The Pakistani Rupee (PKR) dropped further against the US Dollar (USD) and posted heavy losses during intraday trade today.

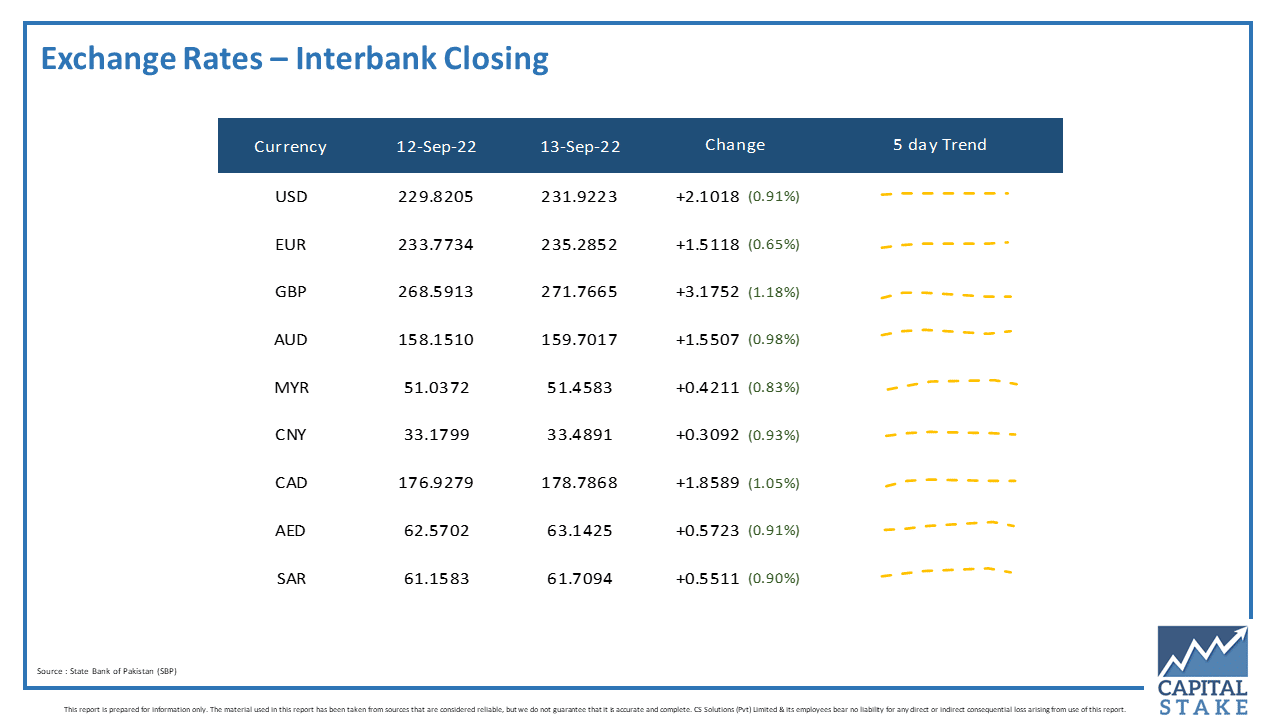

It depreciated by 0.91 percent against the USD and closed at Rs. 231.92 after losing Rs. 2.10 in the interbank market today. The local unit quoted an intra-day low of Rs. 231.75 against the USD during today’s open market session.

The local unit was bearish since the opening bell and opened at 231.00 at 10:03 AM. By midday, the greenback went as low as 230.145 against the rupee. After 2 PM, the local unit stayed in the 230-232 level against the top foreign currency before the interbank close.

The rupee closed in red against the dollar today eighth day in a row today. In the past eight trading sessions, the local unit has lost 5.89 percent or Rs. 13.32 against the greenback. On a calendar year-to-date (CYTD) basis, the PKR has shed 23.89 percent, while on a fiscal YTD, it has already trimmed 11.67 percent of its value.

Money changers are of the view there’s added pressure on the country’s import bill due to the floods, and as a result, dollar demand was rising. Cotton and wheat crops will be reduced this year, raising the import bill and disrupting the balance of payments. The pressure could continue until friendly countries provide the $4 billion promised prior to the agreement with the International Monetary Fund.

On the banking side, managers are reluctantly opening letters of credit (LCs) and impeding the manufacturing industry. If the due process for LCs is not streamlined any time soon, the country’s export base could face a real challenge in the shape of a scarcity of raw materials and related problems.

The country needs political stability and the government has struggled to navigate a clear vision for recovery so far.

Globally, oil prices rose despite bumpy trade on Tuesday as concerns about restricted fuel supplies ahead of winter offset investor worries about decreased demand in China, the world’s biggest crude importer.

Brent crude was up by 0.97 percent at $94.91 per barrel, while the US West Texas Intermediate (WTI) went up by 1.03 percent to settle at $88.68 per barrel.

Crude markets remained fuzzy as prospects for reviving the West’s nuclear agreement with Iran remained bleak. On Monday, Germany expressed regret that Tehran had not responded positively to European proposals to resurrect the 2015 agreement with the US. According to Secretary of State Antony Blinken, an agreement is unlikely in the near future.

The PKR slid against the other major currencies in the interbank market today. It lost 55 paisas against the Saudi Riyal (SAR), 57 paisas against the UAE Dirham (AED), Rs. 1.85 against the Canadian Dollar (CAD), Rs. 1.51 against the Euro (EUR), and Rs. 3.17 against the Pound Sterling (GBP).

Moreover, it lost Rs. 1.55 against the Australian Dollar (AUD) in today’s interbank currency market.