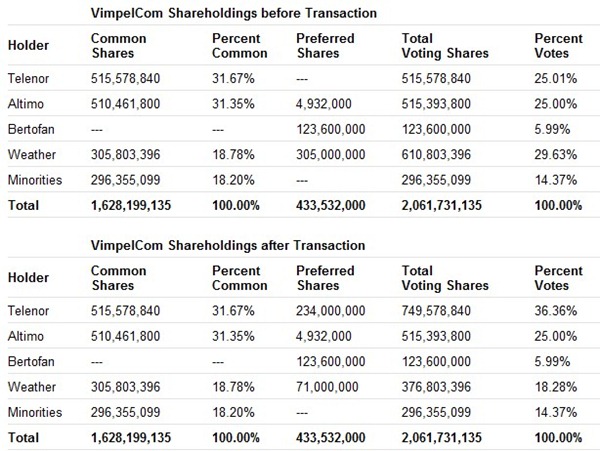

Just to recall, Mr. Naguib Sawiris and his family last year bought 29.63 percent stakes in VimpelCom through Weather Investments in exchange of Orascom Telecom.

Weather’s shares in VimpelCom, after this transaction, will come down to 18.28 percent.

In connection with this new buyout of shares, Telenor has withdrawn all its claims against Altimo Holdings & Investments Ltd., Altimo Cooperatief U.A. and VimpelCom in the pending arbitration proceeding, and will work to expand the VimpelCom Board to eleven members.

Check below the previous and present voting rights of various groups in VimpelCom:

It merits mentioning here that Mobilink is currently fully managed by VimpelCom, which is now majorly owned by Telenor Group, also the parent group of Telenor Pakistan, creating a potential situation for conflict of interest in Pakistan and Bangladeshi markets.

To put in simpler words, 5 out of 11 directors at VimpelCom board (who directly manages Mobilink) come from Telenor International, a group that also controls Telenor Pakistan.

This translates into a proposition according to which Mobilink and Telenor Pakistan will be owned by same group (Telenor International) at a parent group level.

The outcome can potentially form a cartel in Pakistan which may not be favorable for competitors such as Ufone, Warid Telecom and CMPak.

Though Competition commission of Pakistan had approved the deal, but this new transaction may arise new situation for the industry, especially when 3G auction is round the corner.

In a related news, Telenor wants to drop its Indian joint-venture partner Unitech after the Supreme Court revoked their mobile licences in the country and is seeking a new local partner. Telenor said it would seek indemnity and compensation from Unitech.

And Unitech has replied by threatening counter legal action.

@Aamir…What can be the possible implications of this transaction for the 3G auctions when the Information Memorandum(issued by PTA for 3G auction) says under section 7.8 titled OWNERSHIP DISCLOSURE REQUIREMENTS

“All bidders must disclose their ownership information in a separate sheet. NO TWO BIDDERS SHALL HAVE ANY COMMON DIRECTORSHIP ON THEIR RESPECTIVE BOARDS.”

Aamir bhai what is your take on that?? Doesn’t that make Telenor and Mobilink unqualified for the bidding, if the requirement is fairly interpreted to include parent (Orascom) company’s BoD as well?

I will going to do a separate post on this… tomorrow inshAllah

a simple reply could be :

as Mobilink now comes under Telenor Pakistan control , Telenor will bid for 3G licence showing the owner ship of Telenor Group & let Mobilink operate as they are currently.

This way they will have the 3G licence , benefit for people using 3G enabled devices. & the current operating licence ( Mobilink) which majority of the people are using.

It looks in this situation that Telenor may try to indirectly keep Mobilink away from the license through it’s stake in Vimplecom.

on a very basic level, Telenor’s profits are their own while only a smaller portion of MObilink’s profits would contribute to Telenor group :)

So. I guess we are looking at a merger of Mobilink and Telenor sometime down the line in Pakistan.

Kindly also discuss this in your post tomorrow that why is the Senate Standing Committee demanding that 50% of the license fee be paid right now and remaining in 5 equal installments (probably yearly as I guess) when the Information Memorandum (IM) under section 7.6 titled AUCTION PROCEDURE gives a better alternative that will result in a quicker cash inflow for the government.

Subsection 7.6.1.11 says:

“Each one of the Winning Bidders shall deposit 50% of the Auction Winning Price (Initial License/Spectrum Fee) as Bid Deposit in PTA’s designated bank account in US Dollars or its equivalent in Pak Rupees to be converted at the TT selling rate of 35 National Bank of Pakistan on the day preceding the date of payment for the selected block after adjustment of the Bid Earnest Money within thirty (30) working days from the Auction Result Notification Date.”

Further subsection 7.6.1.12 says:

“The remaining 50% of the Initial License/Spectrum Fee shall be paid within sixty (60) working days from the Auction Result Notification Date in US Dollars or its equivalent in Pak Rupees to be converted at the TT selling rate of National Bank of Pakistan on the day preceding the date of payment.”

I don’t know if my interpretation is wrong or the senators haven’t done their home work!

NO TWO BIDDERS SHALL HAVE ANY COMMON DIRECTORSHIP ON THEIR RESPECTIVE BOARDS.

I assume the bidding companies will be Telenor Pakistan and PMCL (the registered company which operates with the name Mobilink). If so, there are no common Board Members.

Even at the Holding level, I am sure CCP must have ensured that cross ownership will not limit competition in Pakistan by ensuring Telenor Group employees do not sit on PMCL’s board. Cross holdings are fairly common in the telecom world and yet at a country level the companies compete aggressively for customers and market share.

Well, what do I see is that they’ll surely put up a single operator in the 3G Auction game.

Well done, very nice and interesting article.