The Federal Board of Revenue (FBR) has significantly increased the customs valuation rates of various mobile accessories such as the import of mobile charger with wire, mobile charger without wire, wireless charger pad/stand, car charger (single pin and multiple pins), desktop battery, mobile battery, selfie sticks and many other items.

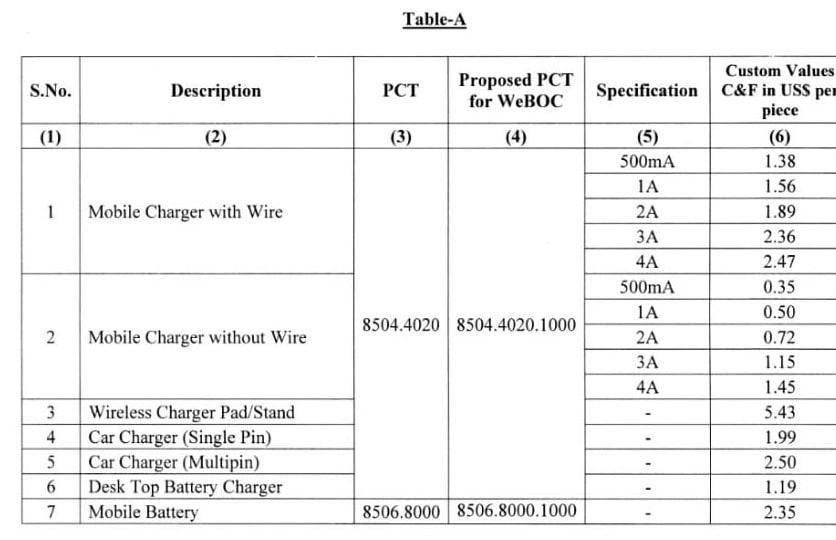

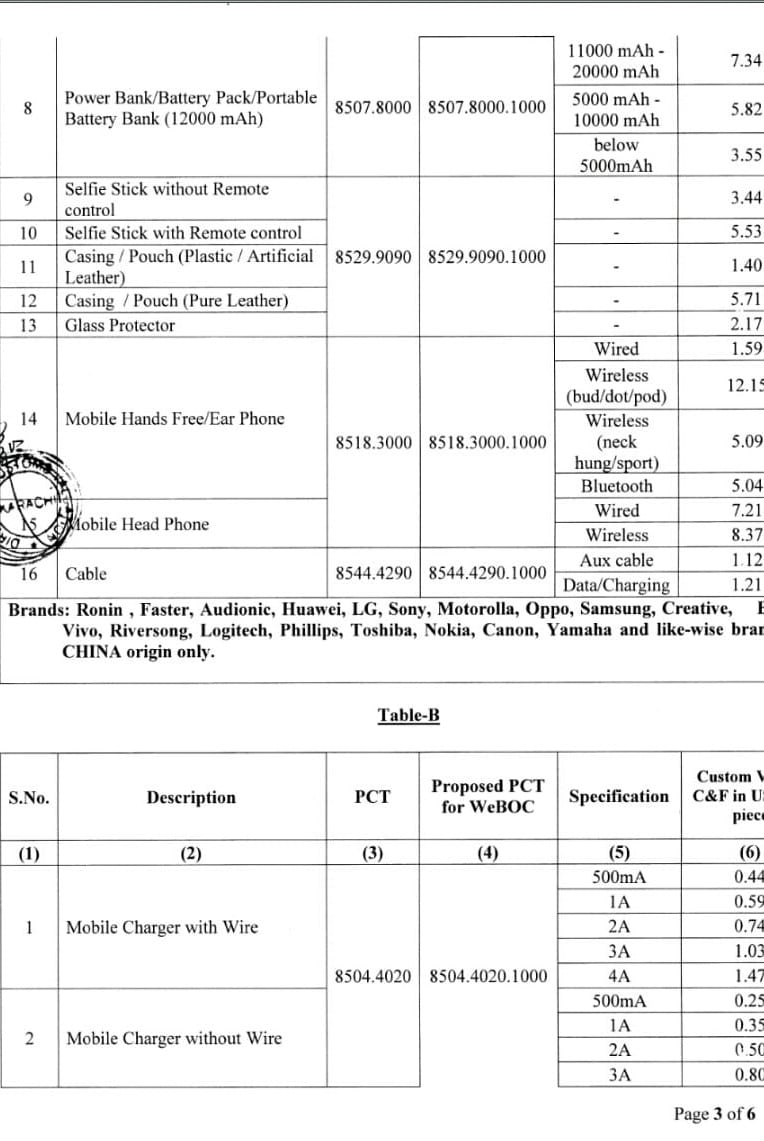

According to the customs valuation rulings issued by the FBR, the new valuation are as follows:

- Mobile charger with wire for different specification ranges on per piece basis from $1.38 to $2.47.

- Mobile charger without wire, the new customs valuation ranges from $0.35 to $1.45 on per piece basis.

- The wireless charger pad/stand, the valuation rate stands at $5.43.

- Car charger (single pin) stands at a valuation rate of $1.99

- Car charger (multiple pins) stands at a valuation rate of $2.50

- Desktop battery charger stands at a valuation rate of $1.19

- Mobile battery stands at $2.35 per piece.

ALSO READ

Your Guide to Getting a Free Coronavirus Test At Home in Sindh

Mobile Accessories hereinafter specified shall be assessed to duty/taxes at minimum Customs values as per Table A and B, said the document.

- Power bank/ battery pack/portable battery bank (12000mAh) with per piece valuation from $3.55 to $7.34 on different specifications.

- Selfie stick without remote control stands at a valuation rate of $3.44 and selfie stick with remote control $5.53 per piece.

- Casing/pouch (plastic/artificial leather) stands at a valuation rate of $1.4 per piece

- Casing pouch with pure leather stands at a valuation rate of $5.71 per piece

- Glass protector stands at a valuation rate of $2.17.

- The valuation rate on mobile hands-free phone ranges from $5.04 to $12.15 per piece on different specifications.

- The valuation rate on mobile headphones of different specification ranges from $7.21 to $8.37.

- The valuation rate on the cable of different specification ranges from $1.12 to $1.21.

According to customs valuation ruling number 1448/2020 issued by the FBR earlier customs values of mobile accessories were determined under section 25-A of the Customs Act 1969 vide valuation ruling number 908/2016 dated 12-8-2016. The valuation ruling was very old and values in the international market had shown upward trends. A number of new accessories had also been introduced in the market.

Therefore, an exercise was initiated to determine the customs valuation of mobile accessories under section 25-A of Customs Act 1969.

It was stated that the meetings with all stakeholders and trade bodies were held in the Directorate General on 21-8-2019 and 13-01-2020 and the importers were requested to submit their proposals/suggestions as well as following documents before or during the course of stakeholders’ meeting so that the customs values could be determined:

- Invoices of imports during the last three months showing customs value.

- Websites, names and E-mail addresses of known foreign manufacturers of the items in question through which the actual current value can be ascertained.

- Copies of contracts made/LCs opened during the last three months showing the value of the item in question.

- Copies of sales invoices issued during the last four months showing the difference in price (excluding duty and taxes) to substantiate their contentions.

It was pointed out that importers neither attended the scheduled meetings nor submitted any import related documents to this Directorate General despite being given reasonable opportunities of hearings.

Methods Adopted

It was stated that valuation methods provided in Section 25 of Customs Act 1969 were duly applied in their regular sequential order to arrive at the customs values of subject goods. The transaction value methods provided in subsection (1) of section 25 of Customs act, 1969 was found inapplicable due to wide variations of values displayed in the import data.

Moreover, since no one attended the meeting nor submitted the documentary evidence to prove that their declared value was the real transactional value, hence, requisite information under law was not available to arrive at correct transaction value and identical/similar goods values as provided in sub section 5 and 6 of section 25 of ibid were examined for applicability to valuation issue.

Are they trying to promote local production?

this move doesn’t make any sense to me.Can someone please explain this?