Commercial and microfinance banks have been directed to compensate customers for any delays in clearance of their cheques and other payment instruments.

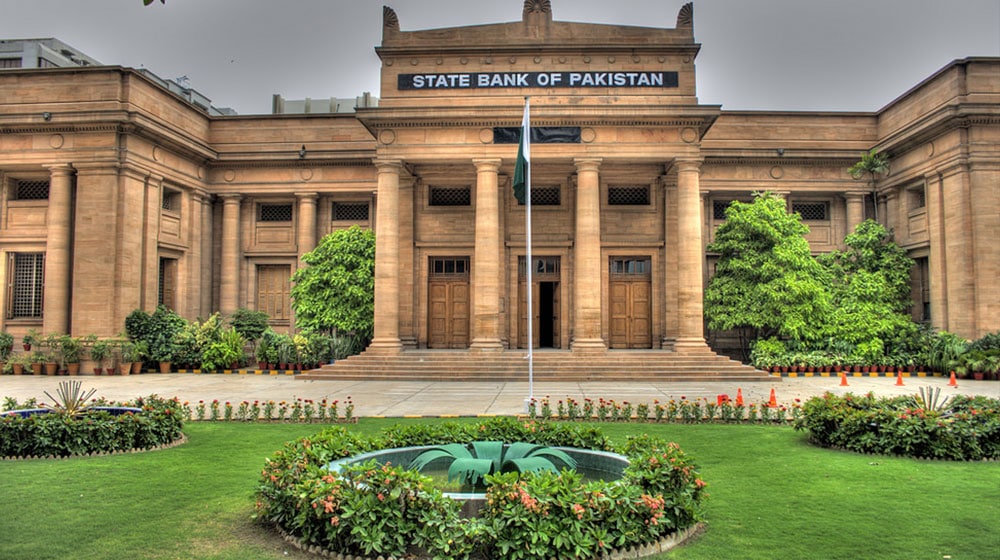

State Bank of Pakistan (SBP) has directed commercial and microfinance banks to pay an amount of 3% markup plus policy rate to customers in case the bank fails to transfer (credit) the funds into the user account within preset timelines or if the cheque or any other instrument is lost during transit.

The collecting bank shall pay the compensation amount to payee’s account without any claim from the payee within thirty-one days from the lodge of payment instrument by the payee.

In case the collecting bank is not responsible for the delay, it can claim the compensation payment from Drawee or Clearing House, whoever is responsible, except in case the Drawee/Clearing House has declared force majeure (situations beyond its control).

Banks/Clearing House shall not be liable to compensate the payees in case the Bank/Clearing House declares force majeure. The banks are not allowed communicate the force majeure events to customers.

These instructions were stated in the ‘Guidelines for Clearing Operations’ by the SBP issued for compliance by Clearing House(s) and its member companies including banks and microfinance banks involved in clearing of Rupee payments.

The aim of the guidelines is to facilitate general public for timely transfer of money into their bank accounts and ensure consumer protection. The guidelines will be effective from January 1, 2018.

Banks shall process the intercity payments by within 3 extra days. Banks shall ensure that payee account is credited against the proceeds of the clearing before the end of this timeline, the guidelines stated.

Banks that do not have online branches shall conduct the clearing cycles as per the existing procedures.

Banks/microfinance banks have also been advised to make arrangements for centralized clearing of their intercity payments through their designated branches in cities where they are present to reduce the clearing time due to physical movement of money.

Banks shall centralize their clearing operations to make the Intercity Clearing more efficient, provided inter and intra city cash withdrawals/payments are offered by the banks to payees. Consequently, the practice of physical movement of intercity payments shall be discontinued.

Accordingly, banks have been asked to designate a branch in each clearing region for processing and clearing of any payments drawn via the online branches of the banks in other cities.

Clearing Houses must forward the intercity payments in a separate bundle to the branches designated by the Bank for processing of Intercity Clearing.

The Clearing House and bank’s charges for clearing of intercity payments shall be in line with intra-city clearing charges. Banks shall ensure that payee account is credited against the proceeds of the payment instrument lodged in Intercity Clearing before the close of the next business day.

Further, in order to timely resolve customer complaints, dispute resolution mechanism, with a fixed turnaround time, has also been prescribed for banks/microfinance banks. In addition, all banks have also been advised to disclose the cut-off time for delivery of payments, timelines to credit the customers’ accounts, and the roles, responsibilities and liabilities of customers with respect to collection and clearing of payments.