The Pakistani Rupee (PKR) continued its fall against the US Dollar (USD) for the 23rd consecutive day today.

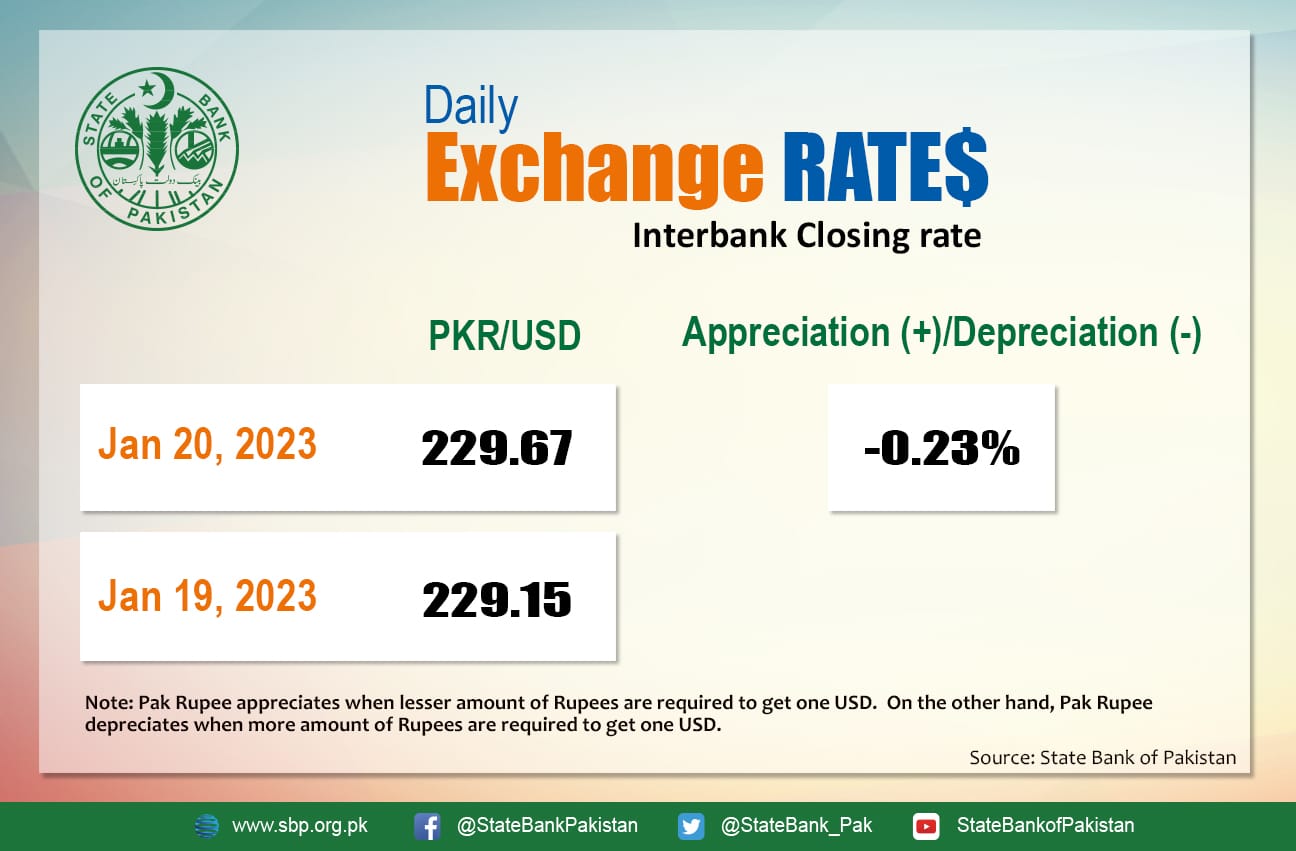

The PKR depreciated by 0.23 percent and closed at Rs. 229.67 after losing 52 paisas. It quoted an intraday low of 230 against the greenback before close.

The local unit was bearish against the greenback and opened trade at 229.85 in the open market. By midday, the greenback moved higher against the rupee to 230.125. After 1 PM, the local unit slowed losses and stayed at the upper 229 level against the top foreign currency before the interbank close.

The rupee reported losses against the US Dollar today despite big news from Russia. Pakistan and Russia have agreed on late March as the timeline for crude oil export. Pakistan wants to import 35 percent of its total crude oil requirement from Russia. Moreover, Pakistan and Russia have mutually agreed to finalize the transaction structure for trade in the oil and gas sector by March 2023.

All of this was agreed to at the Eighth Session of the Pakistan-Russia Inter-Governmental Commission on Trade, Economic, Scientific, and Technical Cooperation (IGC) held on January 18-20, 2023 in Islamabad.

The federal government is also working on bringing a money bill through an ordinance in two to three days for the imposition of more than Rs. 150 billion in taxes to meet most of the conditions of the International Monetary Fund (IMF) with regard to the imposition of an additional Rs. 150 billion taxes but also to increase gas and electricity prices.

Money changers said the proposed reforms of the IMF will burden every man and sentiments behind that outlook weighed heavily on traders who decided to hold on to their greenbacks.

Globally, oil prices climbed on Friday and were on track for a second straight weekly gain, boosted largely by improved economic prospects in China and expectations of increased fuel demand in the world’s second-largest economy.

The lifting of COVID-19 restrictions in China is expected to boost global demand to a record high this year, according to the International Energy Agency (IEA), a day after OPEC forecasted a Chinese demand rebound in 2023.

At 4:40 PM, Brent crude was up by $0.64 or 0.74 percent to reach $86.80 per barrel, while the US West Texas Intermediate (WTI) was also green at $80.55 per barrel. Both benchmarks were initially headed for a weekly gain of about 1.5 percent before slowing down.

Oil was also backed by expectations that the US Federal Reserve will soon shift to smaller rate hikes, as well as optimism about the US economy.

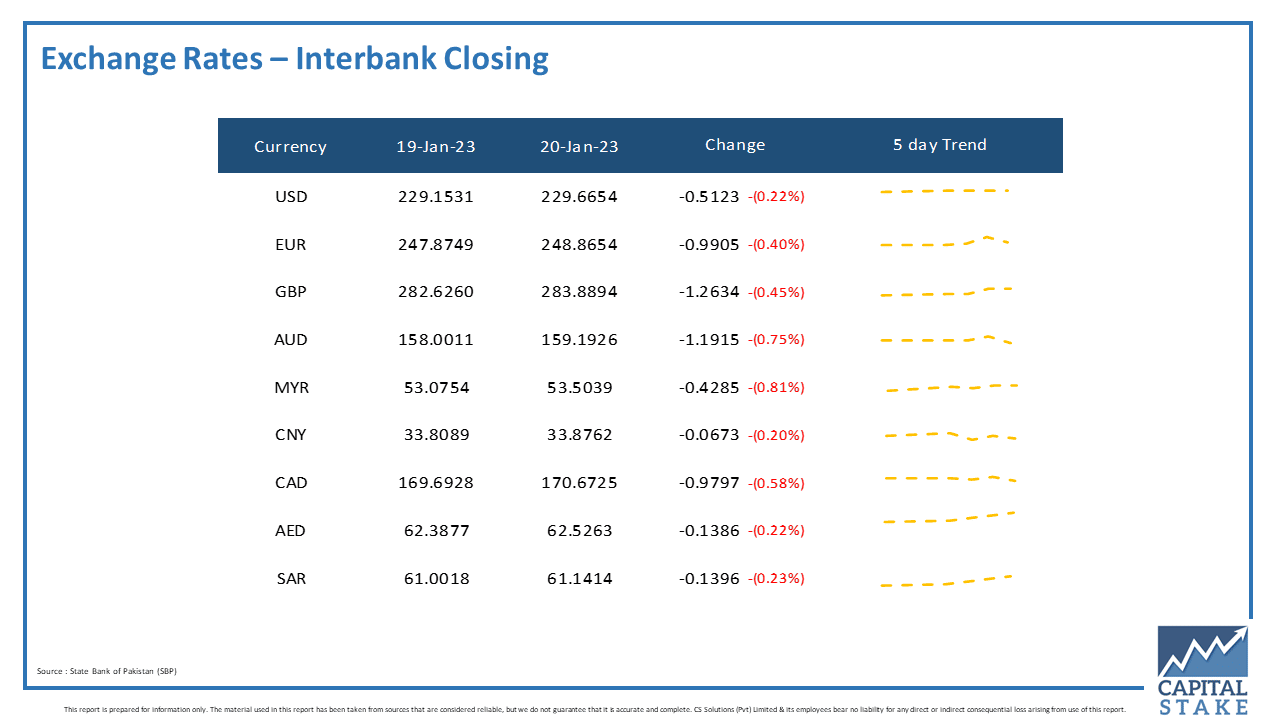

The PKR was bearish against all of the other major currencies in the interbank market today. It lost 13 paisas against the UAE Dirham (AED) and 13 paisas against the Saudi Riyal (SAR).

Moreover, it lost 97 paisas against the Canadian Dollar (CAD), 99 paisas against the Euro (EUR), Rs. 1.19 against the Australian Dollar (AUD), and Rs. 1.26 against the Pound Sterling (GBP) in today’s interbank currency market.

nice

Very sooner Pakistan is engaging with Chinese financial system as US and European countries are unduly punishing Pak govt and its people by using $as a weapon ,one day they will repent their decision ,once Pak people will find refuge somewhere else

Pakistan

Farmar

Pakistan