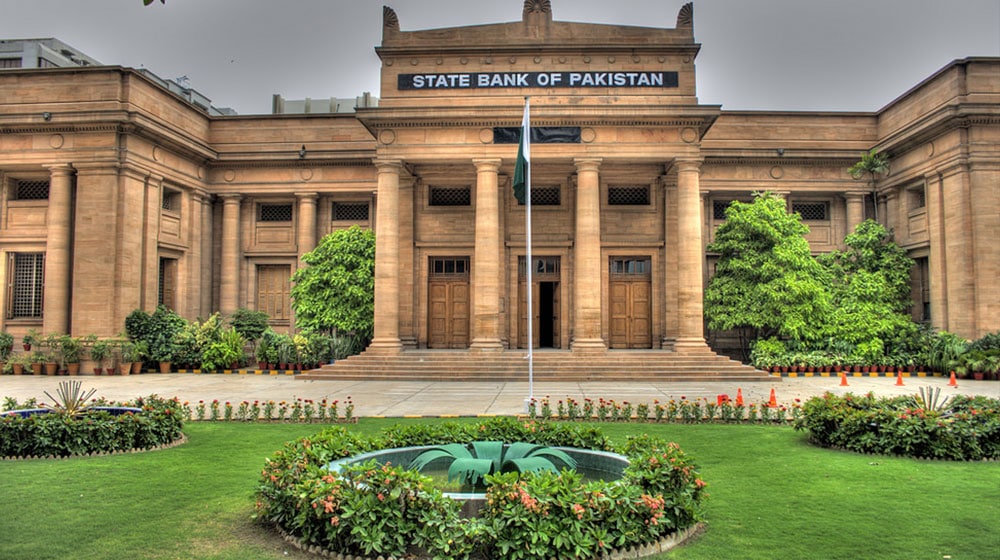

The Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) has decided to maintain policy rate at 6.0 percent for the next two months.

The committee decided to keep the policy rate at uniform level for the second time. Previously, the policy rate was revised in the last monetary policy announcement from 5.75 percent to 6.0 percent.

Controlled inflation, expected outcomes of Rupee depreciation and stabilized performance of the real sectors were impacted positively on the policy rates.

CPI inflation has remained moderate during Jan-Feb FY18, averaging 4.1 percent mainly, because of subdued food prices and lower than anticipated increase in house rents.

The real sector is progressing well and growth remains on track. Agriculture sector, despite some shortfall in cotton production, is projected to post positive growth for the second consecutive year. Industrial sector has managed demand pressures through improved utilization of existing capacity and continuing additions in installed capacity.

On the monetary front, a relative improvement in financial intermediation, coming from sustained growth of private sector credit (PSC) is leading broad money (M2) growth, the statement reads.

Improved demand from major trade destinations and the Government’s ongoing export package are generating the momentum of growth for Pakistan’s exports. During Jul-Feb FY18 exports growth has reached 12.2 percent as compared to the decline of 0.8 percent in the same period last year.

Despite the decline in new labor proceeding abroad, workers’ remittances have recorded a growth of 3.4 percent in FY18 so far.

However, the growth in imports remains high. Even with a deceleration during the current year due to higher regulatory duties and exchange rate movements, import growth has remained high during Jul-Feb FY18 compared with the growth in the same period last year.

As a result, the current account deficit has reached USD 10.8 billion during Jul-Feb FY18 which is about 50 percent more than it was during the same period in FY17.

Although the full impact of recent exchange rate depreciations on exports and imports is going to unfold gradually in the coming months, financing of the high current account deficit is challenging as a healthy growth in FDI and higher official inflows were insufficient to finance it completely. Consequently, SBP’s foreign exchange reserves declined to USD 11.78 billion as of 22nd March 2018.

Going forward, along with a focus on narrowing the current account gap, Government’s plans to timely mobilize external inflows, both official and commercial, will play a pivotal role in maintaining adequate level of SBP’s foreign exchange reserves and anchoring sentiments in the FX markets.