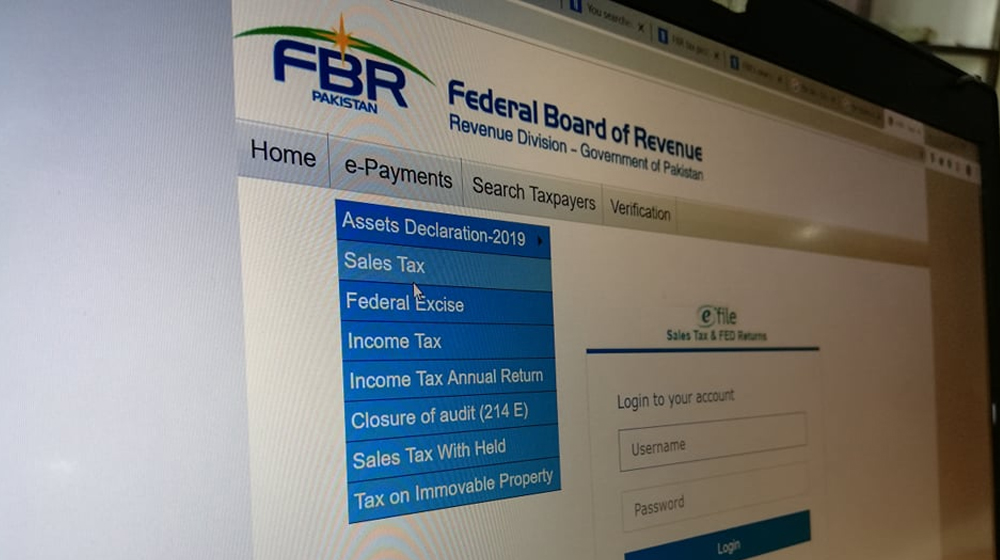

In continuation of FBR reforms and modernization drive, an E-Payment facility for payment of all FBR taxes as well as some provincial taxes have been introduced for convenient and hassle-free payment.

On the one hand, traders can electronically pay all import duties and taxes through Customs computerized system WeBOC at ports and border stations across Pakistan.

While taxpayers can also electronically pay income tax, sales tax and Federal Excise duty sitting in their homes. E-Payment system provides round the clock facility to taxpayers and traders to make online payment of customs duties and other FBR taxes, as well as provincial cess and stamp duty, said a statement issued by the Federal Board of Revenue.

The facility is available through the internet and mobile banking by using more than 15000 ATMs of 16000 Over the Counters (OTC) bank branches of commercial banks spreading across the country.

ALSO READ

PM Imran Reveals the Govt’s Solution to Fix Pakistan’s “Corrupt” Tax System

The taxpayers’ confidence and interest in E-payment are growing fast and it can be gauged from the fact that the proportion of the number of E-payments of Income Tax, Sales Tax, and Federal Excise Duty has increased from 6.26% of total payments during July to December 2019 to 40.5% during the same period of 2020.

Similarly, the proportion of the amount deposited in these E-payments has increased from 13.55% of total payments to 76.5% during the comparative periods.

E-payment facility has greatly helped the traders and other taxpayers’ during the COVID pandemic since all transactions can be completed without physical interaction.

Currently, 18.6% of import duties and taxes are being collected by Pakistan Customs through the E-Payment system. More than 80,000 consignments consisting of nearly 22% of total imports were cleared in WeBOC through E-Payment in the last 6 months. Apart from major Customs stations including Karachi, Lahore, Islamabad and Peshawar, the facility is also being availed by importers in remote areas like Taftan and Khunjerab.

FBR has urged the traders and other taxpayers to utilize the E-Payment facility as it reduces their cost of doing business and contributes significantly towards improving the ease of doing business. It also speeded up the clearance of goods, enhances transparency in the duty payment mechanism and ensures timely revenue reconciliation.

ALSO READ

IMF Highlights Pakistan’s Efforts to Deal With COVID-19

Acknowledging E-payment as a major step towards trade facilitation, the World Trade Organization’s Trade Facilitation Agreement also promotes the use of electronic payment methods amongst the traders.

FBR has launched an awareness campaign to enhance the use of an E-payment facility. In this regard, a number of seminars have been conducted to educate trade bodies and Customs Agents about the benefits of E-Payment. The traders can also take benefit of the FAQs section relating to E-payment available on the WeBOC web page.