The Pakistani Rupee (PKR) dropped further against the US Dollar (USD) and posted losses during intraday trade today.

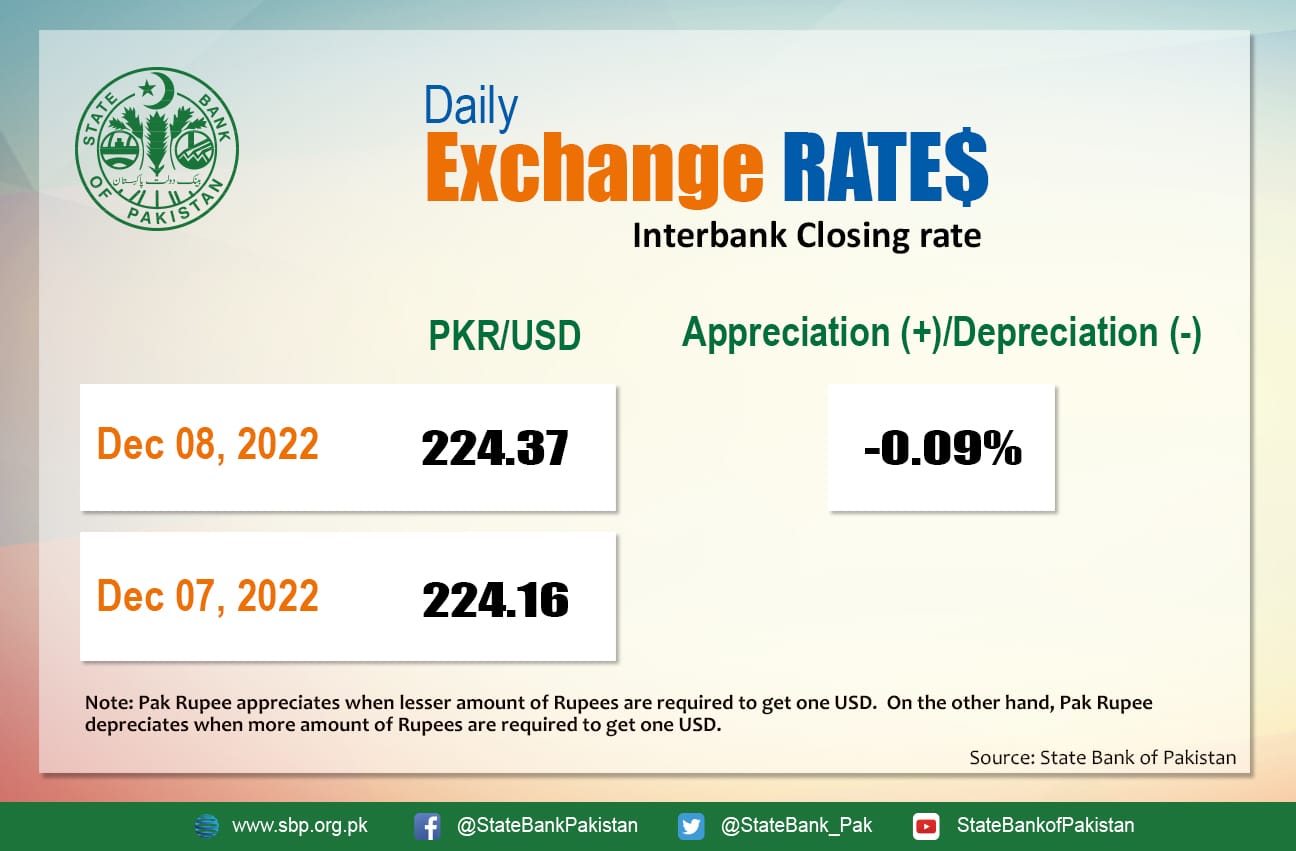

It depreciated by 0.09 percent and closed at Rs. 224.37 after losing 21 paisas against the greenback. It quoted an intraday low of 224.925 against the greenback before close.

The local unit was all red in the morning against the greenback and opened trade in the 224 range in the open market. By midday, the greenback moved higher against the rupee. After 1 PM, the local unit was still red and stayed on the 224 level against the top foreign currency the interbank close.

The rupee reported losses against the US Dollar fourth day in a row today as shrinking foreign exchange reserves, rising imports, and a delay in funding from the International Monetary Fund (IMF) weighed on investor sentiment.

Money changers and commentators say the repayment of external debt is a big issue. Investors are also paying close attention to the IMF’s developments. The next $1 billion tranche has been delayed because the government has not met the benchmarks required to complete the bailout package’s ninth review.

Ishaq Dar claimed last week that Pakistan had met all of the review’s objectives. However, the IMF resident chief stated that discussions with Pakistani authorities are ongoing, particularly given that not all end-September quantitative targets have been met. Confusion everywhere!

Despite today’s relentless sea of red, Pakistan is projected to become the sixth-largest economy in the world by 2075, according to a research paper published by Goldman Sachs. Pakistan’s star future status is predicted on the back of its population growth, which could place it among the largest economies in the world in the next 50 years, according to the paper.

Globally, oil rose on Thursday after four sessions of big drops, boosted by hopes that easing anti-COVID measures in China will boost demand, as well as signs that some tankers carrying Russian oil have been delayed since a G7 price cap went into effect.

At 4:45 PM, Brent crude surged by $0.42 or 0.54 percent to reach $77.59 per barrel, while the US West Texas Intermediate (WTI) was all green at $72.58 per barrel.

On Wednesday, both Brent and US crude hit 2022 lows, wiping out all gains made after Russia’s war with Ukraine aggravated the worst global energy supply crisis in decades and sent oil close to its all-time high of $147.

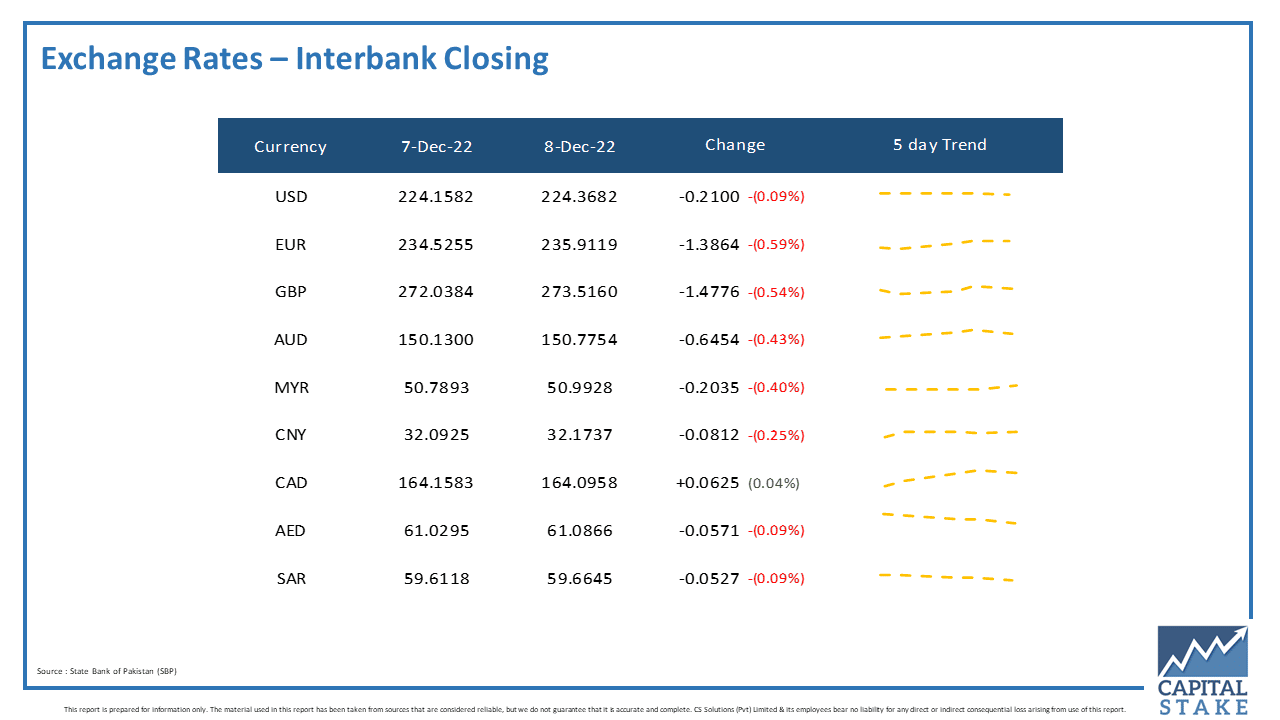

The PKR was bearish against most of the other major currencies in the interbank market today. It lost five paisas against both the Saudi Riyal (SAR) and the UAE Dirham (AED), 64 paisas against the Australian Dollar (AUD), Rs. 1.38 against the Euro (EUR), and 1.47 against the Pound Sterling (GBP).

Conversely, it gained six paisas against the Canadian Dollar (CAD) in today’s interbank currency market.