The State Bank of Pakistan (SBP) will most likely keep the policy rate unchanged at 15 percent.

The Monetary Policy Committee (MPC) of the central will convene on Monday (October 10, 2022). According to Arif Habib Limited (AHL), SBP will keep the policy rate unchanged at 15 percent in its upcoming monetary policy statement.

To recall, in the last MPS too, the policy rate was kept unchanged at 15 percent. The current pause of the MPC has been dictated by the planned fiscal consolidation in FY23, recent developments in inflation are in line with expectations, moderation in domestic demand, and improvement in the external position.

The recent Balance of Payment numbers show that Pakistan’s current account deficit decreased by 19 percent YoY to USD 1.9 billion during 2MFY23, as against a deficit of USD 2.4 billion during the same period last year. This YoY decline is mainly on the back of lower imports and a jump in exports. With the measures taken by the authorities to curb imports along with a decline in international commodity prices, the current account deficit is likely to remain lower in FY23 compared to the FY22 current account deficit (CAD).

As a result of a contained CAD and disbursement from IMF post successful completion of the seventh and eighth review, PKR showed recovery against USD in Aug’22 which, however, was short-lived and the following month (Sep’22), PKR depreciated by 4.2 percent against the USD.

However, SBP believes that Pakistan’s external financing needs should be more than fully met in FY23 aided by rollovers by bilateral official creditors, new lending from multilateral creditors, and a combination of bond issuances, FDI, and portfolio inflows. Thus, pressure on the Rupee should lessen while SBP’s FX reserves should assume an upward trajectory which currently stands at USD 8 billion (23 Sep-2022).

In addition, another positive development since the last MPC meeting has been the decline in international prices of major commodities such as WTI (-12 percent), Coal (-14 percent), Brent (-9 percent), Steel (-2 percent), Cotton (-18 percent) and Arab Light (-6 percent). This bodes well for the country’s external account position, hence providing much-needed relief to trade numbers.

On the domestic front, most of the high frequency (demand) indicators showed moderation to decline in growth on a YoY basis. Attributable to monetary and fiscal tightening, which helped shrink the positive output gap and curtail demand-side pressures, there was a decline in sales of petroleum products (-23 percent YoY), cement (-8 percent YoY), DAP (-79 percent YoY), and power generation (-12.6 percent YoY). Moreover, with recent floods damaging agriculture growth, lower yields of cotton and seasonal crops could weigh on growth this year.

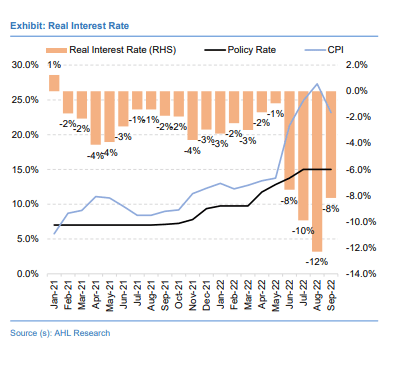

As mentioned in the last MPS, SBP is closely monitoring the inflation trajectory. On the inflationary front, the headline inflation continues to remain in the double-digit since November 2021 mainly on the back of an uptick in food and energy prices. In the month of September 2022, headline inflation clocked in at 23.2 percent YoY.

However, on an MoM basis, inflation receded by 1.15 percent mainly due to a cut in electricity costs. Headline inflation, after peaking in August 2022, has started to taper off. Moreover, it is expected to have peaked in the outgoing quarter of FY23 and is likely to come down with high base-effect kicking in.

Money market Yields Down

Meanwhile, considering the shape of the yield curve to extrapolate markets’ expectations for monetary policy, the secondary market yields since the last monetary policy of August 2022 have come down in the shorter tenure at 15.50 percent (-23 bps) for the three-month paper 15.65 percent (-15 bps) for the six-month paper, and 15.74 percent (-16 bps) for the 12-month paper. It can be assumed that the market too expects SBP to keep the policy rate unchanged in the upcoming policy.

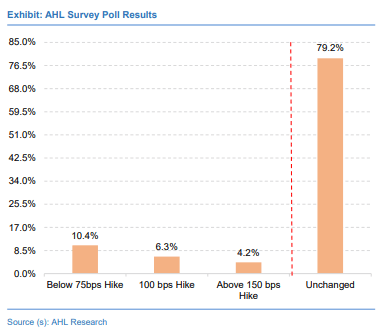

Survey Poll Results

In order to find out what the market is expecting in the upcoming monetary policy to be held on 10 October 2022, AHL conducted a survey (poll) taking feedback from various sectors. The respondents belong to sectors such as:

- Financial services: Banks, AMCs, Insurance, and DFIs

- Non-Financial Services/Manufacturing: E&Ps, Cement Fertilizers, Steel, Textiles, and Pharmaceuticals

Results

- 79.2 percent of the total respondents are of the view that the SBP will keep the policy rate unchanged at 15.0 percent.

- 20.8 percent of the total respondents expect a rate hike whereas 10.4 percent anticipate a rate hike of below 75 bps, 6.3 percent expect a rate hike of 100 bps, and 4.2 percent foresee a rate hike of 150 bps.