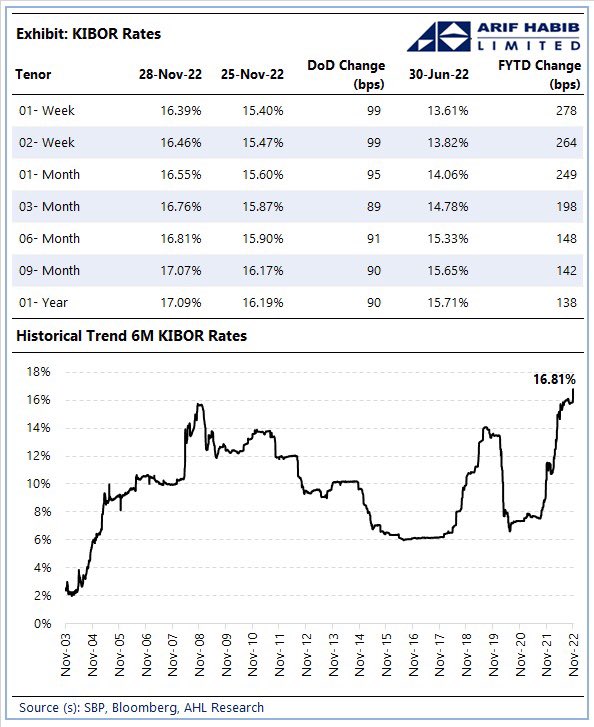

The 6-Month Karachi Inter-Bank Offered Rate (KIBOR), a benchmark for lending to consumers and businesses, surged by 91 basis points on a day-on-day (DoD) basis on Monday (November 28) to touch an all-time high after the State Bank of Pakistan’s (SBP) monetary policy decision on Friday.

According to data by Arif Habib Limited (AHL), the KIBOR has reached 16.81 percent, which is an all-time high. The hike is owed to expectations of rising inflationary pressures after the price impact of the new policy rate is passed onto the consumers.

The other widely used 3-Month KIBOR increased by 89 basis points to 16.76 percent, while the 9-Month KIBOR increased by 90 basis points from 16.17 percent to 17.07 percent. The 1-year KIBOR increased by 90 basis points, from 16.19 percent to 17.09 percent.

The spread also shows that the 1-Week KIBOR surged by 99 bps to 16.39 percent, the 2-Week KIBOR by 99 bps to 15.47 percent, and the 1-Month KIBOR from 15.6 percent to 16.55 percent.

Today’s hike comes after the central bank’s Monetary Policy Committee (MPC) on Friday raised the policy rate by 100 basis points to 16 percent. The decision reflects the MPC’s view that inflationary pressures have proven to be stronger and more persistent than expected.

It is aimed at ensuring that elevated inflation does not become entrenched and that risks to financial stability are contained, thus paving the way for higher growth on a more sustainable basis.

The government’s elevated borrowing needs and upcoming maturity payments are likely to keep KIBOR under pressure indefinitely.