The State Bank of Pakistan (SBP) will most likely raise the policy rate by 100 basis points (bps) from 12.25 percent to 13.25 percent as a looming economic crisis threatens progress in the upcoming fiscal year.

The Monetary Policy Committee (MPC) of the central bank will convene on Monday, 23 May 2022 to announce the last scheduled monetary policy for fiscal year (FY) 2021-22. According to Arif Habib Limited (AHL), SBP will likely increase the policy rate by 100 bps to 13.25 percent in its upcoming monetary policy statement.

To recall, in an emergency monetary policy meeting held on April 7, 2022, the SBP increased the benchmark policy rate by 250 bps to 12.25 percent. The MPC stated that since the monetary policy meeting held in March FY22, the outlook for inflation had deteriorated and risks to external stability had risen. Therefore, these developments necessitated a strong and proactive policy response.

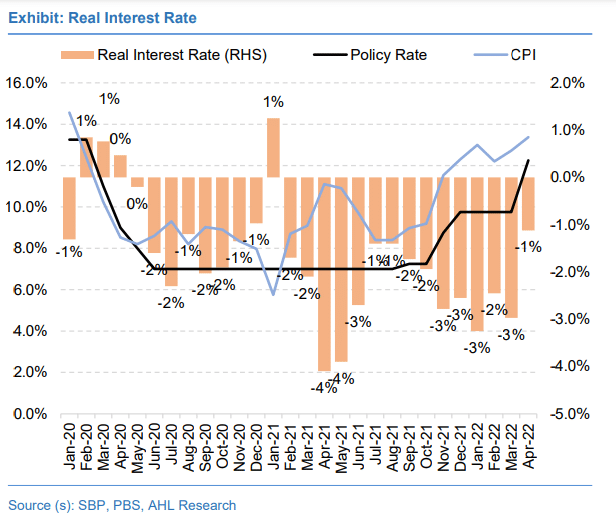

Notably, headline inflation has remained in the double digits since November 2021 mainly on the back of an uptick in food and energy prices. This phenomenon still continues with headline numbers hitting almost two-year highs in April, clocking in at 13.4 percent with pressure mainly emanating from higher food and commodity prices. In April, the SBP stated that the average inflation forecasts had been revised upwards to slightly above 11 percent for FY22 before moderating in FY23.

Moreover, in the last policy meeting (April 2022), SBP had termed its action of a rate hike as ‘decisive’ and a timely measure to ensure the goal of financial stability. In addition, the Governor in a post-MPS briefing had hinted at some ‘good news’ regarding the International Monetary Fund (IMF) which was conditional upon certain measures pending at the government’s end.

The next round of meeting with the IMF starts on May 18th (tomorrow), so the government is expected to soon consider rolling back fiscal relief measures in order to get the seventh review through successfully. However, this step will most likely further augment inflationary pressures, hence, the central bank might want to act proactively and consider a rate hike in its upcoming policy.

Clearly, the MPC is not going to consider inflation trajectory alone, but also a few other developments in the economy such as the ones on the external account, which will be a key consideration in the policy decision. While the post-policy decision was made in April, the current account deficit (CAD) has come down to a billion dollars after peaking at USD 2.5 billion in January 2022.

This moderation in CAD is likely to continue in the upcoming months as the impact of monetary policy setting adjustments made in April 2022 is yet to reflect in the numbers. However, the major concern on the external front remains the depleting SBP reserve position which now stands at USD 10.3 billion as of 6 May 2022, resulting in the depreciation of the Pakistani Rupee (-9.1 percent against the greenback CY22TD).

Money Market Yields Up

Meanwhile, considering the shape of the yield curve to extrapolate market

expectations for SBP’s upcoming monetary policy, a jump is clearly visible in the yields since April. The yield on the treasury bills of 3-month, 6-month, and 12-month was up 129 bps, 114 bps, and 96 bps (respectively) from the previous auction, clocking in at 14.79 percent, 14.99 percent, and 14.81 percent, respectively (auction dated: 27-Apr-2022). It can be assumed that expectations of a further increase in inflation leading to a rate hike have pushed short-term yields higher.

Survey Poll Results

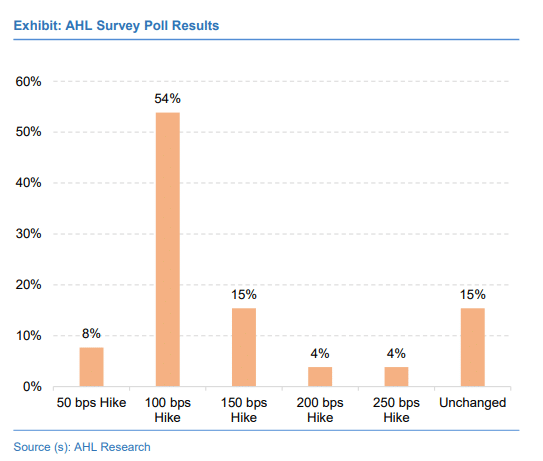

In order to find out what the market is expecting in the upcoming monetary policy to be held on 23 May 2022, AHL conducted a survey (poll) taking feedback from various sectors. The respondents belonged to sectors such as:

- Financial services: Banks, AMCs, Insurance, and DFIs

- Non Financial Services/Manufacturing: E&Ps, Cement, Fertilizers, Steel, Textiles, and Pharmaceuticals

Results

- 85 percent of the total respondents are of the view that the SBP will increase the policy rate in May-22’s MPS while 15 percent eye no change.

- Of the 85 percent of respondents expecting a hike, 54 percent (majority) are anticipating a rate hike of 100 bps, 15 percent expect a rate hike of 150 bps, 8 percent expect a rate hike of 50 bps, and 4 percent anticipate a rate hike of 250 bps and 200 bps each.

sood ek lanat hah jitna marzi isko graphs ya financial figures k peeche sugar coat karlo…