Recently we published an overview of Pakistan’s Telecom Industry with various indicators including the traffic (voice + SMS) size, ARPU, subscribers and others. Today, derived from PTA’s quarterly report, we are presenting Economic Indicators of Pakistan Telecom Industry.

Note: All stats mentioned below are till December 2010.

Overview:

Pakistan’s economy remained stressed in the first half of the financial year 2010-11 (July-Dec). This downtime didn’t occur only because of global trends, but mainly due to unprecedented floods that damaged one-fourth of the country’s agriculture land.

The catastrophe resulted into high oil pricing, damages to private and public infrastructure, energy shortage, and above all – the damage to telecom equipment in the field.

However, an unexpected good performance by the services sector provided support to GDP growth and the government somehow managed growing macroeconomic imbalances in the economy.

State Bank of Pakistan continued tight monetary policy to contain the inflationary impact and the only positive activity as a consequence to the floods was the strength of external sector, where large inflow of aid and remittances played positive role to economic recovery.

Highlights

-

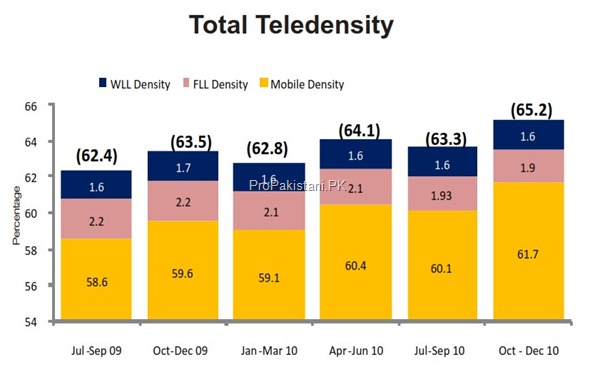

Total telecom teledensity reached 65.2 percent

-

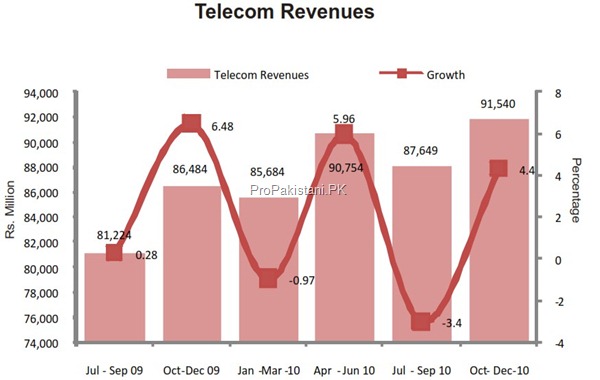

Telecom revenues reported in 1st half of the FY2011 were over Rs. 180 billion compared to Rs. 167 billion earned during the same period last year.

-

Cellular Mobile sector shares 67 % of the total telecom revenues, whereas fixed line services share is 26% of total revenue generation of telecom sector.

-

The share of mobile operators in total revenue of mobile services is according to subscriber share of each operator

-

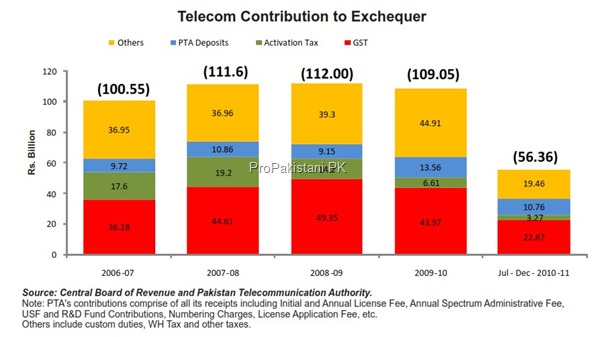

In the first half of the FY2011 the total contribution to national exchequer by Telecom sector was Rs. 56.3 billion which was Rs. 49 billion during same period last year, showing growth of 15%.

-

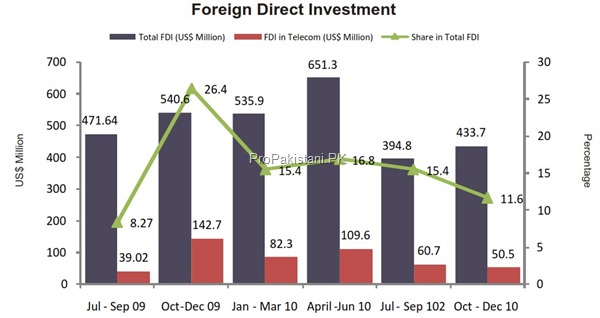

FDI and investments in Telecom sector showed notable decline

Teledensity

In contrast to the Pakistan economic situation the growth of telecom sector remained positive, though the growth rate hasn’t been the same that we have witnessed in recent years – in fact it has been its at its lowest pace during the reported period, but the good thing is that direction has been positive.

The total teledensity growth kept oscillating between highs and lows till the end of year.

Total teledensity (including mobile, fixed and WLL services) stood at 65.2%. The teledensity growth in the first half of the year (Jan to June 2010) was 0.9% whereas in the second half of the year (July-Dec10) the growth was 1.7%, showing more stability and resilience as compared to 1st half of the year.

Total teledensity of the country grew by more than 2.67% in the last one year.

Telecom Financials

Although the telecom sector has been experiencing decreasing ARPU’s, exorbitant advertisement budgets, power crisis, and negative net profits, aggressive competition, market saturation and decreasing exchange rates, the financial health of the sector remained stable and didn’t take a down turn.

The telecom revenues reported in 1st half of the FY2011 were over Rs. 180 billion which were 167 billion in the same period of FY 2009-10. The revenue growth during the reported period kept moving between highs and lows where in July-Sep 2010 it was -3% whereas in Oct-Dec 2010 it was 4%.

Cellular Mobile sector is a driving force in terms of revenue in the telecom sector where it counts 67% of the total telecom revenue whereas fixed line services share is 26% of total revenue generation of telecom sector.

The share of mobile operators in total revenue of mobile services is according to subscriber share of each operator, where Mobilink has maximum share in total revenue followed by Telenor and Ufone.

Amid high telecom usage, the contribution of telecom sector to national exchequer through taxes, duties and regulatory charges kept growing. The sector has been contributing over Rs. 100 billion each year since last few years.

At the end of FY2010 the total contribution was over Rs. 109 billion of which almost 50% came from GST.

In the first half of the FY2011 the total contribution to national exchequer was Rs. 56.3 billion which was almost Rs. 49 billion in the first half of FY2010 showing growth of 15% since last year. It is therefore expected that by end of FY2011 the total contribution to national exchequer would be higher than the last year’s contribution.

According to an estimate, telecom sector contributes more than 90% share in total taxes by the services sector of Pakistan which is being diverted to provinces under 18 Amendment.

Similarly share of GST in total contribution from telecom sector is also very impressive

where almost 50% of total contribution comes from GST collection. Only in the 1st half of FY 2010-11, total GST collection is Rs. 23 billion which was Rs. 21 billion in the same period of FY 2010.

GST collection in telecom services mainly comes from mobile sector and its share in total GST collection is 86% followed by basic services as 11%. The Activation Tax contribution to national exchequer stands at Rs. 3 billion at the end of 1st half of FY2010-11, which was Rs. 4 billion in the same period last year.

Main reason for drop in the activation tax is due to market maturity, there is time for the Government to abolish this tax on operators to further strengthen its growth whereas in order to increase GST the government needs to reduce the existing 19.5% rate, so that usage could be enhanced, which would result in better GST collection.

Foreign Direct Investment

The overall inflow of Foreign Direct Investment in the country shows a negative trend in last few years and same is the case in Pakistan Telecom sector where FDI has reduced up to some extent in the last two years, however, no drastic reduction has been witnessed.

FDI in telecom sector of Pakistan shows about 17% decline in quarter ending December 2010 on compared to previous quarter. In case of telecom the FDI is showing some major reduction since early 2010.

At the end of FY 2010 the total FDI in telecom sector was US$ 374 million which was US$ 815 million in 2009. Similarly the FDI in telecom was US$ 112 million in the 1st half of FY 2011, where as it was 181 million in the same period of FY2010. It is predicted that the total FDI in telecom for FY2011 would be less than FY2010.

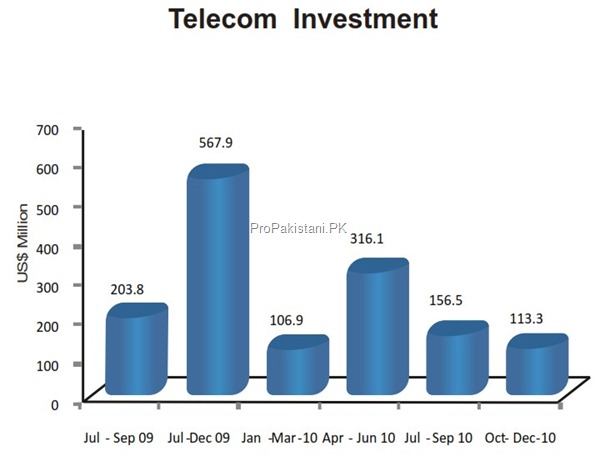

Investment in Telecom Sector

Telecom sector now moving towards maturity and saturation is experienced in metropolitan cities – hence the investment in the sector is decreasing.

Although in FY 2010 the investment situation was not alarming, However, investment figures for first two quarters of FY 2010-11 are not very encouraging. A

total of US$ 270 million have been invested during Jul-Dec 2010 in telecom sector in Pakistan which is 36% less then the investment made first six months of 2010 which stands at US$ 423 million.

While comparing figures of first quarters of FY 2011 with FY 2010 there is a drop of 65% in total investment made in telecom sector of Pakistan.

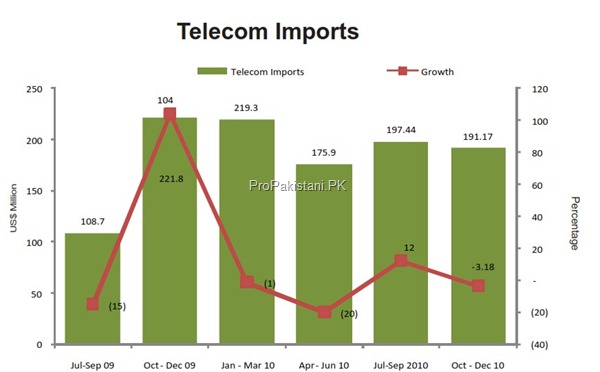

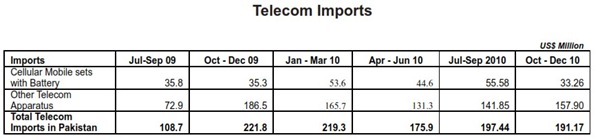

Total Telecom Imports

Total Telecom imports showed negative trend in Quarter ending December 2010 where total imports declined about 3.2% in one quarter. However, this decline was observed due to decline in cellular mobile handsets where as the other equipment imports increased in the same quarter by about 11.3% in the same period.

Last year, Government of Pakistan imposed Custom Duty and regulatory duty @ Rs. 750 per mobile handset that curtailed the import of mobile handsets, however, Government of Pakistan abolished the regulatory duty @ Rs. 250/ per handset and reduced the custom duty from Rs. 500 to Rs. 250/ per mobile handset that resulted into surge in the import of mobile handsets in Pakistan.

The imports of handset automatically increased right after the reduction in import duty and increase in total imports were witnessed in the reported period.

Total imports of US $ 388 million were recorded in the 1st half of FY 2010-11, as compared to US$ 329 million in the same period of FY 2009-10.

While looking at the quarter wise situation, it can be observed that total imports are almost the same during the first two quarters of FY 2010-11.

A closer analysis of the first two quarters of FY 2010-11 in comparison with previous two quarters reveal that the industry imported other telecom apparatus worth of US$ 300 million during Jul-Dec 10 of the FY2010-11 whereas it was US$ 259 million in the same period of FY 2009-10.