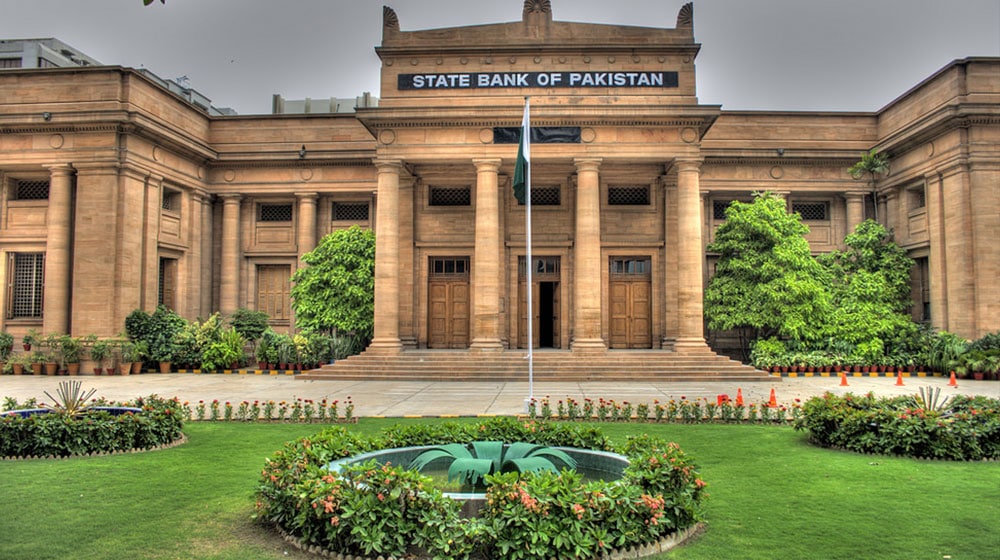

In order to facilitate banking consumers, State Bank of Pakistan (SBP) has established a dedicated helpline in Karachi with the Universal Access Number (UAN) 111-727-273. This helpline will operate during the working hours of SBP, from Monday to Friday.

SBP has advised to disseminate the above UAN to all branches of the bank. This number will be displayed at prominent places for consumers’ facilitation.

The central bank reiterated that Banks, MFBs and DFIs will continue to provide assistance to their consumers for complaint resolution according to regulatory instructions. It is expected that the banks will improve procedures and provide better services to enhance customer experience.

Governor State Bank of Pakistan, Tariq Bajwa, inaugurated the Helpline today and expressed his best wishes. He advised concerned officers to make the general public aware of the helpline and ensure that the banking consumers are properly facilitated.

SBP Guidelines For Banks To Solve Customers Issues

Earlier, the central bank issued guidelines to provide banking customers an efficient and fair mechanism for resolution of their grievances. These guidelines have been effective from July 1, 2016.

- SBP instructed banks to promote a culture that values customer experience and where customer satisfaction is considered an important factor to drive growth.

- Banks are required to establish a separate function responsible for maintaining overall service quality with the complaint handling unit ideally being a part of it.

- SBP does not advocate a particular structure, the banks may follow any structural arrangement keeping in view the scale and scope of their operations.

- It must be noted that the resources allocated, stature of head of service quality and his/her reporting line have direct implications on the business conduct of the institution.

- It is therefore desirable that in large banks, the Head of Service Quality/other relevant head should report directly to the CEO and should be aware of the stature of other business heads.

- While it is not mandatory, banks with large retail exposure and branch networks may also consider establishing a management committee to monitor service quality of the bank.

- Such committee enhances coordination within the institution, augment operational efficiency of complaint handling and integrate customer experience with the products and services being offered.

- It is expected that the banks will address any conflicts of interest while adopting a relevant structure for handling complaints.

- Banks will also ensure that the complaint handling function works independently and has adequate powers and resources.

- The structural arrangement, with respect to receipt and disposal of complaints, should not, in any way, hinder accessibility and visibility of the process. It should ensure that all complaints are recorded, irrespective of how they are lodged.

- Branches being the focal point of contact should be given access to the centralized complaint management system.

- At least one person in the branch should be entrusted with the responsibility to log every complaint regardless of the fact that it is resolved at the branch level or escalated to the region or at the head office.

Banks should facilitate fair and efficient resolution of consumer grievances to foster confidence in the banking system. It should reduce the burden on external dispute resolution forums and help SBP focus on policy related issues.

At present all banks operating in Pakistan have a dedicated section tasked with the responsibility of handling customer complaints. The robustness of said section, however, varies across the industry.