The Pakistani Rupee (PKR) dropped further against the US Dollar (USD) and posted losses during intraday trade today.

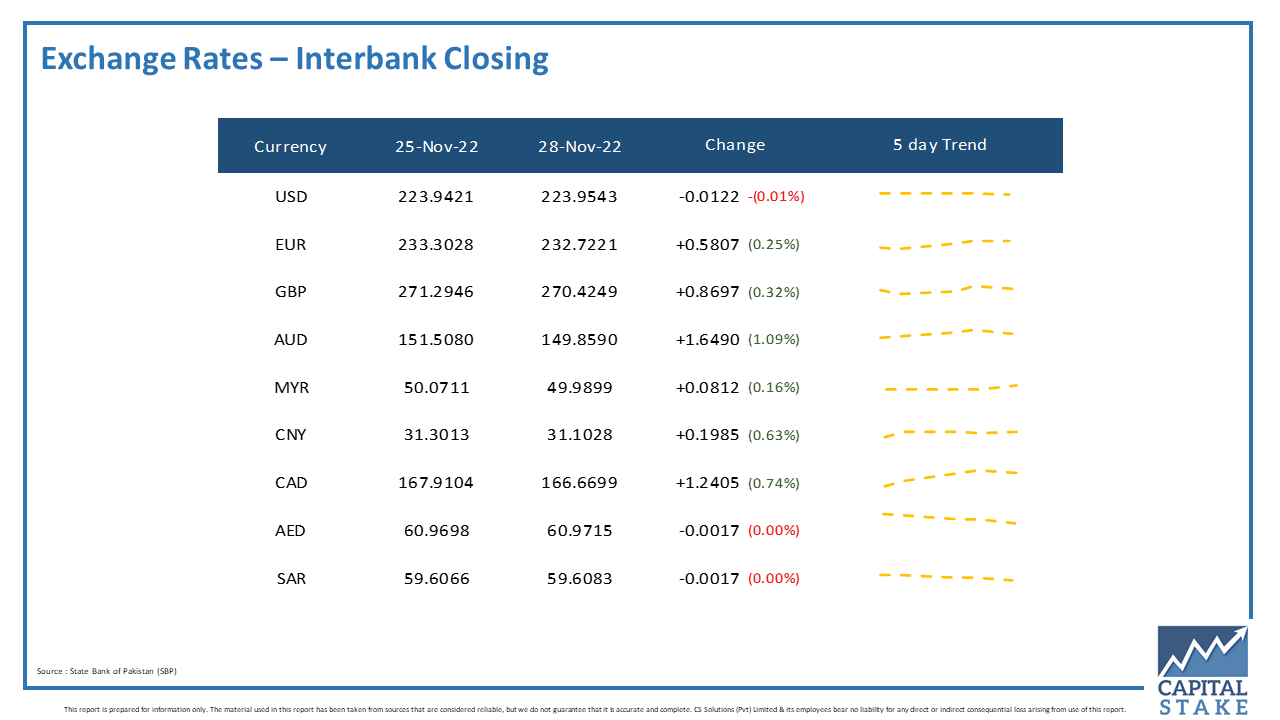

It depreciated by 0.01 percent and closed at Rs. 223.95 after losing one paisa against the greenback. The local unit quoted an intraday low of 224.40 against the greenback.

The local unit was initially bearish in the morning against the greenback and opened trade at 224.3 in the open market. By midday, the greenback moved lower against the rupee. After 1 PM, the local unit was stable and stayed on the 223 level against the top foreign currency before the interbank close.

The rupee reported losses against US Dollar for the fourth consecutive day today after the State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) on Friday raised the policy rate by 100 basis points to 16 percent. The hike represented the MPC’s view that inflationary pressures have proven to be stronger and more persistent than expected. It is aimed at ensuring that elevated inflation does not become entrenched and that risks to financial stability are contained, thus paving the way for higher growth on a more sustainable basis.

Money changers were of the view today’s drop as the market’s reaction to SBP’s Friday decision where it hiked the policy rate to 16 percent.

Trends seem red overall as the 6-Month Karachi Inter-Bank Offered Rate (KIBOR), a benchmark for lending to consumers and businesses, surged by 91 basis points to an all-time high of 16.81 percent. On the flip side, Pakistan equities witnessed a selling spree early today with the top KSE-100 index losing over 800 points.

Globally, oil prices fell to near-year lows on Monday as street protests against strict COVID-19 curbs in China, the world’s largest crude importer, fueled concerns about the outlook for fuel demand.

At 3:55 PM, Brent crude dropped $2.67 or 3.19 percent to reach $80.96 per barrel, while the US West Texas Intermediate (WTI) was significantly down by 3.11 percent to settle at $73.91 per barrel.

Both benchmarks have dropped three weeks in a row after reaching 10-month lows last week.

In addition to growing concerns about weaker fuel demand in China as a result of an increase in COVID-19 cases, political uncertainty caused by rare protests in Shanghai against the government’s stringent COVID restrictions prompted selling.

Markets appeared volatile ahead of this weekend’s OPEC+ meeting and a looming G7 price cap on Russian oil.

The PKR was bullish against most of the other major currencies in the interbank market today. It held out against the UAE Dirham (AED and the Saudi Riyal (SAR), gained 86 paisas against the Pound Sterling (GBP), Rs. 1.24 against the Canadian Dollar (CAD), and Rs. 1.64 against the Australian Dollar (AUD).

Moreover, it gained 58 paisas against the Euro (EUR) in today’s interbank currency market.

Where is PML N ky financial wizard BISKA ( Ishaq Dar media houses and lifafa journalist ky favorite finance minister 🤪