The government will soon make operational a new system to create an Electronic Data Interchange (EDI) with Afghanistan and other important trading partners to plug revenue leakage through mis-declaration and under invoicing on imports.

According to the latest report from Federal Board of Revenue (FBR), Pakistan is losing a around $2.63 billion revenue a year due to smuggling of just 11 goods that were studied in report.

The losses were calculated by aggregating numerous customs duties and state taxes as were applicable at the time of the study i.e. last year.

FBR report has estimated the value of these 11 goods at $9.1 billion. The revenue lost in the form of duties and taxes on smuggled goods could be far higher than $2.63 billion or Rs. 276 billion, if the scope of the study is widened to all the smuggled goods.

59% of phones or $4.4 billion worth of phones shipped in Pakistan are smuggled

Out of $2.63 billion losses, the country sustained $1.1 billion losses due to smuggling of mobile phones. The estimated value of smuggled phones was $4.4 billion and the smuggled phones met 59% of the country’s demand.

To plug the leakages in revenue through mis-declaration and under invoicing, EDI (Electronic Data Interchange) is already being established with China. In the next stage, EDI will also be established with Afghanistan and other important trading partners of the country.

In this regard technical details like development of the software, data mapping, customs procedures etc will be finalized soon. Business process will be designed and developed for transmission, receipt and use of the Certification of Origin (CO). Electronic issuance of Certificate of Origin (CO) for the Trade Development Authority of Pakistan (TDAP) has also been developed.

Total worth of smuggled goods in Pakistan go well beyond $10 billion a year

However the government is claiming that it is vigorously pursuing the policy of strengthening and invigorating the taxation system so as to achieve the overall economic objectives by providing level playing field to all sectors of economy.

Through automation and computerization, collection of duty and taxes at import stage has been made hassle free and cost effective. Legitimate trade is being facilitated through Pakistan Customs computerized clearance system, WeBOC (Web based One Customs).

Currently there are more than 58000 users of this system including clearing agents, traders, terminal operators, cargo handlers, shipping agents, bonded carriers, warehouses and airlines.

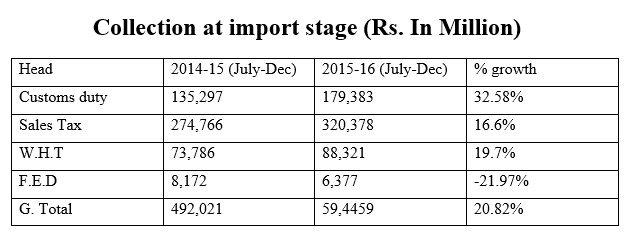

As a result of these measures and better administrative performance the tax collection has improved as detailed below;

Majority of Pakistani’s want to go through from proper channel. Better focus on proper & hassle free transparent channel & smuggling will be only done by 4-5% corrupts

Majority may want to go to proper channel but 30% duty on all imported electronics have thrived smuggling industry

interesting info

Not everyone wants to evade taxes despite knowing where the tax money is spent. It’s just that the Customs mafia covers up the smuggling losses by charging duties up to 70% on simple books from Amazon. Or health related supplements at 78% duty of the product value.