The Pakistani Rupee (PKR) reversed gains against the US Dollar (USD) and posted losses during intraday trade today.

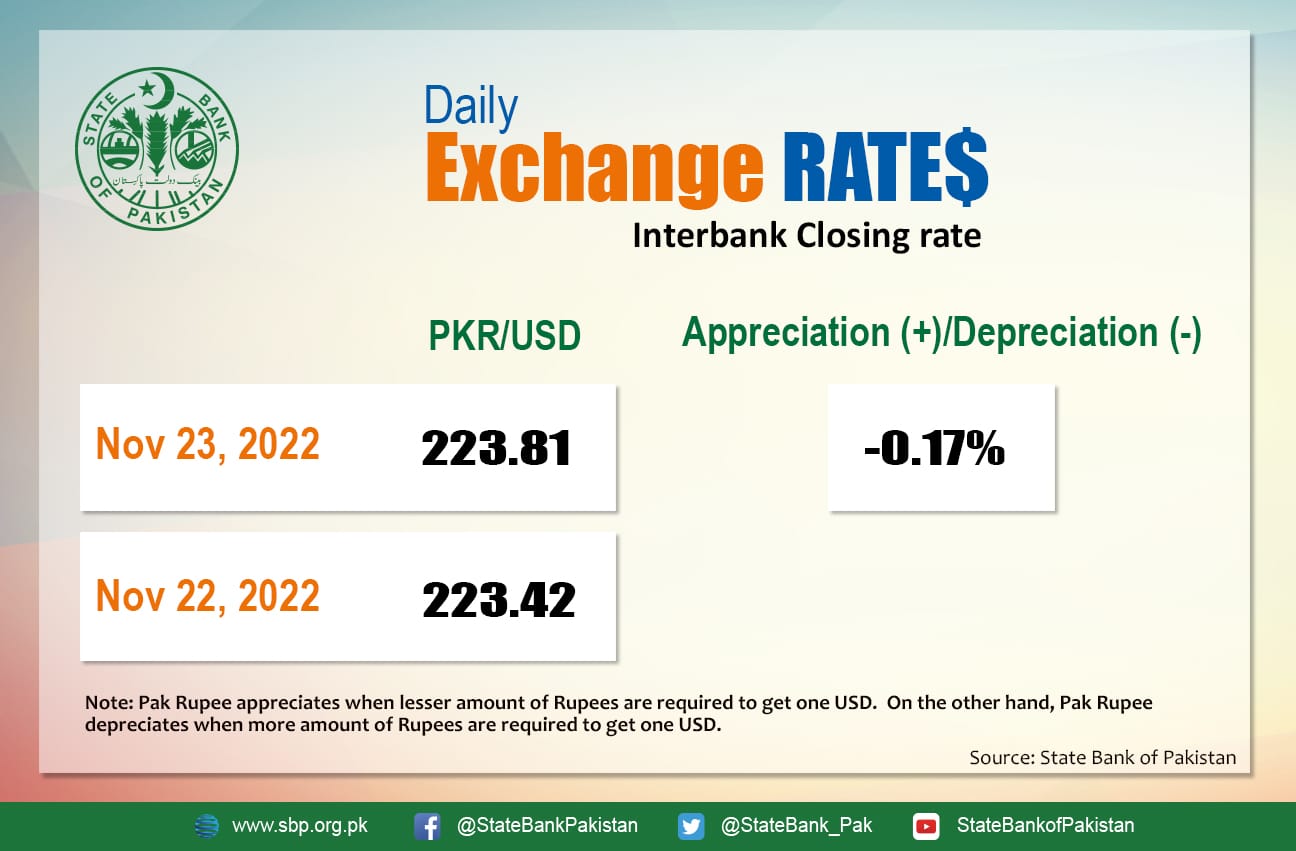

It depreciated by 0.17 percent and closed at Rs. 223.81 after losing 39 paisas against the greenback. The local unit quoted an intraday low of 224.72 against the greenback.

The local unit was initially bearish in the morning against the greenback and opened trade at 224 in the open market. By midday, the greenback moved higher against the rupee. After 1 PM, the local unit was red and stayed on the 223-224 level against the top foreign currency before the interbank close.

The rupee reported losses against US Dollar today despite a massive decline in Pakistan’s default risk. The country’s benchmark 5-year Credit Default Swap (CDS) dropped significantly on 22 November by a whopping 5,224 basis points to 71.64 percent. The instrument has chopped off over 52 percentage points in a single day and shows that investors are once again somewhat willing to take on Pakistan’s default risk at a price level of over 70 percent, which is still a mindboggling figure.

Money changers see today’s PKR drop as a signal for more volatile trends to come in the days ahead as the country braces for upcoming political and socioeconomic events.

Interestingly, a top Japanese investment bank Nomura said Pakistan is now at a high risk of currency crises owing to high inflation, limited fiscal space, negative real interest rates, a weaker balance of payments, and reduced FX reserve cover.

Globally, oil prices fell by more than $1 per barrel as the Group of Seven (G7) nations considered a price cap on Russian oil above where the crude grade is currently trading.

Both contracts soared by more than $1/bbl earlier in the day but slipped back following reports that the G7 price cap on Russian oil could be higher than the current level.

At 4:40 PM, Brent crude was down by 2.60 percent at $86.06 per barrel, while the US West Texas Intermediate (WTI) was down by 2.37 percent to settle at $79.03 per barrel.

An OECD economic forecast that predicts a slowing of global economic expansion next year added to the pressure.

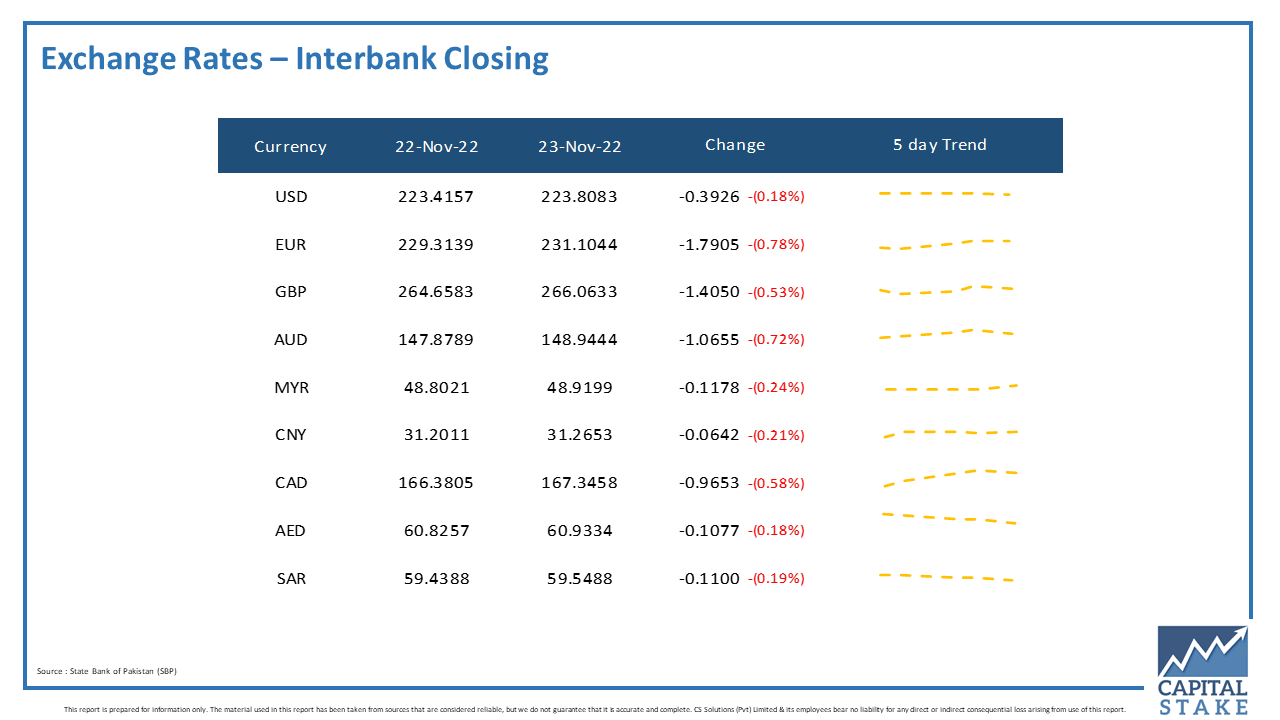

The PKR was bearish against the other major currencies in the interbank market today. It lost 10 paisas against the UAE Dirham (AED), 11 paisas against the Saudi Riyal (SAR), 96 paisas against the Canadian Dollar (CAD), Rs. 1.06 against the Australian Dollar (AUD), and Rs. 1.79 against the Euro (EUR).

Moreover, it lost Rs. 1.40 against the Pound Sterling (GBP) in today’s interbank currency market.

I have no money