When 3G/4G licenses were granted in 2014, there was a lot of talk on how the market will shape, what will happen to data revenues, who will be the winners and who will find it difficult to justify the 3G investments?

In my blog back then “Leaving the gates open” I had predicted that Zong, by virtue of acquiring both the 3G and 4G licenses, has bought an advantage over others and that Ufone, Telenor and Mobilink may have given an opportunity to Zong to gate crash.

I had also predicted that Warid will have a tough time without the 3G licenses and the best strategy for them was to find a buyer. It’s almost two years since then and it would be interesting to analyze the performance of each operator.

But before we go into each operator’s performance, it would be interesting to see how the overall market performed after the licensing.

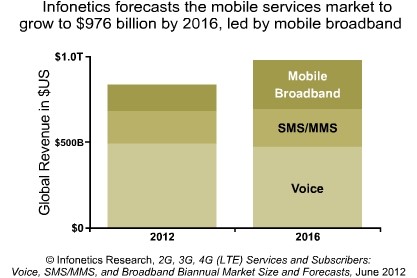

By the time 3G licenses were given, the data contribution in the total revenue was around 4%. The January 2016 numbers are showing that the data revenues have now grown to 12% of the total revenue. This is a three times increase in share in less than two years, which can be termed as a good performance.

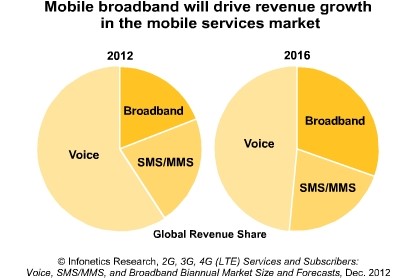

The data revenue growth from 2014 to 2015 was a staggering 101% while the predictions based on Jan 2016 numbers estimate another 83% growth over 2015. This in the backdrop of a lackluster overall revenue growth performance during the same period – is a definite tell tale and sign of things to come. The writing is on the wall for voice revenues and operators need to factor it in their long-term plans.

Just so that we put things in some perspective, in India the data revenues are touching 18% of the total revenues while US and UK markets have data revenues over 50% of over overall telecom revenues.

One way to look at this is that we have already seen zero growth in the voice revenues over the last 2/3 years. The only growth is coming from data revenues. Going by what happened in the western world the maximum it can reach is 50% of total revenue (don’t know in 5, 10 or 15 years).

Total data revenues expected in 2016 are around Rs. 45 billion, while the voice revenues stand at Rs. 315 billion. A simple calculation tells us that there is potentially Rs. 266 Billion more revenue out there to be achieved through data. This will take the industry revenue to around Rs. 620 billion. That’s the maximum. Period.

So this is how important data is! All of the growth is going to come from data. And how are Pakistani operators doing in this market? Lets try to dig out by having a look at below graphs:

By looking at the above chart it is interesting to note that Zong has the highest market share in data revenues among all operators. It is even more commendable when you see that Zong’s overall subscriber market share stands at 21% in the same period. But this static chart doesn’t tell the real story. When we look at the same data for the year 2014 (the year 3G was launched) an interesting conclusion can be reached.

The above chart (comparison of data revenue between 2014 and Jan-2016) reveal that after the launch of 3G/4G services in 2014, Zong has achieved the biggest gains in data revenue market share. A whopping 15 percentage points! Mobilink and Telenor have lost 7 and 10 percent points respectively over the same period.

Warid has lost one point while Ufone is the only other company to have gained market-share, 4 pp, during this period.

Exactly the way I had predicted back in 2014 — that by not going for 4G, Mobilink, Telenor and Ufone were leaving the gates open for the Chinese company — Zong grabbed the opportunity with both hands and ran away.

Considering that all growth from now will come from data, that’s a very clear sign that Zong will take the major share of growth in the future.

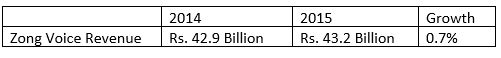

The only point of concern for Zong should be that their dominance in data has not gotten them the high value customers from other networks, which would have given them a boost in voice revenues. This would have been a major argument while going for the expensive 4G spectrum.

Some Suggestions Going Forward:

Zong:

Need to focus on getting high value customers on board through;

- Improving Brand equity in HVC market

- Create Channel Relevance for HVC Market

- Organization Structure needs to follow strategy

Ufone:

If there is no investment in 3G/4G, Ufone can forget about growth. With the spectrum Ufone has today, satisfying the data needs of the urban markets like Karachi, Lahore and Rwp/Islamabad will become prohibitively expensive.

2016 could be a defining year for Ufone – the question is that whether they will be able to hold on to their data customers or not?

Ufone can focus on tier two and three cities on 3G to participate in the growth from data. They may also look into re-farming some of its 900 spectrum so that they can use it for 3G, giving them additional capacity.

Mobilink

It’s quite strange to see that even though Mobilink has ample data capacity, they still lost market share in data revenues – quite a big drop. Whatever they are doing it is not working. A possible strategy could be to focus more on content rather than the pipe.

It has been proven all over the world that video is the real catalyst for data revenue growth. Video should be the focus of Mobilink. They have the HVC, the volume, the image and the capacity. Just need compelling content.

On a different note, 2016 could be lost for Mobilink and Warid both – in fighting the merger demons. More often these mergers turn into a nightmare in terms of culture management. I wish all the best to both the companies on this front.

The combined data revenue market share of Mobilink and Warid is today 32%, which will make them the market leader.

Telenor

After having lost 10 percentage points, Telenor needs to review its strategy on data. Maybe they are right on the money in terms of achieving their strategic objectives. After all they showed little confidence in Pakistan’s data market when they only bid for 5 MHz. When you look at their website, you have this feeling that they are not really pushing or positioning themselves on data. After Mobilink they have the largest number of 3G subscribers, but with very little capacity, the download speeds are quite poor. Resulting in customers using other networks for data usage.

With the current 3G capacity, it would be wise for Telenor to focus on rural 3G customers, where they will be able to offer comparably good experience. The Urban war is lost!

With over 25 years of experience in telcoms, Salman Wassay has served as CCO of Ufone and Marketing head of Zong when it was Launched in Pakistan.

Zong is simply the winner!

Congratulations

TELENOR service is WORST.

Being a Telenor user, I also hate their download speeds and pricey data packages.

Than why don’t u port?

Because I use my PTCL DSL connection as primary Data source

Ive been using telenor 3g for months. Its worse. You pay to get torture. They dont reply support questions. They dont improve signal even after complaining for months. Even gsm wont in the middle of lahore. Finally I bought zong 4g device. Now Im in peace. Very smooth n satisfying internet.

Great Analysis

The worst position is of telenor they just dont want to improve loooosers.

Isn’t it interesting to see that Salman Wassay has shown zong & ufone as winners, both companies he worked for :p

Unfortunately true. While rest of the world could clearly see the dismal picture of Ufone’s future.

where has he shown ufone as winner?

CCO positions in Zong and ufone are currently up for grab thats why

Well written (the language part only), but very much biased article.

Article is all based on facts, the best you can argue is about facts and not about the tone.

Ufone is all time looser

Well, statics and indicators are showing that PTML (Ufone) is best cellular company at the movement (For data/voice) , yet vital gap to improve in MFS (Mobile Financial Services.)

thanks for improving the typography much better now but still we can go further!

As far as these operators are linked with chines they will loose .Even in china They are not using chines equipments on large scale then why in pakistan they are using these alot

The Chinese have become No 1……Ur thinking is 15 years old… the European are bankrupt .. Where is Nortal, Seimens Alcatel, NSN…… Lucent…. History only

Even quality of equipment matters among Chinese companies.

Really interesting with sense of knowledge and experience

The most pathetic 3G network on planet earth is ufone

But after merger; mobilink will be winner until telenor acquires ufone as well as 4G license.

Let’s see

I was a Telenor user who ported to Zong in order to get 4G connectivity. I am still using Zong because there is no alternate when it comes to high speed data, however, the strategy of Zong has left me baffled.

While most companies want to increase their Post Paid consumer base, I’ve had Zong customer reps call me to talk me out of converting to post paid. (When you port, you initially port in to prepaid and then have to convert to post paid).

When I was with Telenor they had assigned a Relationship manager to my account, so instead of calling the helpline and waiting on hold, I can just call my relationship manager and he would take care of everything for me. When I had an issue with Zong, I had to call and wait for 10-15 minutes on hold before getting to a customer rep and even then the attitude of the said rep was that he simply couldn’t care less. That issue had me wishing to port back to Telenor however, their slow data speeds have so far held me back.

As soon as Telenor or Mobilink get 4G license, I’d probably be the first one to abandon Zong simply because they don’t have any clue about customer satisfaction.

Ufone just can’t convert some of its 900 MHz license to 3G from 2g.that would be a disaster.why? Because call quality will certainly drop as 2g spectrum will decrease. Similar situation with their Evo devices since they introduced Charji (LTE) service their cdma2000 based service got from bad to worse due to small spectrum for cdma2000. but if they do turn off their 2g and port completely to 3G on 900 they might be in better shape . Another thing is switching off 2g isn’t easy as many devices depend on it like credit card readers ,etc.

For telenor I could say it might be much better if they had just opted for 4g spectrum as it is most efficient and might kept their position strong in the future. And had stopped 2g service all together and converted their 2g license to 3G.

Recently Zong sent me a SMS telling that you have been given 300 MBs free; but when i open my data connection it eats up all of my balance. I don’t know what they are doing. BTW I keep close eye on my data consumption and have installed apps that track data.