatever it touches and redefines.

One thing however hasn’t changed much over the last 50 years: the way people handle and manage money and the way payments are made. The ATM looks the same and performs pretty much the same functions. The POS machine is exactly the same and so much so that even the colour of the casing is the same dull grey or black. The plastics have the same DNA and no radical change there either. Now compare this to the radio, TV, Phone or any other device that comes to mind and see how much those have changed in the last 4 or 5 decades to get a perspective of the lack of change in the way people handle money and make payments.

The big question really is that how is it that the banks, the payment gateway associations, POS/ATM manufacturers etc. have managed to stick to the old ways for so long in face of such colossal changes elsewhere?

To understand this phenomenon, one needs to deconstruct the payment dynamic and reduce it to its simplest form: There are two maim actors in the payment dynamic the seller or the merchant and the buyer or the customer.

The banks and the payment associations are only the enablers or side actors if you will. In the past and in the present, the side actors were enabling payments by dealing in the physical value chain doing real work in terms of deploying the POS machine and connecting it to the network, managing the pre authorization, settlement, repudiation functions and so on and hence the justification for 3/2 percent Merchant Discount Rate (MDR) charged to the seller or the merchant. The card is produced, personalized, packaged and shipped to the customer and this obviously requires work to be done in the physical value chain and hence the fee levied in shape of annual and other charges to the customer.

Fast forward to the present and the near future; things have changed. Both buyers and sellers own smart phones connected to the wireless internet. POS machines or plastics are not the only options available anymore and the transactions don’t have to be delayed anymore either as they will happen in the real or near real time through mobile wallet-to-wallet interactivity with little or no cost to the parties involved.

Savings in MDR and instant credit are not the only benefits that we are talking about here. The big break through is about bringing into reality a completely new connection between the merchants and the customers that was impossible to conceive earlier.

Think of a ‘zero-cost’ app-to-app or wallet-to-wallet notifications over the internet that the merchant will now be able to send to the potential customer handsets informing them of 50% discount if they bought within the hour or for example till stocks last. Customers will have the option of buying instantly through the mobile wallet sitting at home or while in the store.

A little stretch of imagination and the picture of complete disruption of the retail space (including pre-sales, actual purchases and post sales scenarios) at the hands of smartphones powered by the wireless internet and linked with mobile wallets starts to reveal it-self.

Let’s examine what’s going on in some of the other industries. New age technology companies have made a habit out of disrupting the good old Mobile Network Operators (MNOs). The 20 year old SMS service is already been disrupted by Whatsapp and so many other similar messaging services. Skype and Viber are disrupting the standard and international calls and similar disruptions have become pretty much a norm across several other markets as well. Why?

Simple. These services are distributed digitally in real time and are device and platform agnostic but most of all they are free or have a price point close to zero. How do you compete with such an onslaught if your propositions still partly or wholly deal in the physical value chain? You can’t. You simply get disrupted!

There however still remains one little spec of silver lining in the cloud: When the incumbent industry gets inflicted repeatedly with disruption, sometimes the disrupted players develop resilience and get really good at dishing out the similar treatment to cross industry players. So the MNOs after being disrupted repeatedly by the new age technology companies are now getting good at disrupting the retail financial services industry. MNOs are striking back through the combination of agent network and mobile wallets to disinter mediate the bank branches and the bank accounts and in certain cases the payment associations as well.

Instead we think about what we need to accomplish and consume and payments as necessary enablers for doing just that. This would mean that the more payments fade away in the background, the less visible they get, the more effortless handling money becomes; the faster these new behaviours would spread and take root.

Also we need to remember that payments don’t unfold in a vacuum. They always unfold in a social context. In case you are thinking about business payments these too have a social backdrop to them.

The wallets of the future or at least the ones that would disrupt or attain any meaningful scale will be built and designed on the fundamentals and principles of the social networking platforms.These will be networked-financial services products at their core with going-viral built into their DNA and not as marketing after thought.

These services will come without any preconditions and will be platform independent meaning bank, telecom and devise agnostic. These wallets will reside in the cloud and will be distributed digitally and initialized or personalized sitting at home.

Just as nobody could predict 100s of pictures almost every short vacation taken these days and that too mostly ‘slefies’ to be shared on sites like Instagram; it is almost futile to attempt to predict just how many payments a day people will be making as mobile payment transformation and the related ecosystems get going. May be 10, may be 20, or maybe 30 a day; who knows, it is anybody’s guess. But one thing is for sure; we will be making a lot more of these payments through smart phones as our new payment contraptions compared to what we are making in the physical world today. And let there be no doubt that there will be a lot more of these mobile wallets around to make these payments from.

Buckle up! There appears to be serious payment-disruption brewing just right around the corner to where we have already arrived in this country.