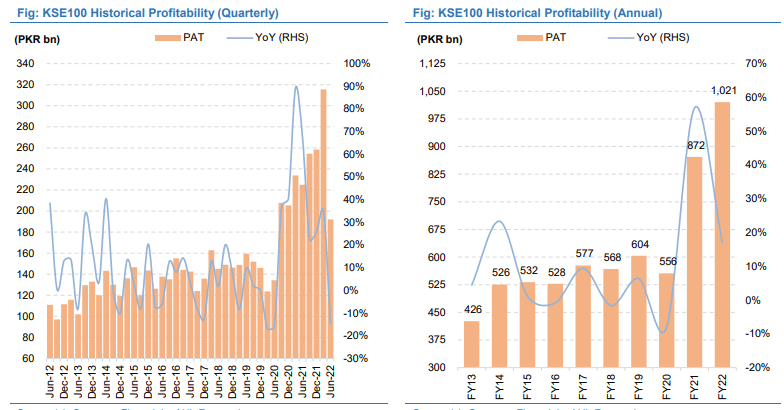

Despite being a tumultuous year in terms of change in economic policy and domestic response to the spate of global demand-supply disruptions ensuing from post-COVID jitters and Russia Ukraine war, the KSE-100 broke its own record from last year to post all-time high earnings in FY22 to Rs. 1,021 billion.

According to a report by Arif Habib Limited (AHL), profitability posted a sound jump of 17 percent YoY, which remains noteworthy given the scale of unrest during the year. The report also highlights that earnings could have been much higher had the incumbent government not imposed super tax growth on a PBT basis was a stunning 39 percent YoY during FY22.

The report includes the result of 83 companies, while the remaining 17 companies have not disclosed their results yet. The companies which have been included in the report represent almost 90.4 percent of the market capitalization of the benchmark bourse.

Earnings growth of the benchmark bourse in FY22 was led by the heavy-weight Commercial Banks sector, although modest at just 3 percent to Rs. 253 billion, was owed to the lagged impact of asset repricing post interest rate hike. The PBT growth was 25 percent YoY but was slashed due to hefty super tax imposition.

This was followed by another index heavy, the Oil and Gas Exploration sector (+30 percent YoY to Rs. 246 billion), given higher oil prices and exchange gains booked amid PKR depreciation.

The cement sector also posted an earnings growth of a robust 28 percent YoY to Rs. 55 billion in lieu of higher retention prices during the year which offset the impact of volumetric decline (-8 percent YoY), higher coal prices, hike in energy tariffs as well as PKR depreciation.

Similarly, the Automobile sector remained another cyclical benefitting from a massive jump in prices to pass on the impact of a steep increase in steel prices as well as depreciation in the Pakistani Rupee (earnings growth of 5 percent YoY to Rs. 31 billion), together with volumetric growth.

Profitability of the Chemical sector (+25 percent YoY to Rs. 39 billion) was aided by higher international margins coupled with PKR depreciation and volumetric growth (EPLC’s expansion came online). Another sector supported by a stronger USD was the Textile Composite sector (+83 percent YoY to Rs. 27 billion).

The Oil and Gas Marketing sector posted a noteworthy 3x escalation in earnings on account of inventory gains to Rs. 115 billion, while the Refinery sector displayed a 7x surge in profitability to Rs. 24 billion due to the aforementioned reason as well as higher margins given augmented domestic fuel prices.

On the flip side, sectors that observed a decline in earnings during FY22 include the Fertilizer sector (-31 percent YoY to Rs. 80 billion) as super tax axed the bottom line.

In addition, the Technology sector witnessed a 74 percent contraction in profitability given the loss booked by PTC. Finally, earnings of the Power sector shrunk by 16 percent YoY as HUBC posted a loss amid recognition of impairment loss (Rs. 1,990 million) on CPHGC’s equipment that was damaged during 1QFY22.

With that said, profitability during 4QFY22 posted a decline of 14 percent YoY/39 percent (quarter on quarter) QoQ to Rs. 193 billion attributable to the imposition of super tax and the impact of deferred tax liability.

Most heavy-weight sectors posted an earnings decline in the last quarter, starting with Commercial Banks (-38 percent YoY), Fertilizer (-92 percent YoY), Oil and Gas Exploration sector (-28 percent YoY), and Technology (-69 percent YoY). Whereas some sectors managed to post a jump in profitability despite super tax levy, such as Cement (+23 percent YoY) due to a significant jump in retention prices, Power (+178 percent YoY) amid KEL’s robust earnings, Oil and Gas Marketing sector (+177 percent YoY) owed to inventory gains, and Textile Composite (+40 percent YoY) given PKR depreciation.

On a sequential basis, KSE-100 index earnings posted a 39 percent dip QoQ, led by Banks (-48 percent) as super tax eroded the impact of higher interest rates, Fertilizer (-93 percent), Oil & Gas Exploration (-55 percent), and Cement (-18 percent).

While the Power sector displayed a jump in earnings of 56 percent QoQ and the Refinery sector observed a 211 percent QoQ escalation in profitability led by higher margins. It is pertinent to mention, that on a PBT basis, the bottom line of the KSE-100 showed a growth of 16 percent QoQ and it was primarily super tax that eroded the PAT.

During FY22, the KSE-100 index went down by -12.28 percent (-5,815 points). The cement sector remained the worst performing sector, eroding 2,335 points followed by Technology (-897 points), Banks (-524 points), Food (-439 points), Textile Composite (-400 points), Pharmaceuticals (-386 points), and Engineering (-383 points). However, the Fertilizer sector added 660 points to the index followed by Chemical (+460 points), Miscellaneous (+294 points), and Automobile Assemblers (+181 points).

On a sequential basis, during 4QFY22, the KSE-100 posted a negative return of 3,388 points, down by 7.54 percent. The banking sector remained the worst performer eroding 1,474 points from the index, followed by Cement (-1,040 points), Textile Composite (-215 points), Technology (-180 points), and Engineering (-147 points).