The Pakistani Rupee (PKR) dipped further against the US Dollar (USD) and posted losses during intraday trade today.

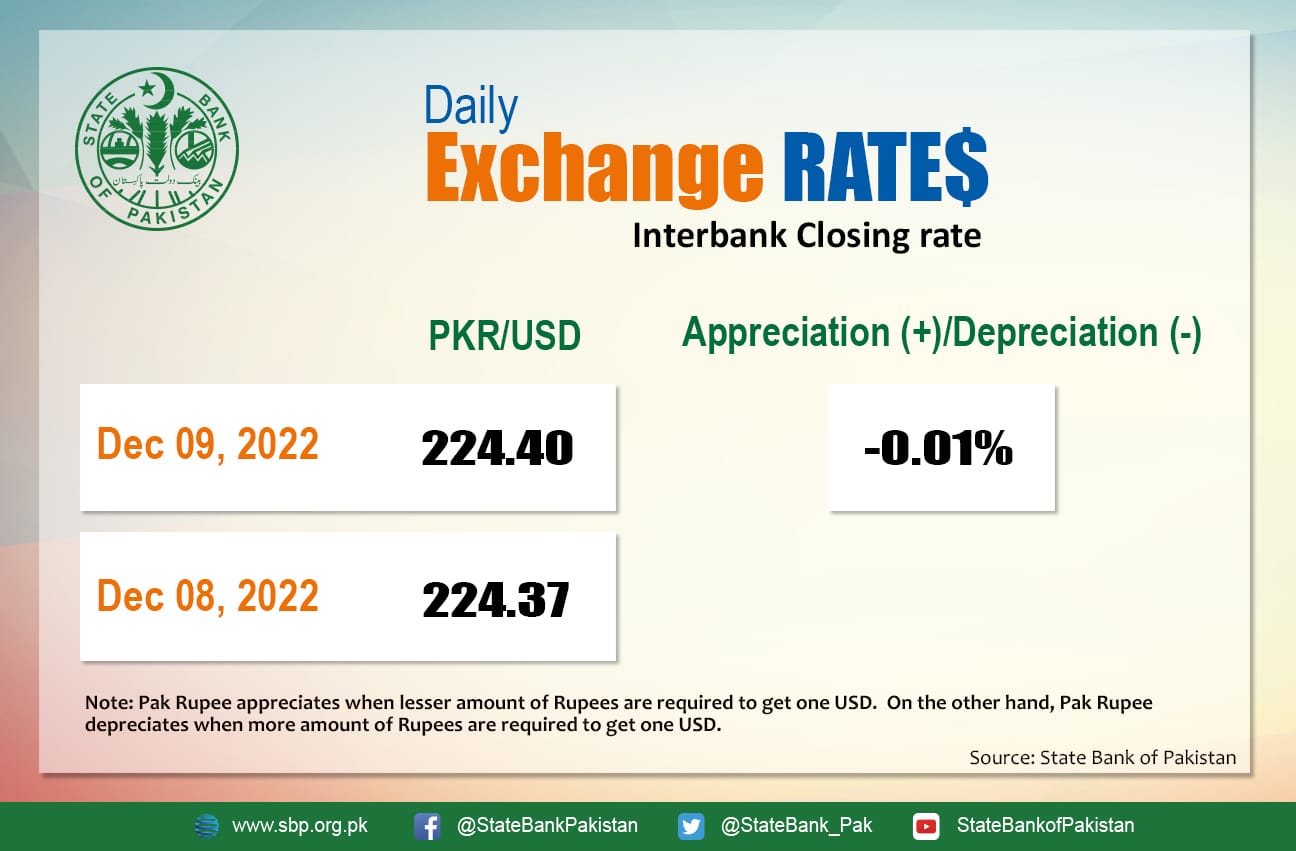

It depreciated by 0.01 percent and closed at Rs. 224.40 after losing three paisas against the greenback. It quoted an intraday low of 225 against the greenback before close.

The local unit was all red in the morning against the greenback and opened trade in the 224 range in the open market. By midday, the greenback moved lower against the rupee. After 1 PM, the local unit was bearish red and stayed on the 224 level against the top foreign currency the interbank close.

The rupee reported losses against the US Dollar fifth day in a row today despite assurances from the central bank governor Jameel Ahmad that “all debt repayments are on track and the country’s foreign exchange reserves are expected to rise in the second half of the current fiscal year 2022-23”.

“Our foreign exchange reserves were $7.9 billion last week after receiving $500 million from the Asian Infrastructure Investment Bank (AIIB). Although it is common knowledge that the central bank recently paid off a Sukuk, other debt obligations were also fulfilled in the past week. After accounting for inflows during the period, reserves stood at $6.7 billion at the end of the week on December 2nd,” the governor added. “Forex reserves will improve as soon as these amounts start coming in”.

Globally, oil prices remained stable on Friday, but both benchmarks were on track for a weekly loss due to concerns about weak economic outlooks in China, Europe, and the United States, which were weighing on oil demand. The contracts are set to lose around 10% per week, their worst weekly percentage drops since August and April, respectively.

At 3:25 PM, Brent crude surged by $0.85 or 1.12 percent to reach $77 per barrel, while the US West Texas Intermediate (WTI) was all green at $72.41 per barrel.

Brent contract market structure has shifted to contango, which means that contracts for near-term delivery are cheaper than contracts for delivery in six months, indicating that traders expect weaker demand.

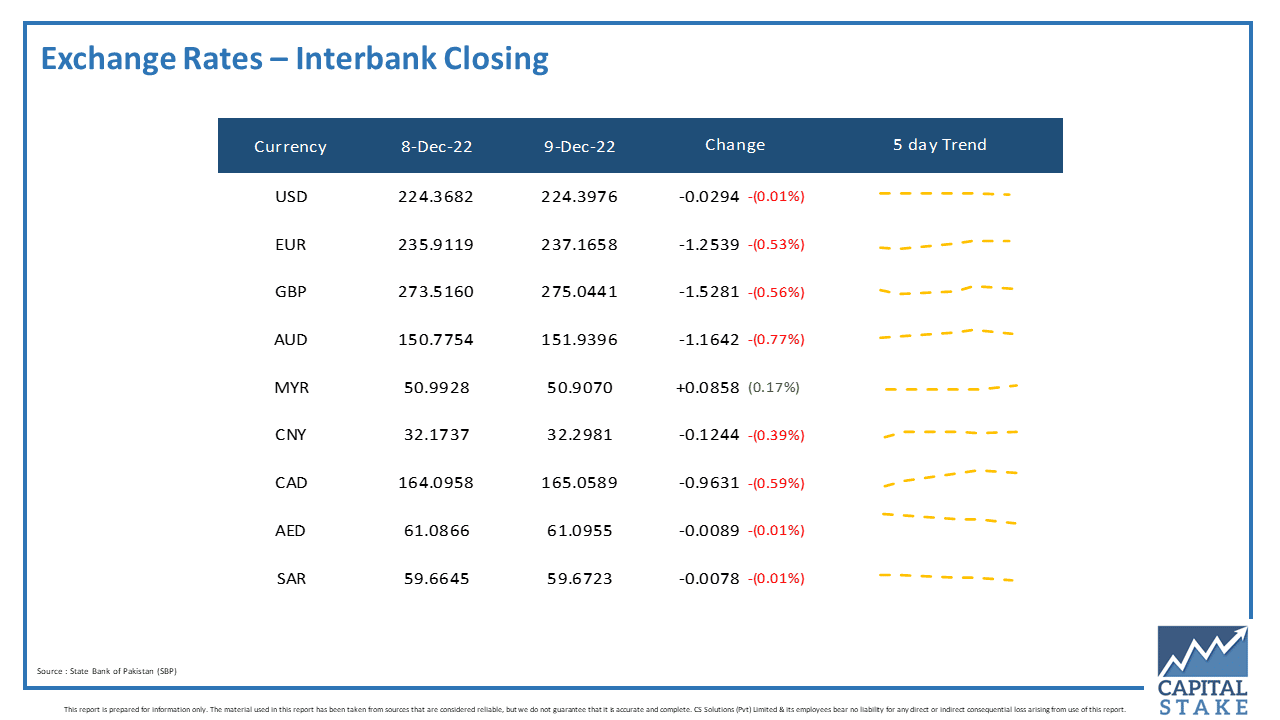

The PKR was bearish against the other major currencies in the interbank market today. It held out against both the Saudi Riyal (SAR) and the UAE Dirham (AED), Rs. 1.16 against the Australian Dollar (AUD), Rs. 1.25 against the Euro (EUR), and 1.52 against the Pound Sterling (GBP).

Moreover, it lost 96 paisas against the Canadian Dollar (CAD) in today’s interbank currency market.