Gas bills for the fertilizer sector are likely to go up as the government tries to convince the International Monetary Fund (IMF) to resume its $6 billion bailout.

According to a report by “JS Global”, an increment in end-user gas prices is likely ( (last increase for the Fertilizer sector in 2019), given the recent hikes in fuel and electricity prices.

“The Oil and Gas Regulatory Authority (OGRA) has recently approved a 45 percent gas rate hike for gas network companies. Fertilizer plants operating on Fertilizer policy 2001, are currently charged Rs. 302 per MMBtu for feedstock and Rs. 1,023 per MMBtu for fuel. Companies like Fatima Fertilizer Company (FATIMA), and Engro Fertilizers Ltd (EFERT) on its Enven plant had a concessionary feed gas rate arrangement fixed at US$0.7 per MMBtu which expired in July 2021,” said the Assistant Vice President at JS Global, Muhammad Waqas Ghani.

He further added that “FATIMA has been booking gas costs at regular rates since then. Even though EFERT’s concessionary period is under dispute at the moment as the company had faced significant gas outages at the start of the ten-year arrangement, it has also been accruing gas costs at regular rates since September of last year on a prudence basis.”

Impact of Increase in Gas Rates

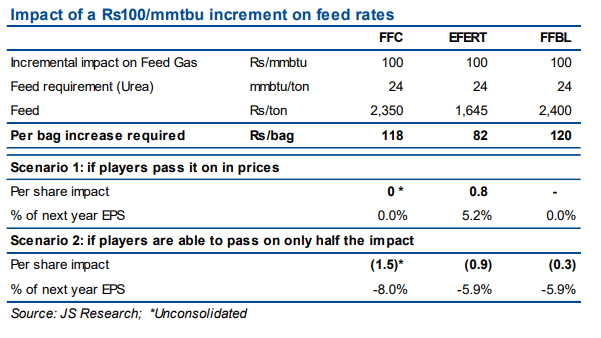

The report suggests passing on the cost-push to farmers would be a question given the government’s recent notice on urea prices. The impact of a Rs. 100 per MMBtu hike in feed rates on the largest urea manufacturer FFC would be Rs. 3 per share to neutralize which would require around Rs. 118 per bag increase in urea prices.

EFERT, on the other hand, would need a lesser price increment of Rs. 82 per bag. The report highlights that around 30 percent of the feed gas used by EFERT (i.e. ~70% of base plant) is charged at Petroleum Policy 2012 rates, hence, a lower per bag price increase is required.

On the flip side, since EFERT’s price on the said portion is contingent on global oil prices, it will continue to get impacted in a rising oil price scenario. In a scenario where feed gas rates increase by around Rs. 100 per MMBtu, notice in the table below how EFERT has a relative advantage over its peers, added the report.

Urea and DAP sales likely to decrease in May-2022

As per provisional data, Urea sales in May-2022 are expected to clock in at 412,000 tons, down by 18 percent year-over-year (YoY). The import of 100,000 tons in recent months has provided support to the inventory situation. With a production assumption of 530,000 tons for the month, urea’s closing inventory for May 2022 is expected at around 436,000 tons, said the report.

Additionally, Di-ammonium Phosphate (DAP) sales in May 2022 are expected to clock in at 92,000 tons, a decrease of 47 percent YoY likely due to the higher price of the commodity. DAP sales for the 5MCY22 are also down by 16 percent on a YoY basis.