Pakistan’s top cement companies reported double-digit profit growth in the current fiscal year’s second quarter (FY23) despite current macroeconomic challenges in the country.

“The recent core performance for JS Cement Universe has reflected resilience to the ongoing macro adjustments, bringing the sector back to the radar.

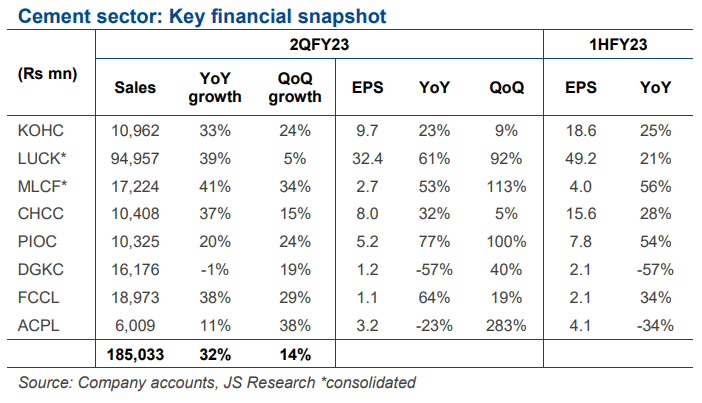

The sector reported 14 percent quarter-on-quarter (QoQ) profit growth, on the back of higher sales (owing to better QoQ volumes as 1QFY23 carried the impact of monsoon and heavy flooding). 2QFY23 earnings for JS Cement Universe (8 companies) showed a 42 percent YoY increase despite higher finance charges. Similarly, 1HFY23 earnings for these companies showed a 21 percent YoY increase,” according to Assistant VP at JS Global Waqas Ghani.

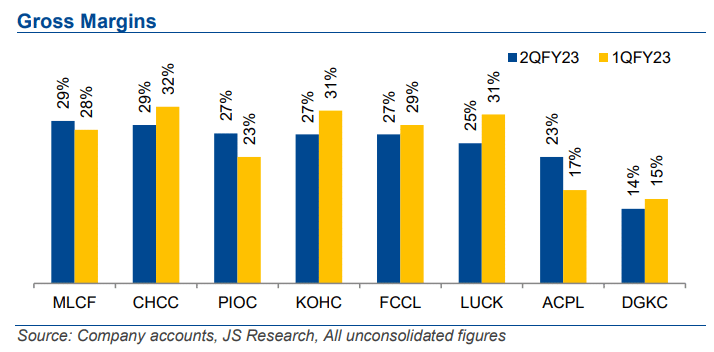

Average gross margins this quarter broadly brought a positive surprise to most quarters of the market. The sector’s average margins were reported at 25 percent, only trimming by 140bp QoQ despite rising input costs and higher inflation in 2QFY23, owing to effective coal inventory management. While Pioneer Cement Limited (PIOC), Attock Cement Pakistan Limited (ACPL), and Maple Leaf Cement Factory Limited (MLCF) improved on the gross level, margins for the remaining companies were slightly trimmed.

Company-Wise Summary

Lucky Cement (PSX: LUCK) posted lower-than-expected gross margins (-5ppt QoQ, +3ppt YoY) in the last quarter. Cumulatively for 1HFY23, the company posted an unconsolidated profit of Rs. 7.1 billion (EPS: Rs22.04), +23 percent YoY.

On a consolidated basis for 2QFY23, LUCK showed a 39 percent YoY increase in Revenue as a result of higher turnover for most subsidiaries whereas its consolidated bottom line grew by 61 percent YoY.

Pioneer Cement (PSX: PIOC) presented a better core level result in 2QFY23 where the company’s operating profit grew 59 percent YoY as it utilized lower cost of coal for the quarter. The company’s gross margins showed an increase of 7ppt/4ppt on a YoY/QoQ basis.

Cherat Cement (PSX: CHCC) posted a decent 2QFY23 result, its operating profit depicted a growth of 47 percent YoY.

Kohat Cement (PSX: KOHC) posted a PAT of Rs. 1.95 million (EPS: Rs. 9.73) in 2QFY23 (+23 percent YoY) while half-year earnings clocked in at Rs. 18.62, a 25 percent YoY increase. The company during 2QFY23 showed a 3ppt YoY drop in gross margins as well as operating margins due to normalization of coal costs on the back of higher priced Afghan coal during winter.

Maple Leaf Cement’s (PSX: MLCF) consolidated earnings for 2QFY23 came in at Rs. 2.9 billion (EPS: Rs2.73), a 53 percent increase compared to SPLY on the basis of a higher quantum of lower-priced local coal in the fuel mix and better retention prices during the period. MLCF posted a 1ppt YoY increment in its gross margins in the last quarter and a 48 percent YoY increase in operating profits.

DG Khan Cement Limited (PSX: DGKC) posted earnings of Rs543mn in 2QFY23 translating into an EPS of Rs. 1.24, a 57 percent YoY decline. Half-year earnings for the company clocked in at Rs. 2.13, also declining by 57 percent YoY. Gross margins for the outgoing quarter declined mainly due to lower retention prices for the south region.

Attock Cement Pakistan Limited (PSX: ACPL) was also among the outperformed during 2QFY23 mainly on the back of improved local dispatches. The company showed an increase of 3ppt/6ppt on a YoY/QoQ basis in gross margins as it attempted to curtail power costs to offset higher fuel cost impact by utilizing its captive plant rather than relying on the national grid for power supply.

Outlook

Waqas said demand improvement in recent months has given the industry room to pass some of the impacts of cost growth along, evident from the passing on of the impact as per the recent supplementary finance bill in which hikes in FED and sales tax were approved.

JS Global has an overweight stance on the sector given its proactive cost management approach and decent gross-level performance despite the mounting cost pressures. Unfavorable effects of anticipated capacity expansions by cement makers continue to be among the sector’s top worries. Nevertheless, any decrease in coal costs is a positive.

Government restrictions on imports however will likely continue to make it difficult for cement producers to avail the lower priced international coal.