The Pakistani rupee dropped further against the US Dollar during intraday trade today after opening trade at 279.75.

The Pakistani rupee was bearish during the afternoon with the interbank rate reversing early-day gains to fall as low as 286.5 before rebounding back marginally. Open market rates across multiple currency counters managed between 295-310 while traders expect the exchange rate to observe bearish trends amid the ongoing Hajj season.

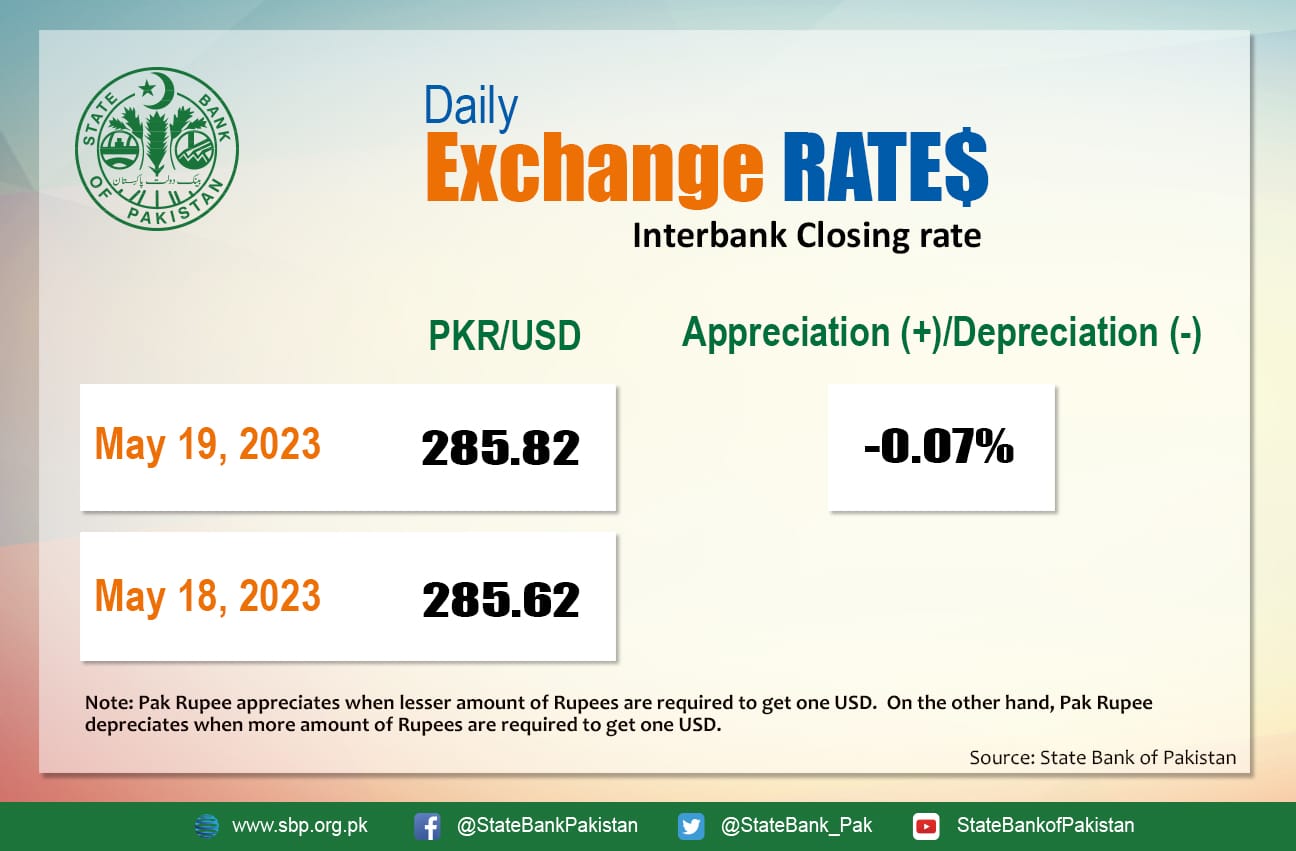

At close, the PKR depreciated by 0.07 percent and closed at 285.82 after losing 20 paisas today.

Markets were bearish despite early-day gains which saw the PKR once again lose roughly Rs. 6 against the USD after opening above 280.

The economy is facing severe headwinds and added pressure from under-performing state institutions could set the PKR on another crash course in the coming weeks. Pertinently, the foreign exchange reserves held by the central bank declined by 1.7 percent on a weekly basis, according to data released by the State Bank of Pakistan (SBP) on Thursday.

On May 12, the foreign currency reserves held by the SBP were recorded at $4.312 billion, down $72 million compared to $4.383 billion on May 5. The central bank said in a statement that the decline in reserves was due to external debt repayment.

Traders lamented the gradual decrease in forex reserves and warned the clear-out amid a forced current account surplus coupled with looming debt maturities is spelling slow death for market sentiments. They said the uncertainty regarding forex reserves, coupled with high inflation and foreign currency shortages due to Hajj season is badly impacting the exchange rate. “To pay $3.7 million in debt by end-June is scaring investors. Dollar sellers are reluctant to visit currency counters as they expect another bashing soon. In short, a falling PKR and an abysmal import cover of fewer than 4 weeks (reserves) are pointing toward default. The IMF is silent,” one of them said.

The rupee is down nearly Rs. 59 since January 2023. Since April 2022, it is down over Rs. 106 against the greenback. As per the exchange rate movements witnessed today, the PKR has lost 20 paisas against the dollar today.

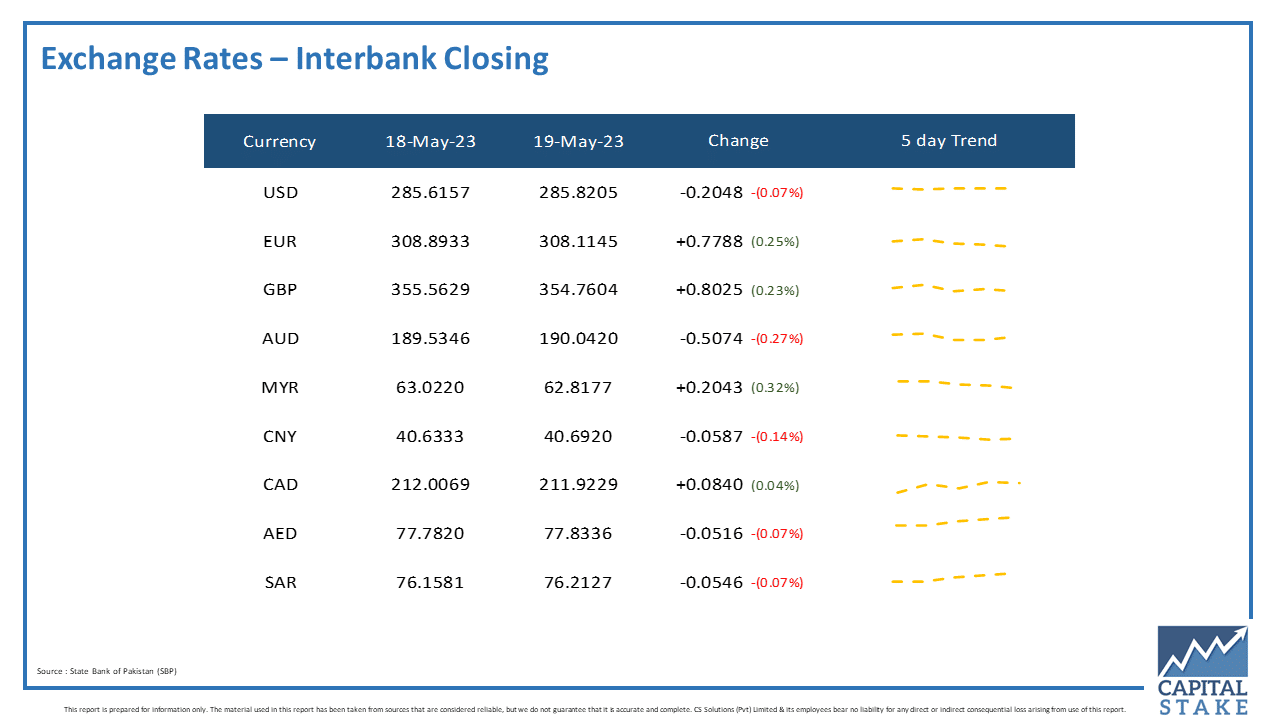

The PKR was green against some of the other major currencies in the interbank market today. It gained eight paisas against the Canadian Dollar (CAD), 77 paisas against the Euro (EUR), and 80 paisas against the Pound Sterling (GBP).

Conversely, it lost five paisas against the Saudi Riyal (SAR), five paisas against the UAE Dirham (AED), and lost 50 paisas against the Australian Dollar (AUD) in today’s interbank currency market.

Ishaq again started controlling the exchange rates. In open market USD is not even available at 320 but in news.

Unfortunately, economy of Pakistan is facing a horrible crisis, not seeing to be stopped even in far future. But the authorities concerned are least interested to manage the menace. Corruption and mining a non productive money causing a big big INFLATION.

Billions of rupees are being transacted as speed money, bribery, kick back, procurement commission, inside trading, unauthorised money transfer, unauthorised corruption and fraud in the field of real estate like RUDA and many others. I am quite certain that stability in Economy can’t be achieved without taking measures against all these corrupt practices along with a good Industry Policy leading to integrity towards Exports.

Conclusion is that the most importantly to be remembered ” Non Productive Circulation of Money Causes INFLATION.

This makes the common men’s life more nd more difficult and an unrest in the society.