We are yet to ascertain whether this capital injection will be used for network expansion, 3G rollout, investment in branchless banking or for an upcoming acquisition. But we are certain that this fund will not be used for meeting operational expenses.

Trading in Mobilink’s TFCs will only take place between the members outside the stock exchange system and settlement of trade will take place on counter party basis. The market lot of one certificate will be of a face value of Rs 100,000 and the minimum amount per transaction (only between institutional investors) will not be less than one million rupees.

According to details ProPakistani has got, the maturity of these TFCs are up to 48 months with the maturity date of March and April 2016 with an expected interest rate of KIBOR plus 2.65% per annum.

The principle repayment of this Rs 200 Crore loan will start from 3rd month of issuance and will be paid in installments of 10%, 20%, 30% and 40% in 1st, 2nd, 3rd, and 4th year, respectively.

These loans are rated Single A plus (A+) by PACRA, which denotes a strong capacity of timely financial commitments, and are secured by Mobilink’s all present and future movable long-term assets.

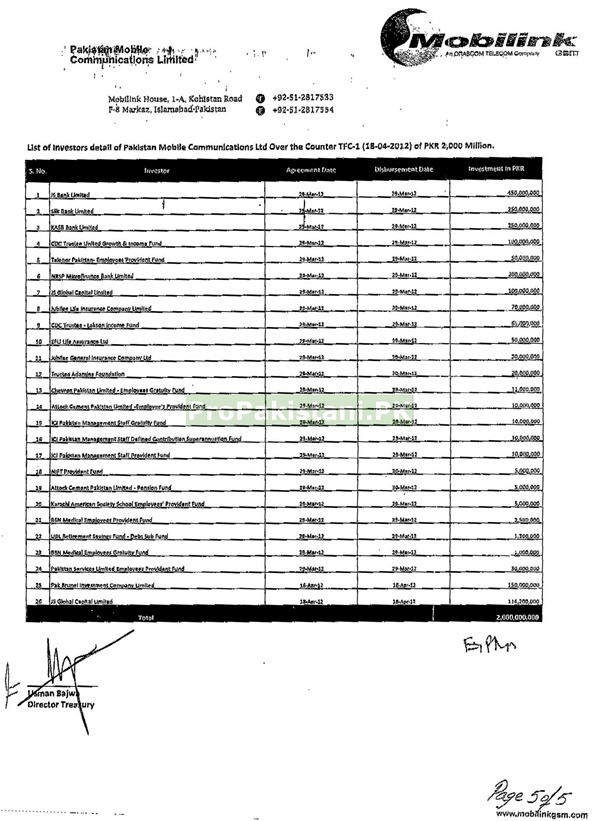

Renowned Banks, Insurance companies and provident funds of multinationals in Pakistan have put their money behind these TFCs. Half of the contributions are made by three banks with JS Bank investing Rs 45 Crore and Silk Bank and KASB bank putting Rs 25 Crore each.

Following is the list of Institutional investors (clicking on image will open it in full size):

Cannot be for an acquisition. 2Bn is a peanuts for an acquisiton

Grate yar companies ku 3G Nhi la rin afghansitan tak Mai 4g aa gya ha yahan hum 3G ko e roty ja ry han aur woh b Nhi mil raha

huh

If u read the termsheet, the issue was primarily for meeting capex not for 3g…

:) My friend – investment in 3G is a capital expenditure as well.

what we cannot ascertain is where this ‘capital expenditure’ will be used?

what i meant was capex (maintenance and upgradation related to 3g) and not for 3g licence.

2bn for capex is nothing for a telecom company like pmcl..

you can get the copy of IM from KSE to read more about the investment.

and the instrument rating is AA- not A+. pls correct ur facts, thanks

This is the term sheet you’re referring to:

http://www.kse.com.pk/notices-updates/detail2.php?id=4&nid=034488&pagesize=1&pageno=3#

And this is the Scale of PACRA rating process. This will help you in understanding the scales PACRA used and the term single Plus and Double AA.

http://www.pacra.com/pdf/scale.pdf

Appreciate that. There is a typo in the above referred term sheet. The ratings can be verified from PACRA website itself.

And interestingly – Mobilink raised another Rs 66 Crore from CitiBank last month.

Source: http://www.economyage.com/2012/06/citibank-pakistan-provides-mobilink-with-rs-660-crore-term-financing/