Mere 16% of Pakistanis have access to a formal financial service in Pakistan. “Lack of need” is cited as the main reason for not using formal financial services, according to Financial Inclusion Insights (FII) Survey by InterMedia USA (www.finclusion.org) in Pakistan (fieldwork conducted by Gallup Pakistan).

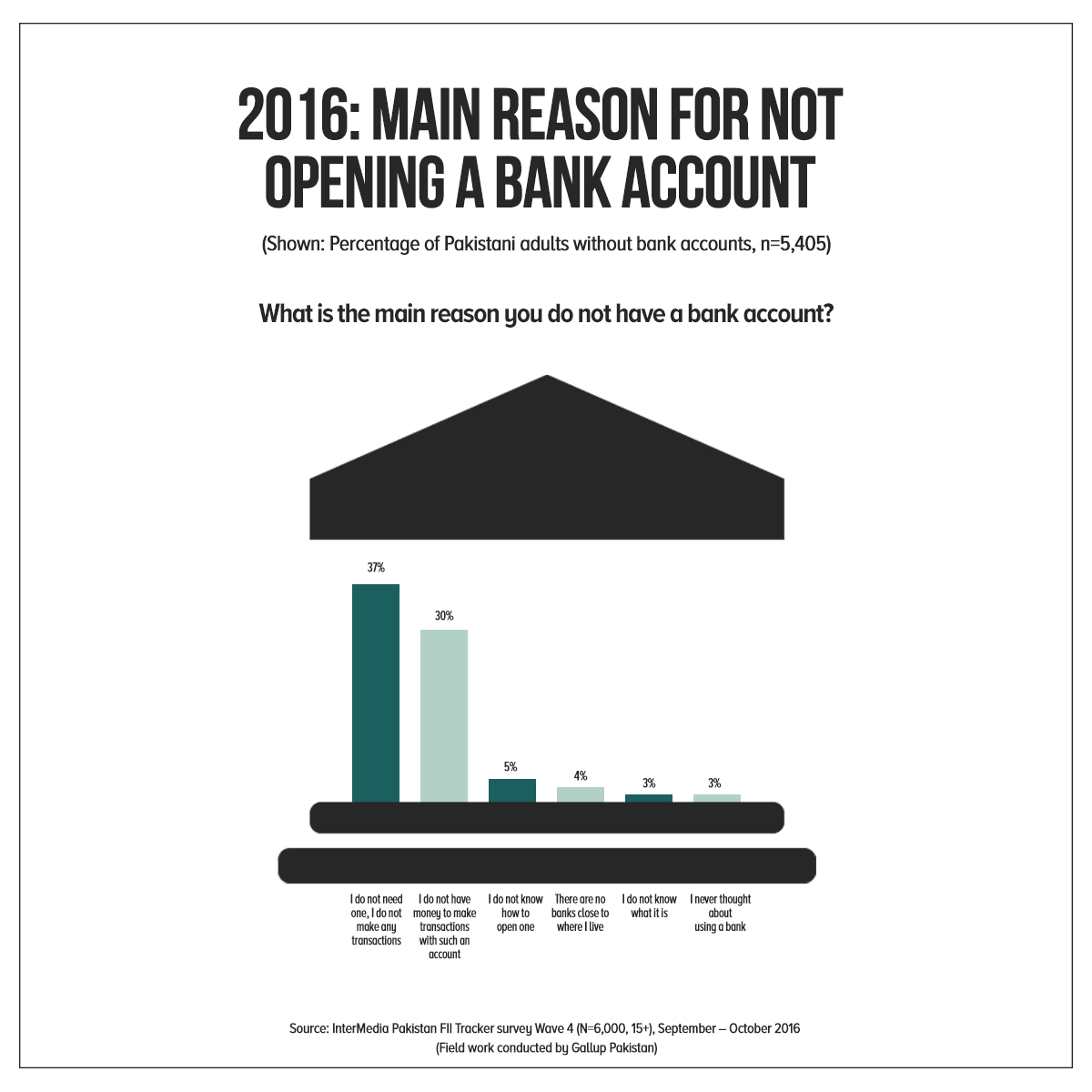

Of these 84% Pakistanis, 37% Pakistanis cite lack of need as the main reason for not opening a bank account or mobile money account, followed by 30% who say they do not have enough money to make any transactions with a bank account, while 5% do not know how to open a bank account.

Moreover, 4% said there are no banks in their vicinity and 3% each said they did not know what a bank is and they never thought about using a bank.

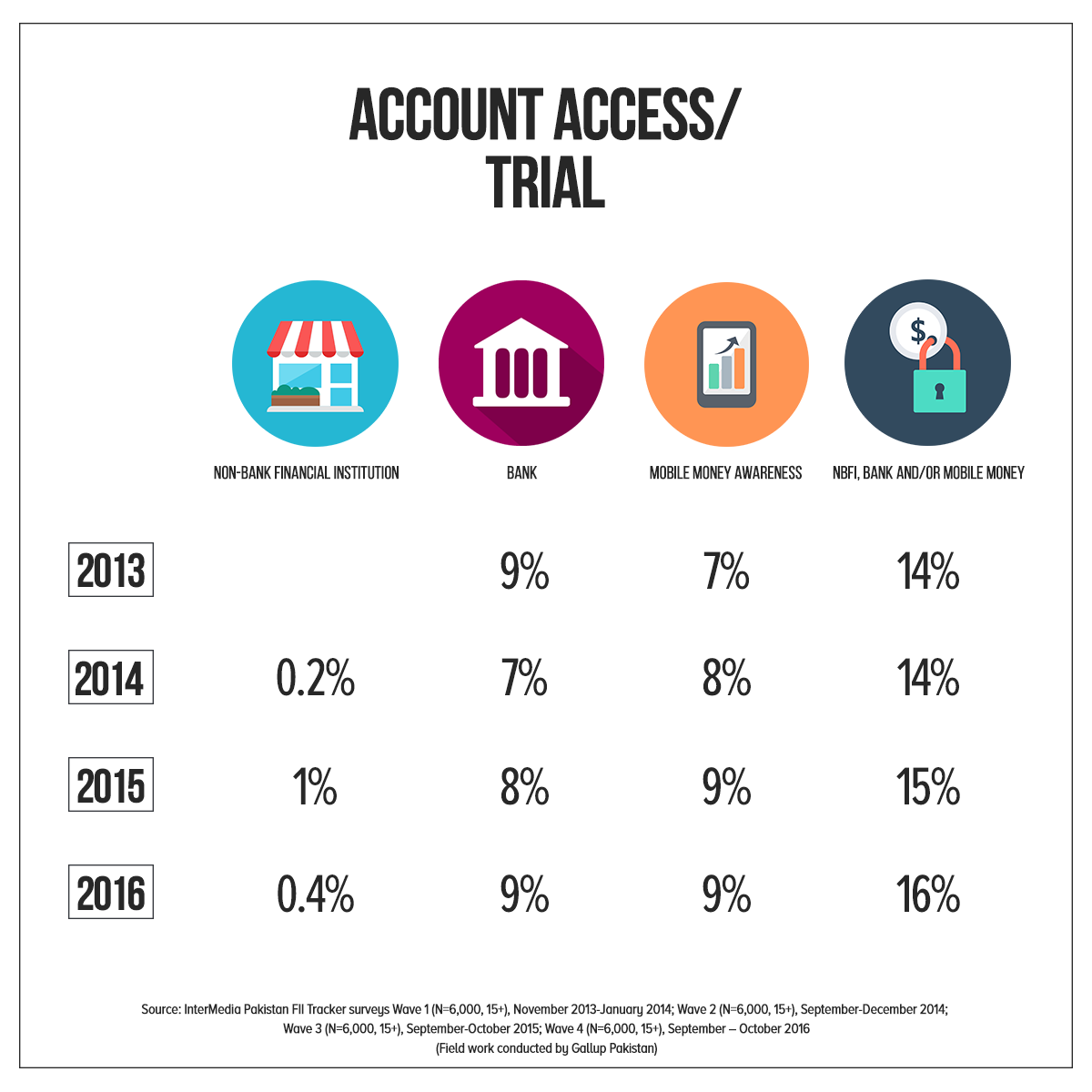

In 2013, only 14% Pakistanis accessed any formal financial account which has now increased to 16% in 2016.

Among the formal financial services, banks and mobile money are the most frequently accessed services (9% each).

Interestingly, 79% adult Pakistanis are aware of a point of financial service within 1 km of their homes, but only 16% have tried to use a service. The latter part of this press release explains the barriers to accessing financial services.

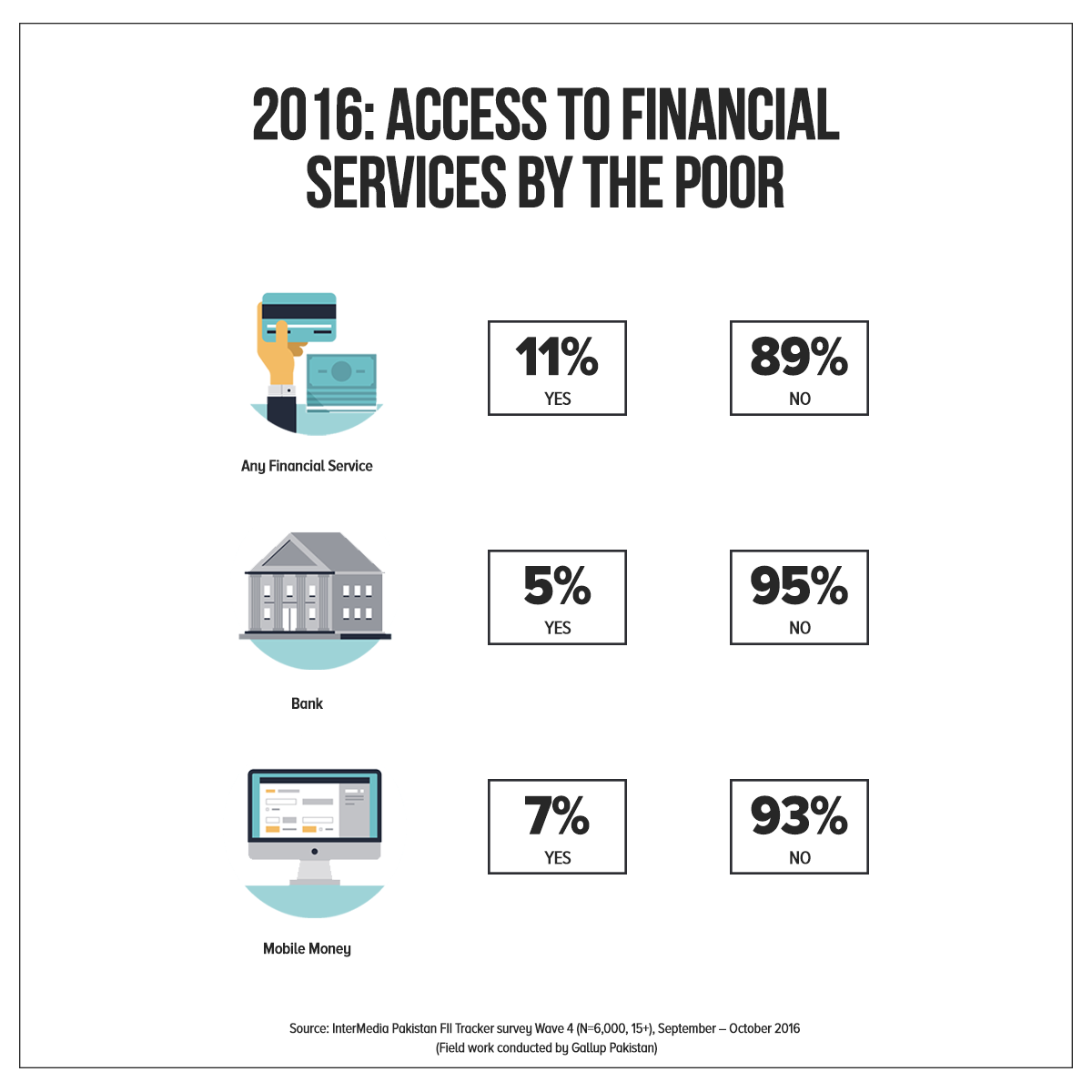

Poor: Mobile Money Mostly Used

11% of the poor have access to any financial service in Pakistan; 89% do not. 7% of the poor have access to mobile money; 93% do not. 5% of the poor have access to banks; 95% do not.

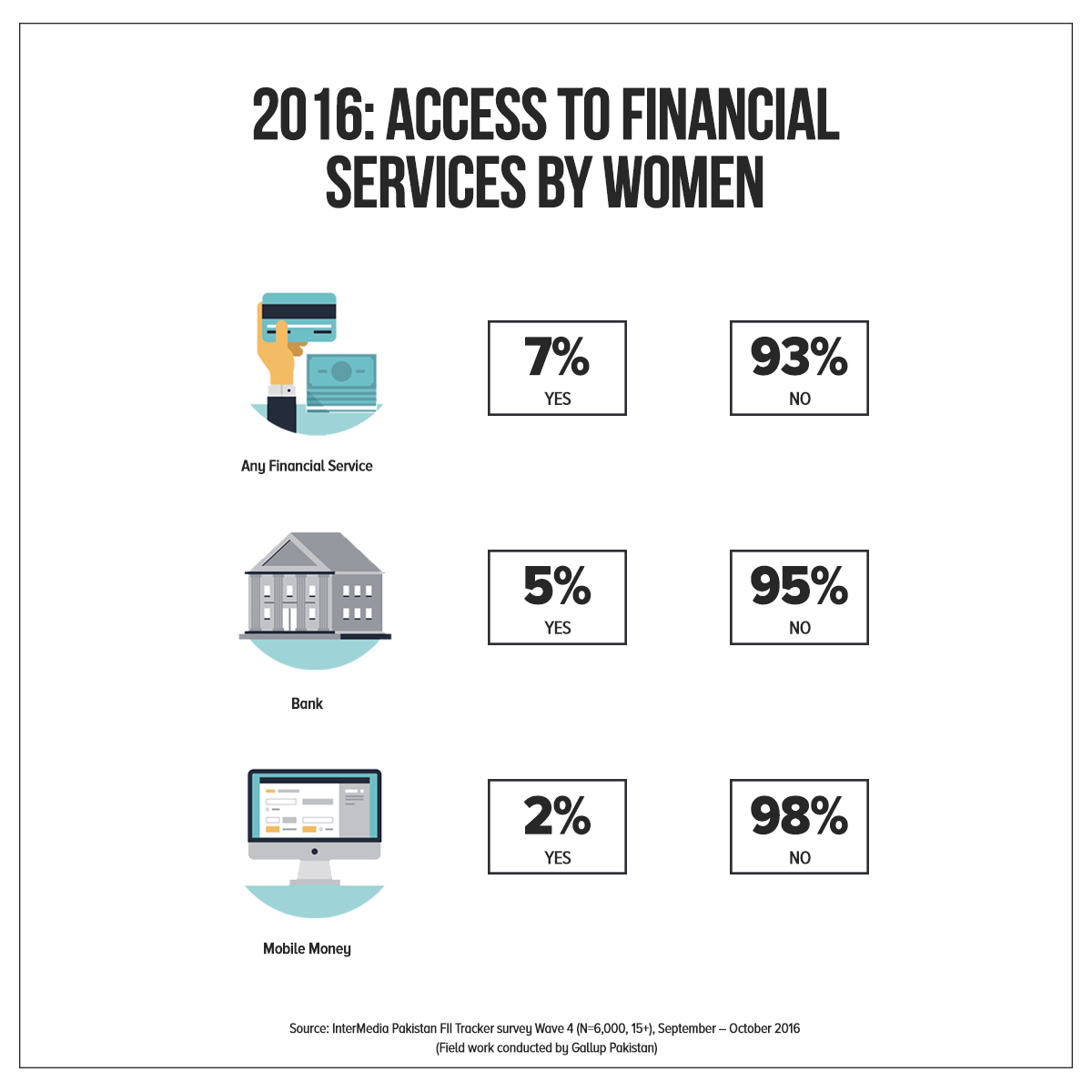

Women: Banks are Frequently Used

7% of women access financial services in Pakistan. Of these, 2% women have access to mobile money and 5% women have access to banks.

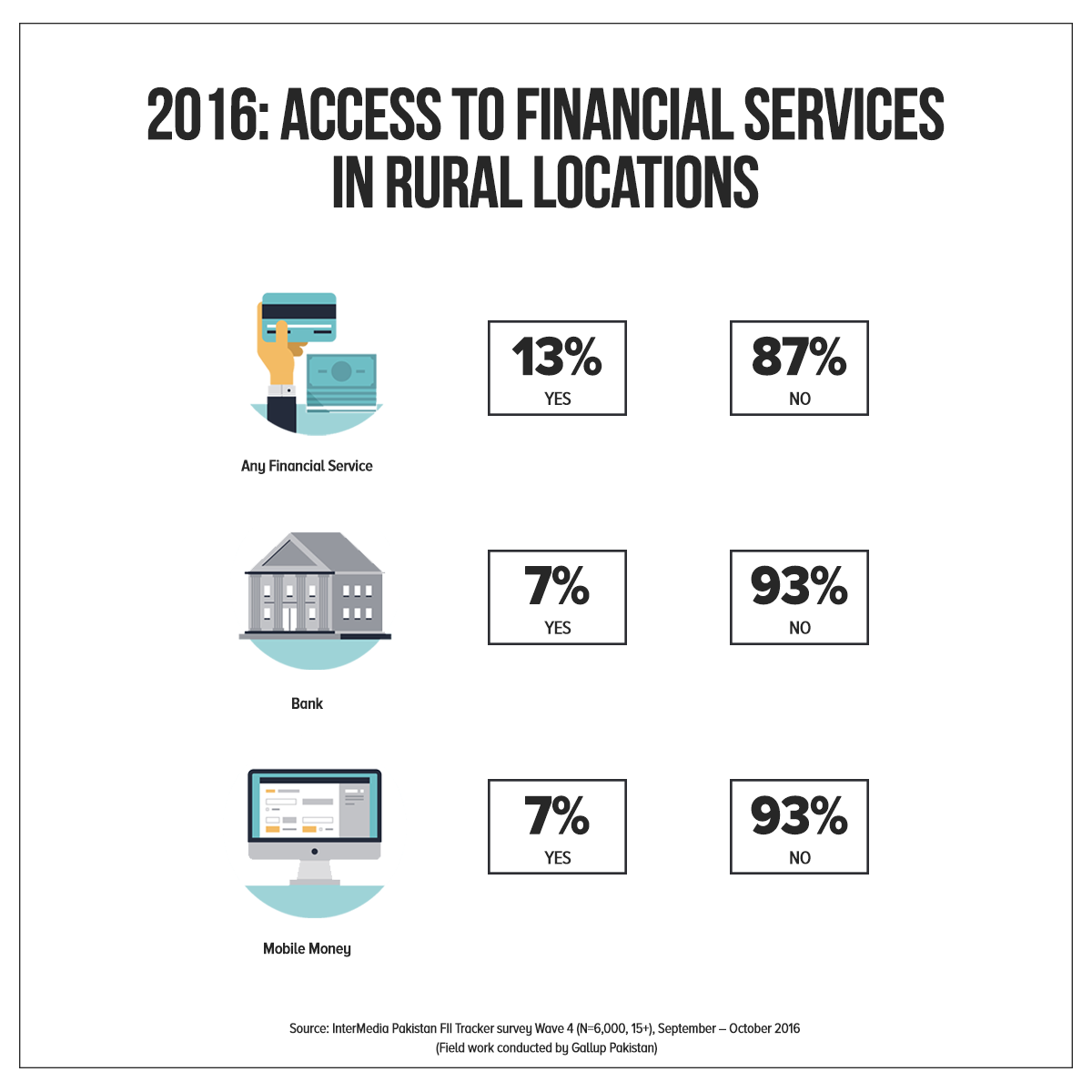

Rural Areas: 7% Residents Have Access to Mobile Money and Banks

13% rural residents have access to any financial service in Pakistan. Of these, 7% rural residents have access to mobile money while 93% do not. 7% rural residents have access to banks; 93% do not.

Peer-to-Peer Money Transfer Drives Mobile Money

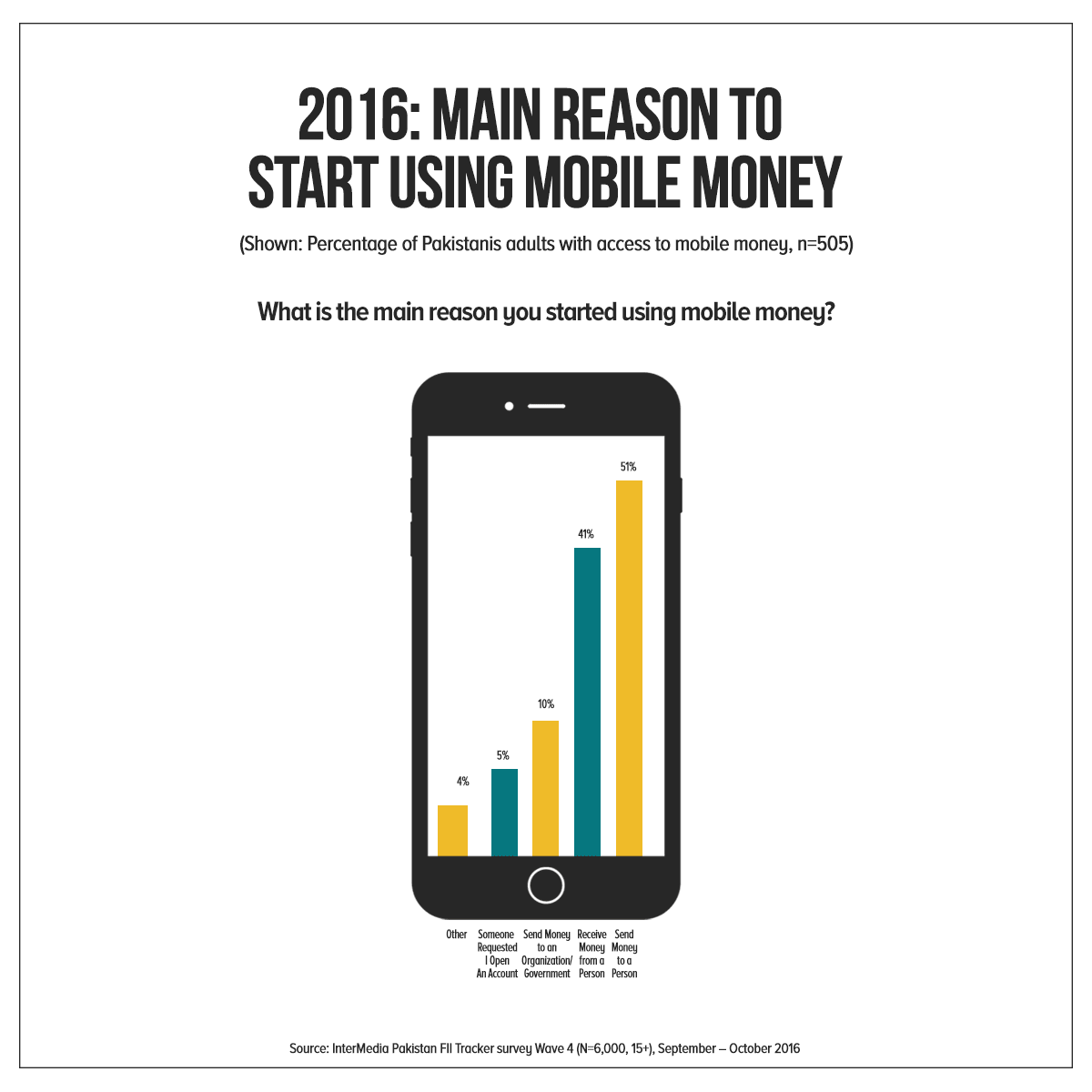

51% Pakistanis cite sending money to another person as the main reason to start using mobile money, followed by 41% who cite receiving money from another person. A further 10% cite sending money to an organization / government, 5% say someone requested them to open an account, while 4% say other reasons.

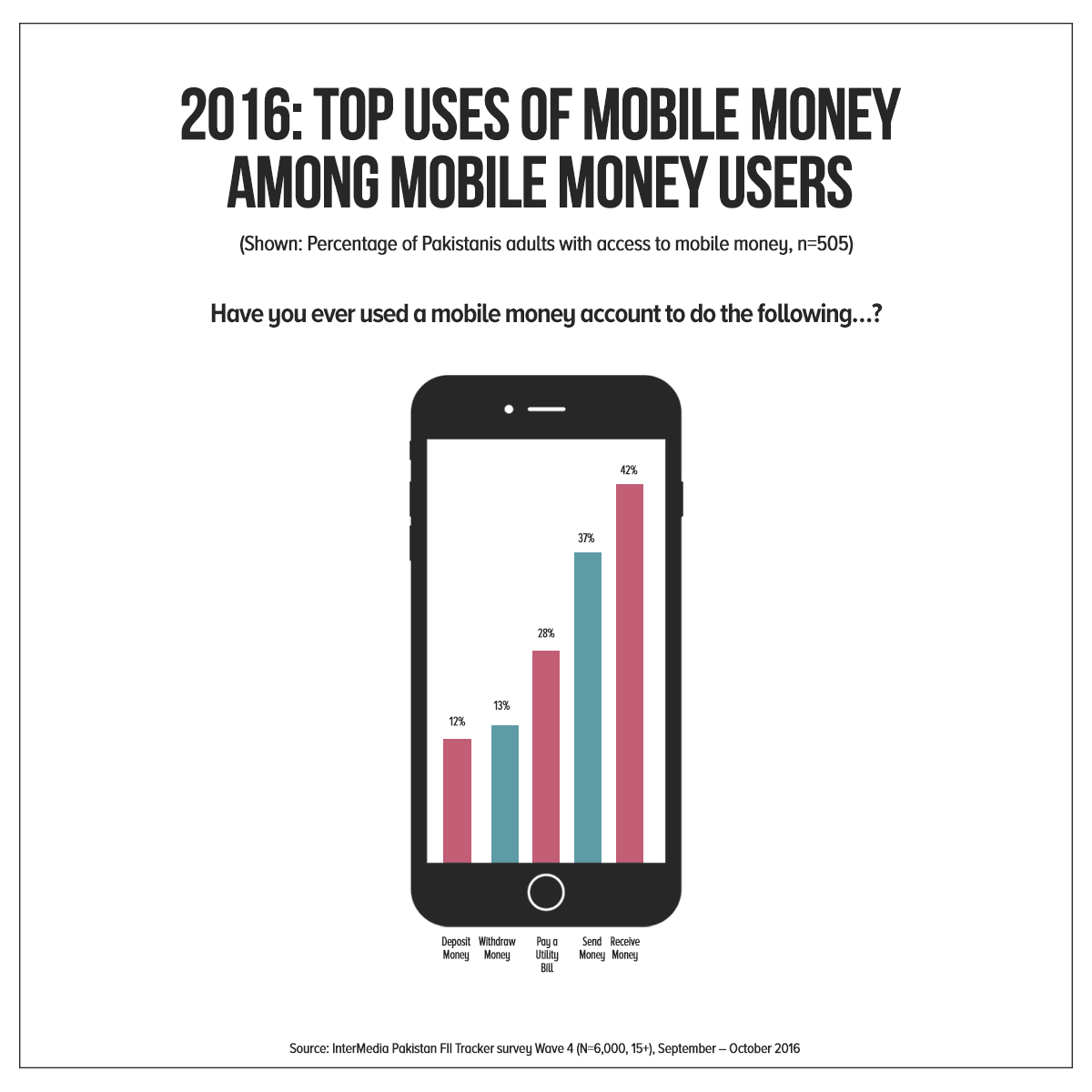

Among mobile money users, 42% cite receiving money as the top use of mobile money, followed by 37% who say sending money. Other frequent uses include bill pay as reported by 28%, withdrawing money (13%) and depositing money (12%).

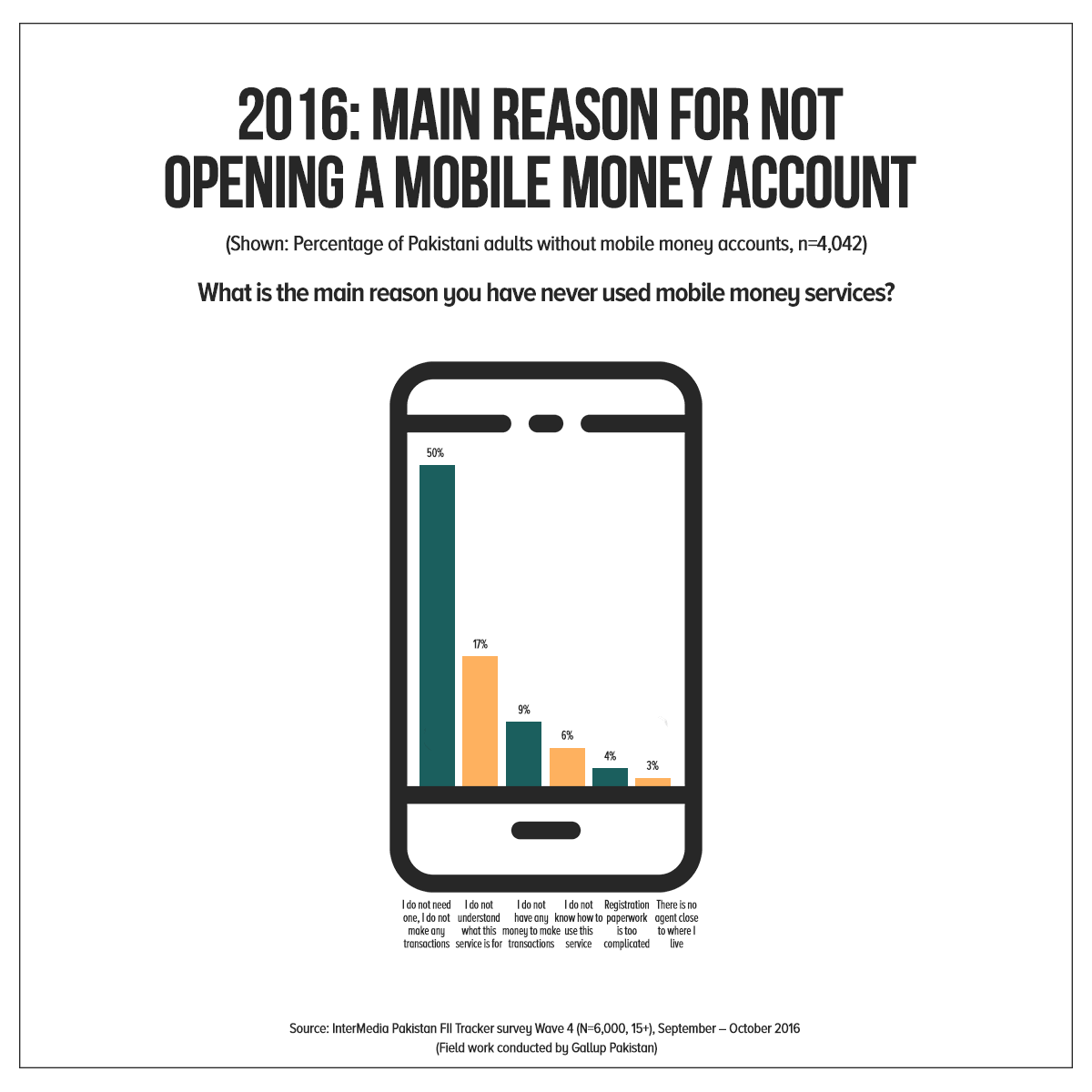

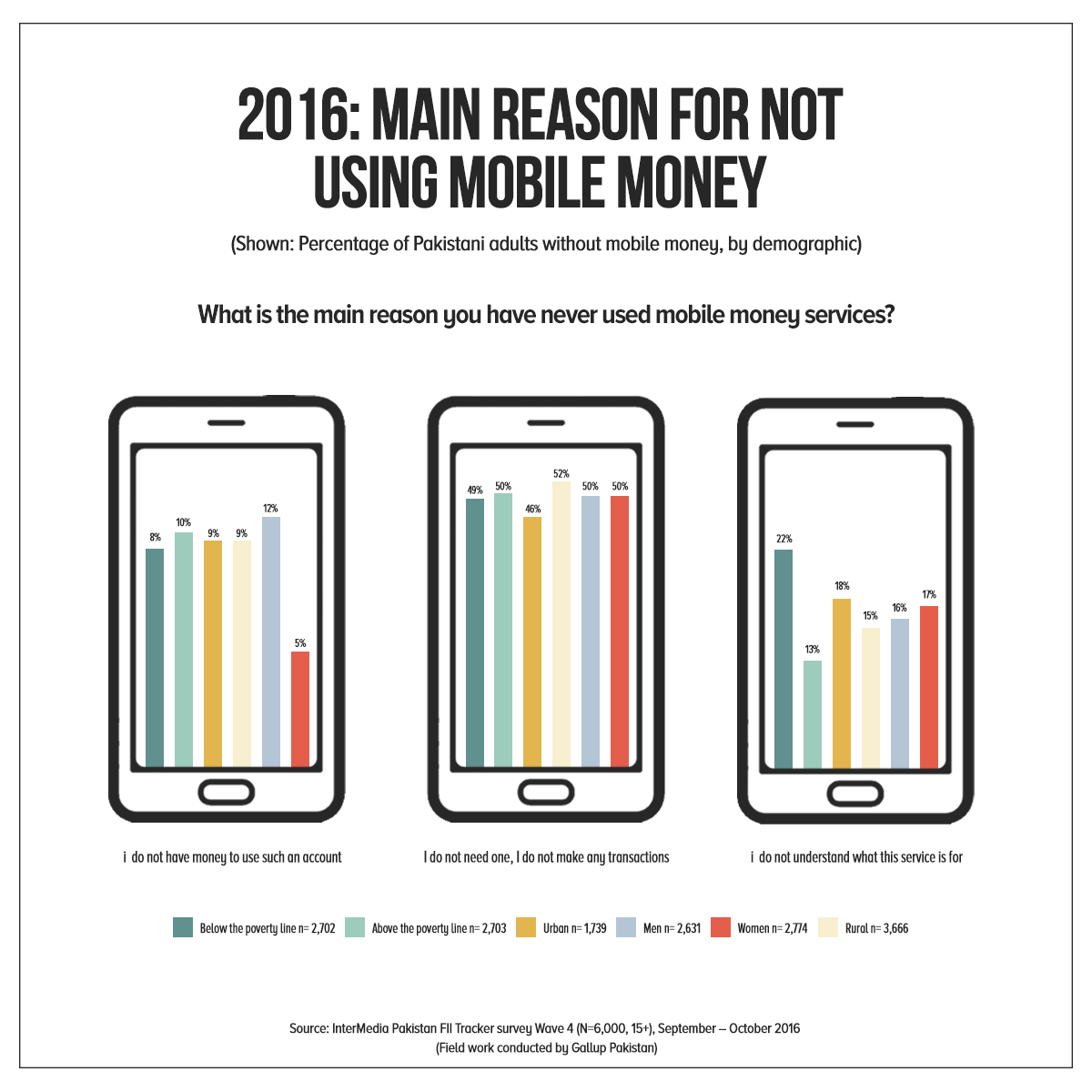

Of these 84%, Pakistanis, 50% Pakistanis cite lack of need as the main reason for not using a mobile money service, followed by 17% who say they do not understand the service, while 9% cite lack of money to make the transaction.

Moreover, 6% said they do not know how to use the service, 4% quote registration paperwork is complicated and 3% say there is no agent in their vicinity.

Barriers to Accessing Banks:

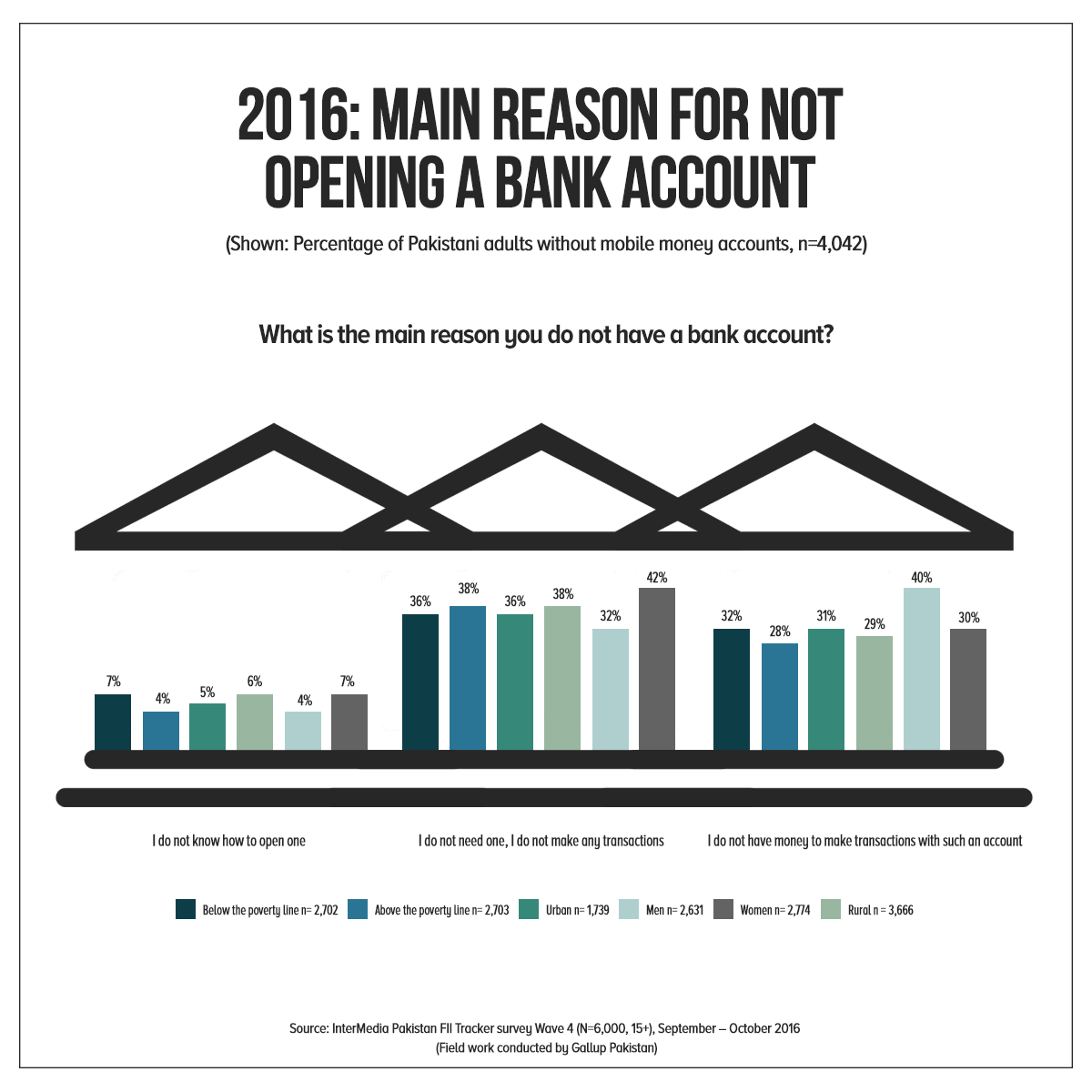

36% below the $2.5/day poverty line cite lack of perceived need as the main reason for not opening a bank account, followed by 32% who quote they do not have enough money to make any transactions and 7% cite lack of knowledge on how to open a bank account.

On the other hand, 38% above the $2.5/day poverty line cite lack of perceived need as the main reason for not opening a bank account, followed by 28% who quote they do not have enough money to make any transactions, while 4% cite lack of knowledge on how to open a bank account.

The Survey findings are from FII series which aims to provide demand-side insights into consumer’s financial behaviors, and identify pathways so those most in need have the financial tools necessary to improve their economic stability.

The survey was conducted among a sample of 6000 men and women in both rural and urban areas across the four provinces in the country.

opening a bank account is like anything else in this country is no EZ task…………Its so hard to do any legal transactions in this country

If you receive money from overseas through legal channels and senders name is non pakistani………..they make it near to impossible to withdraw the money. sad sad

If only mobile account providers recruited merchants so that people could use their mobile accounts to buy and sell things at shops. This would give people a reason to open accounts. I don’t know why mobile account providers haven’t done this in Pakistan. Kenya has shown us how quickly people adopt mobile money if merchants accept it. It’s good for merchants too because they don’t have to deal with cash which is risky for them.

In the World only Pakistani bank uses one way transaction ,They force customers only deposit the money.No bank credits, No overdraft, No short loan, These facilities gets those who have a enough money track record ,actually these peoples already have enough money they don,t need, that,s why the

the rich is more rich and poor day by day poor. Even in you Gallop did not mention root cause . The only cause not to open bank account there is no facility behind , you are getting your own deposit back with cutting of embargo of banks. In our country bank business owners are

because the government takes all the loans and provides guarantee on them too. electrical crisis in Pakistan is due to corrupt contracts and government takes loans to provide so called subsidy on electrical unit costs.

all thanks to ishaq dollar

This result is same on 2050 ! & Never Launch PayPal

bhai ko paypal ka bhi pta hy? wah

PayPal Holdings, Inc. is an American company operating a worldwide online payments system that supports online money transfers and serves as an electronic alternative to traditional paper methods like checks and money orders.

I have a USD account in one of the best banks in country. Their sick mentality is “WHY SOMEONE FROM JORDAN IS SENDING YOU $4000?” It took 7 days of bloody investigation to pass my payment. I changed the bank, same thing happend with them also, WHy someone would send 2000$ in your account, We will send the payment back? I said only one thing, JO log haraam ka pesa money laundering kar ke Pakistan le aaty hain unhe q ni pakarty ap log? I showed them the payment reciepts, my online accounts and then after 3 days they also released my payment…!!!

This is the banking system of our mighty Country when 24 out of 25 times the ATMs and online services are not working. Why would someone rely on bank for massive transactions?

This is due to pakistani government taxes, poor service of banks and ignorance of peoples. If we want to increase financial services then banks must give facilties to customers, Govt should decrease tax to common citizens and at least every government fee should be paid online instead of waiting in long queues.