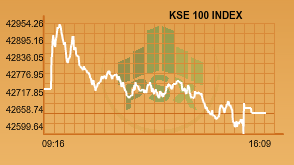

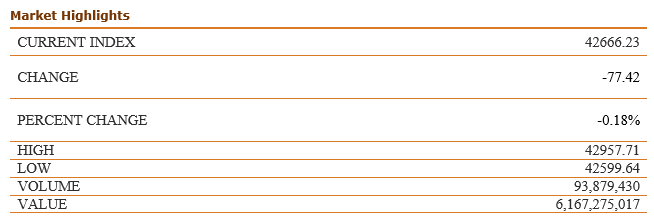

Another volatile session was witnessed today due to the prevailing political uncertainty. At the end the benchmark index closed with -77.42 or -0.18% to close at 42666.23 points.

The market opened positive and touched the intraday high of 214 points. The index gained as Oil sector rallied as the oil prices hit a more than two-year high on Monday after major producers said the global market was on its way towards rebalancing.

The Oil sector was up by almost 510 points during the day which brought up the gain today. All the oil stocks rallied today.

The November Brent crude futures contract was up $1.51, or 2.5 per cent, at $58.37 a barrel by 11:33 am EDT (1533 GMT), its highest since July, 2015. US West Texas Intermediate crude for November delivery rose $1.02, or 2pc, to $51.68 a barrel, close to highs last seen in May.

The market remained volatile over the political uncertainty as well as it went down to intraday low of 144 points. Overall the trading was dull today.

Many corporate results were announced during the day which also affected the market sentiments as well.

Sazgar Engineering Works Ltd. announced Financial Results for the period ended June 30, 2017.

The company reported an increase of 26% in Sales for the period ended June, 30 2017, whereas reported an increase of 33% in Profit after Tax.

The company reported an Earning per share of Rs. 7.95, up by 33% from same period last year.

The board has not recommended a final Cash Dividend for the year ended June 30, 2017. This is in addition to the interim dividend already paid at 12.5% of Rs. 1.25/-. The board issued no bonus or right shares.

Pakistan International Bulk Terminal announced Financial Results for the period ended June 30, 2017.

The company reported an Earnings per share of Rs. 0.02, with a decline of 24% in Profit after Taxation. The board has not recommended any final Cash Dividend for the year ended June 30, 2017. The board issued no bonus or right shares.

Wyeth Pakistan Ltd reported a decrease of 16% in Net Sales for the period ended June, 30 2017, whereas reported loss from continuing operations.

The company reported a Loss per share of Rs. 1.89.

The board has recommended a final Cash Dividend for the year ended June 30, 2017 @ a rate of 300% amounting to Rs. 300/share. The board issued no bonus or right shares.

Trading volumes of All share index surged down to 145 million shares which were more than yesterday’s closing.

Overall, stocks of 357 companies were traded on the exchange, of which 124 gained in value, 212 declined and 21 remained unchanged. In KSE 100, 93 million shares were traded with a net worth of Rs. 6.17 billion.

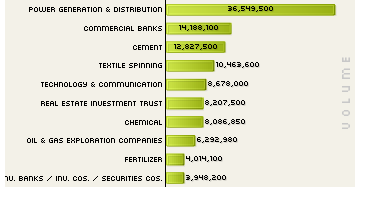

Top traded sectors:

Aisha Steel Mill was the volume leader with a massive turnover of 33.80 million shares, gaining Rs. 0.58 to close at Rs. 6.89. It was followed by Dolmen City with 8.20 million shares, gaining Rs. 0.09 to close at Rs. 11.00, Maple Leaf with 6.00 million shares, losing Rs. 1.46 to close at Rs. 87.38 and Lotte Chemical 5.30 million shares, losing Rs. 0.29 to close at Rs. 8.04.

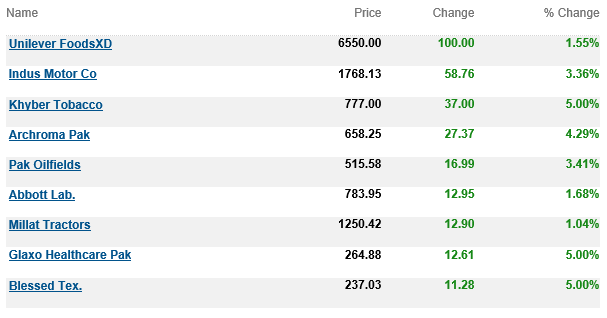

Top Advancers of the market were:

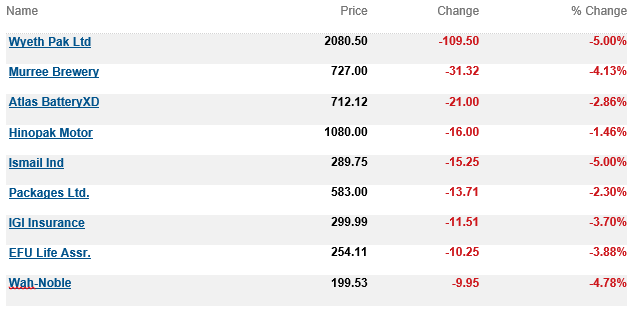

Top Decliners of the market were: