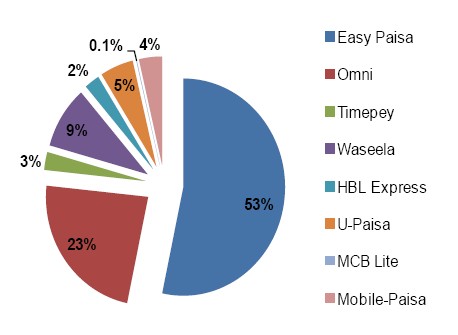

Easypaisa managed to grab 53% of total branch-less banking transactions carried out during April-June 2014, almost double of its nearest competitor UBL Omni, which held 23% of BB transactions during the reported duration, said State Bank’s latest stats.

After Easypaisa and UBL, Waseela’s Mobicash became the third major MFS player with 9% percent market share. Ufone’s U-Paisa managed to get 5% market share while Warid’s Mobile Paisa service retained 4% of market-share during the reported duration.

Share in Number of BB transactions

It is seen that Telco-lead services are mainly driving the BB sector while bank lead services (except UBL Omni, that mostly deals with government payments) are mostly struggling. Take example of HBL express, which has only 2% market share despite the fact that they had started services way ahead of Mobicash and U-Paisa or Mobile-Paisa for that matter.

Increased Competition from New Players

Above figure suggests that established MFS players still hold a noteable share in the sector however their growth rate remained consistent during the reported quarter as new entrants are doing well in terms of snatching the share from bigger players.

Overall almost no growth in volume was seen in EasyPaisa and UBL Omni during the quarter, whereas U-Paisa grew by 46% and Mobicash grew by 26% in volume during the quarter.

Increased growth in new players’s market-share is mainly attributed to shared-agents that were previously selling Easypaisa-only products but now they are lured by new-entrants with more incentives. The situation is alarming for Easypaisa since they invested a lot of time and resources to get the agents the required training and customer-base, which is now freely capitalized by new-entrants against extra-incentives.

Easypaisa is naturally concerned about the situation and is currently lobbying for regulations against agent-sharing, however, the fact remains that agents were never signed for exclusivity and this is where new-entrants found their way to creep up their market-share.

This scenario will also benefit the end-users who are likely to get more innovation in services at lower-costs. With increasing competition, associated services charges are now finally going to get lower that will ultimately result into more inclusion of masses towards branch-less banking.

Not to mention, Easypaisa recently waived service charges for funds transfers between mobile account to mobile account. One can expect more such steps from MFS players in the coming days.

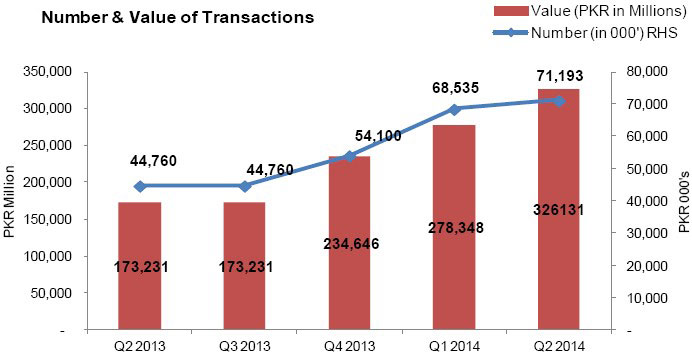

Branchless Banking Stats for April-June 2014

Regulator said that a total of 71.1 million BB transactions — worth Rs 326.1 billion — were made during the quarter that ended June 30th. Sector witnessed 4% increase in volume of transactions while 17% growth in value of transactions when compared with previous quarter.

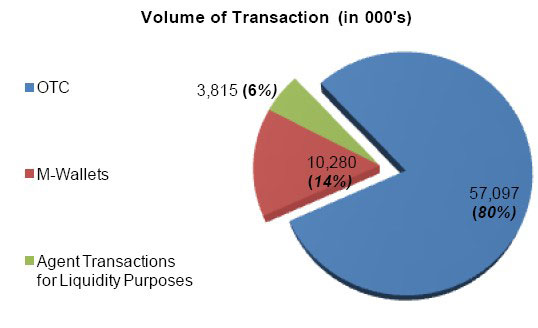

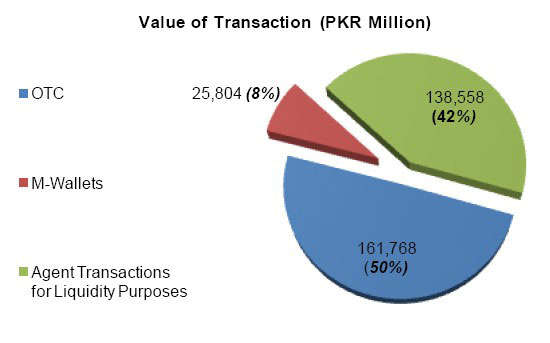

State Bank said that OTC (Over the Counter) transactions remained customer’s preferred mode of transactions during April-June 2014 with an unchanged share of 85% in terms of volume. In overall terms, the share of OTC transactions volume remains at 80%, whereas in terms of value, they seized 50% share, lower than 52% last quarter.

The share of m-wallet transactions has remained at 14% in terms of volume and 8% in terms of value during this quarter. Furthermore, the share of agent transactions carried out for liquidity purposes remained the same at 6% in terms of volume, and rose to 42% in terms of value (from 40% in previous quarter)

Mobile Accounts

During the quarter 428,890 new BB accounts were opened, prompting total BB accounts to increase by 11% (compared to 10% last quarter) and cumulatively reached 4.2 million in number.

Out of the new accounts opened, 94% were m-wallets which have now reached 4.1 million in number. Whereas 6% were Level 3 BB accounts for agents. Furthermore, out of the total m-wallets, 97% were level 0 accounts, driving total level 0 accounts to reach 3.0 million in number.

As the number of accounts is increasing, so are the BB deposits which have increased to Rs 6.2 billion as of June 30, 2014. From the total deposits, 53% stem from agent accounts and 42% are attributed to Level 0 accounts. Moreover G2P accounts are also currently holding Rs 3.6 billion in deposits.

The market leaders remained at the top in opening new BB accounts. Around 60% of the new accounts opened during this quarter were by EasyPaisa followed by 25% by Omni. However the highest growth in account opening was seen in Mobicash whose BB accounts grew by 40%, which has now placed its market share at 2%.

EP is very well maintaining the lead that it secured by having the first mover advantage.

Agreed

Getting advantage of being pioneer. Basic ingredient of Brand Building.

Agreed.But they are working hard for retaining their position.

sab say fazool mobi cash hai

can we have online payment gateway from them?

Warid Great work … :D Smallest network but it has name in list… wow

mobile paisa by Warid is youngest and secured 4% market share. It’s really a growth.

HBL EXPRESS bhi theek ja raha ha or kafi growth kar raha ha