Pakistan’s microfinance sector is gradually expanding with rising penetration of services across the country. This is reflected in the Gross Loan Portfolio (GLP) which surged to a remarkable level of Rs. 202 billion by the end of 2017.

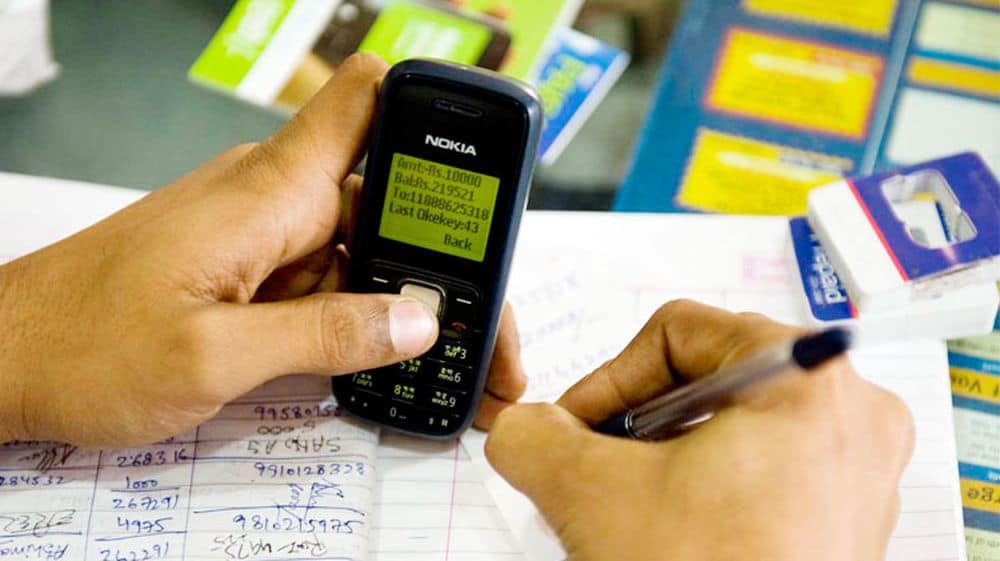

According to Pakistan Microfinance Network (PMN), the number of active borrowers stands at 5.8 million with the total number of loans standing at 1.8 billion, spread over in 106 districts of the country.

30 million savers are maintaining their accounts in microfinance banks with total holdings of Rs. 186 million. The average loan size is Rs. 48,695 per borrower whereas the average saving size is Rs. 6,033 per saver.

ALSO READ

Ant Financial’s Entry Will Change the Way Payments Are Made in Pakistan: CEO Telenor Bank

The microfinance sector is not only empowering people financially but it helps increase the saving-to-GDP ratio in the country, which is comparatively low in the region particularly in the documented sector.

On the other hand, the expanding network of branches of various microfinance banks has reached 3,673 points in 106 districts of the country which indicates the local and foreign investment in the sector along with generation of employment for thousands of educated workers in the country.

Zine El Abidine Otmani, CEO, Advans Pakistan said the scope of microfinance banking is immense in Pakistan provided the products are designed in structured and innovative ways to cater the demand of small entrepreneurs.

He said that his bank provides loans to small businesses with tailored financial services and solutions, in a sustainable and responsible manner to target the untapped niche market.

Briefing on the success of the bank, he said Advans Pakistan started its operations in Karachi in January 2013 and opened nine branches in Sindh and since then has made rapid progress with more than 8,000 active borrowers.

Based on impressive growth and penetration of the microfinance bank, PMN has set an ambitious target for microfinance banks to increase the borrower base to 10 million by the end of 2020. The target for banks includes 11 million insurance policyholders, 50 million depositors as well as increasing financial access points to 400,000 by 2020.

Pakistan is a very potential market for micro finance banking

But Only thing is irritating is these Heavy Schedule of Charges among this Sector and Telecom too

:/