Economic and political issues badly affected the Pakistan Stock Exchange (PSX) during the calendar year 2022.

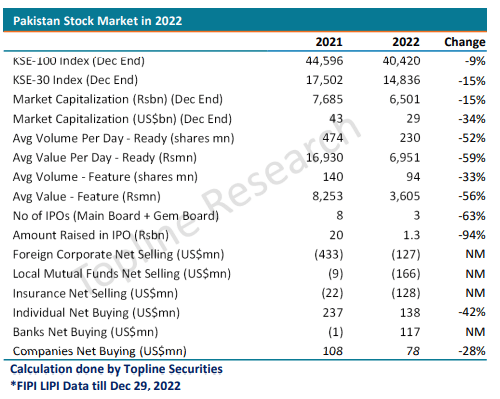

According to Topline Securities, the benchmark KSE Index fell by 9 percent in 2022. With the Pakistani Rupee (PKR) falling by 22 percent against the USD, the index was down 29 percent in US dollar terms.

It was also a turbulent year for global stock markets as $18 trillion was wiped out in 2022 with a drop of approximately 20 percent in the MSCI World Index which is the worst performance since the 2008 crisis. The MSCI Emerging Markets (EM) index fell 22 percent while the MSCI Frontier Markets (FM) was down 29 percent in 2022.

As per Bloomberg data, Pakistan’s KSE-100 Index was amongst the worst-performing markets in US dollar terms in 2022 as shown below.

Due to macroeconomic issues, activity at PSX also remained dull. The average traded volume (ready/cash) per day at PSX was down 52 percent to 230 million shares per day. Similarly, the average traded value per day was down 59 percent to Rs. 7 billion per day which was the lowest since 2019. In the futures market, total traded volume and value per day were also down by 33 percent and 56 percent to 94 million and Rs. 3.6 billion, respectively.

KSE Index also underperformed other asset classes in 2022 including Gold (+45 percent), 1-year US$ Naya Pakistan Certificate (+36 percent), and US Dollar (+28 percent).

T-Bills, Money Market Funds, and Property indices posted returns in the range of 12-14 percent in 2022.

The IPO market was also impacted due to falling equity values as only 3 Initial Offerings/IPOs came to raise funds in 2022 as against 8 IPOs in 2021. The number of IPOs is also the lowest after 2019 when Pakistan saw just one IPO at PSX.

Foreign corporate selling continued in 2022 with net selling of US$ 127 million. In the last 7 years, foreign corporates have sold shares worth US$ 2.5 billion at PSX.

Local mutual funds and insurance companies also trimmed their position in 2022 where mutual funds sold US$ 166 million while insurance companies sold US$ 128 million in 2022.

Selling was absorbed by local Individuals, Banks, and Companies with net buying of US$ 138 million, US$ 117 million, and US$ 78 million, respectively, in 2022.