Federal Board of Revenue has imposed a tax of Rs. 1,000 on every smartphone import and Rs. 500 on every feature phone that will be imported into the country.

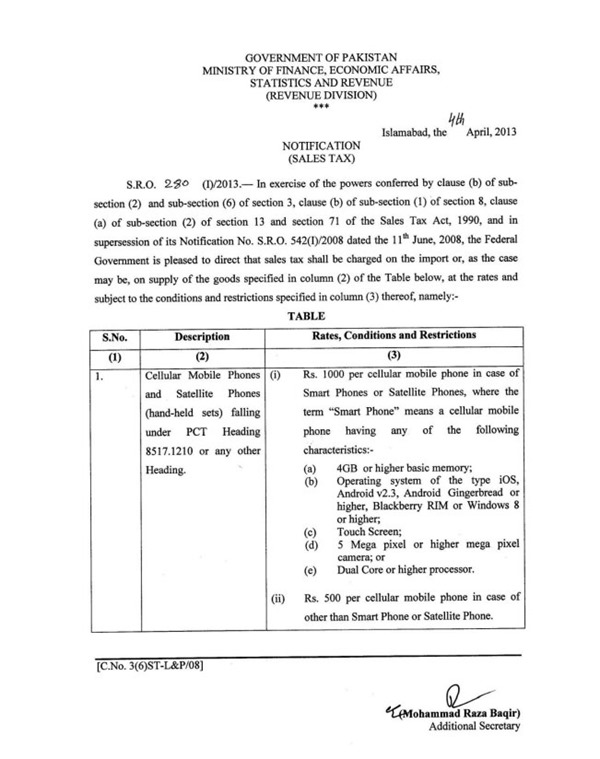

An SRO issued by FBR said that “Government is pleased to direct” to charge sales tax on cell phones as following:

- Rs. 1,000 per cellular mobile phone in case of a smart phone or Satellite phone, where the term smart phone means a cellular mobile phone having following characteristics:

- 4GB or higher basic memory

- Touch screen

- Dual core or higher processor

- 5 Megapixel or higher camera

- iOS, Android version 2.3, Android Gingerbird or higher, Blackberry, Windows 8 phones or higher

- Rs. 500 per cell phone in case other than smart phone or satellite phone

Here is the copy of original SRO issued by FBR:

Under these directions, every phone – which is a touch screen or has a 5MP camera or above – will be charged at a tax rate of Rs. 1,000.

Estimates suggest that FBR is likely to make Rs. 5 billion per annum with this new tax. It merits mentioning here that FBR is short of annual tax collection target of Rs 2.381 trillion and this is probably why it is unfolding every possible avenue to get its target.

Market sources say that even the cheapest cell phones – those imported from China – will come under the tax net and prices for a Rs. 2,000 phone will go up to Rs. 3,000 to 3,500 on average.

The step is likely to increase the cell phone prices in Pakistan by Rs. 1,500 to Rs. 2,000 and those who had stocks available with them are going to make several billions of rupees after this decision. The whole burden is to be endured by the end users of telecom sector who are already paying highest tax rates amongst all sectors.

Increase in tax is also going to promote illegal channels of bringing cell phones into the country, hurting the revenues of main stream mobile phone manufacturers such as Nokia and Samsung.

Commerce bodies and importers have already protested the decision and have demanded the government to withdraw the SRO.

It maybe recalled that government of Pakistan had imposed Rs. 500 sales tax on every imported phone, which was latter cut to Rs. 250 per phone amid industry demands.

“hurting the revenues of main stream mobile phone manufacturers such as Nokia and Samsung.”

What if I don’t want a phone from Nokia or Samsung? None of them decided to manufacture Firefox OS phones. So I have no choice but to purchase it online and I was thinking to buy from Geeksphone or Sony or LG or Huawei. Whoever releases first (better) phone for Firefox OS.

fire fox os is just a feature phone kind of os plus it was terrible in performance when it was demoed

Sorry bro if u think so then u know nothing about it. First it’s “Firefox OS”, not “fire fox os”. When did u saw its demo last time? Did u checked MWC 2013 demos? Maybe you saw its demos when it was in early stage.

https://air.mozilla.org/jay-sullivan-mwc/

Let me correct you here. It’s smartphone OS. Its initial target is not to compete high-end Android or iOS devices. So initially you will see low-end or mid-range devices but it’s not an OS for featured phones.

Now because their initial target is low-end phones so they are trying make it run smoothly even on phones with 256MB of RAM. Check the video in above link and u will be amazed to see how smoothly it’s running on ZTE low-end phone with single core 1GHz processor and 256MB or RAM.

I just answered your misunderstanding about Firefox OS here. But trust me it may require complete multi-part articles to explain why it’s an awesome OS and how it will revolutionize the mobile industry.

You must read this article to know more about it:

http://arstechnica.com/gadgets/2013/03/firefox-os-hands-on-mozillas-plan-to-build-on-top-of-the-web/

Good thing: this tax doesn’t apply to phones with Firefox OS.

How Ppl can protest against it ?

Shouting on Facebook and some tweets will help ._.

Ha ha!

I will wait till this SRO will be taken back. This is a bullshit…

Whats wrong with the government authorities and telecos? On daily basis they are finding new ways to charge customers as high they can. Charging under this type of terms like service charges, fed, call setup charges due to operational factor v vl charge more to customers for uninterrupted services. I m not in a favour of Mr. Musharraf but he did a lot for this sector.new governments are destroying. Ab v vl get Ncp phones like cars in tribal areas and agency.phr fbr vl gonna announce amensity scheme lalchii dogs. Even they ask for money while leaving pakistan 1000 per person.i m sure there is no future of telecommunication in pakistan

Musharraf did nothing, his government did the work.

And before we forget, remember REMEMBER who sold PTCL. Musharraf’s own government.

> Musharraf did nothing, his government did the work.

LOL at that logic.

Yes, he secured the future of telecom in Pakistan by privatizing PTCL. You got a problem with that?

This must be irony or sarcasm right? Because otherwise, WOW.

How many LDI licenses awarded for years? ZERO because of the deal for PTCL.

Do we have 3G or 4G yet? NO. Why not? SAME agreement for PTCL. Looks more like we’ve been forced to stay behind all.

Wonder what future Shaukat Aziz imagined (or what future you live in), but the telecom world we live in inside Pakistan is very much NOT the future of telecom as we see everyone in the world including our neighbours embrasing.

I ask you honestly to state what GIVING PTCL to

foreigners acheived that could not be achived by taking proper control

& management of the state corporation?

I remember a lot of internet providers in 2004-2008 period that are not here now. What are we left with? Worldcall – failing, Wateen – has not been profitable ever. Link – effectively gone. Small ISPs like Nayatel and Brain who have customers less than 20k each. Dancom gone Worldtel gone Habib Rafiq gone — all merged or absorbed into larger ISPs because they simply could not compete against PTCL. The only place where anyone even has a chance at competing is WiMax (qubee witribe etc). Where are the local line loop licenses? Oh I forgot, agreement withPTCL again.

We didn’t end up with a better future, we ended up with FEWER options.

Nigraan Hukoomat bhi logon ko peesne me lagi hoi ha

Allah hafiz is sector ka.

our fucking gov

These taxes would have been somewhat palatable if people had even some confidence that this money won’t be going into private Swiss bank accounts.

They’re promoting smuggling, currently legal and illegal mobile phone import ratio is around 50%, and after this the ratio will likely boost to over 90% illegal channels.

The Tax should have been %age based not fixed amount per set, say 5% tax of value. Because in current scenario, if 1000 tax is imposed on PKR 3000 touch screen mobile then it will be more than 33.33% tax.

Seriously, people need to stop buying mobile phones every few months or every year. Because you can buy a good Nokia or Samsung or HTC and it will work fine for 3, 4 years NO PROBLEM.

Do you really need an 8MP camera in a PHONE?

Do you really need 720p recording in a PHONE?

Do you really need stereo sound speakers in a PHONE? Mini-HDMI?

yup… we need all these things. u dont buy if u dont need it

if u need all this then u should not be worried with just Rs.1000 tax… these type of mobile fone minimum cost is around 15k and you cannot afford 1000 for all this.. surprising

nd for ur info pakistan is loosing billions of foreign exchange in just mobile phones imports every year… these type of cell are luxury items and they should charge more than Rs.1000.

@ Dear Author, so should it implies that no previous taxation structure was there before this directive.. this mean a huge loss of national Exchequer ?

Riaz

Tax @ 500/1000 should not be imposed by the FBR on cell phone of price < Rs. 10,000.

QMobile bach gya tax se

Agar ap daily 1 $ sy 500 $ earn krna chahty hain to ap forex par kam karain ap

kama sakty hain, forex main pore duniaa main log kam krty hain aour markeet poree duniaa main monday sy friday tak 24 ghanty khulle rehtee hain, ap jitnii marzi invest karain ap ko utna zaida faida ho ga, mazdeed malomat kiyla rabta kran

mobile no 03466395817

skype name (nadeem6395)

E-mail id [email protected]

Why don’t you just kill yourself, spammer.

Very good Shahid agree with yaaa!!!

hum to dubaingay sanam tumhay bhi lay dubaingay

ballay ballay

ungal hy es bc govt ko. or awam ny khamosh rehtay e mr jana hy!

i think best option is smuggling

yes…smuggling will be on boom….and fones will be reduced in prices….

1000 IS QUITE LESS GOVT SHOULD CHARGE AT LEAST 5000 ON EVERY PHONE COSTS MORE THAN 20000/- THESE ARE NOT MOBILE PHONE THESE ARE SOURCE OF UNMATCHED PLEASURE AND SHOULD BE CHARGED AS HIGH AS POSSIBLE IF ONE CAN AFFORD TO BUY SUCH HEAVY PRICE MOBILE HE CAN PAY SUCH KINDS OF TAX TOO………………

The shipment cost from China/HK through hand carry is Rs.130 for smartphone. Now it will rise to Rs. 200 per set with accessories.

Pakistan Zindabad………Kar Lo Jo Kerna Ha

its all Badmaashi .. they have no way to collect taxes from Ashraafia .. after 5-8% Admin/Services taxes, still need to get the target tax; now imposing tax on Import Cells in PK; amazingly shopkeepers also increase one thousand price of locally manufacturing mobile by Qmobile also.

Now who keep check & Balance over it – its all win win situation from Govt, Company,Whoeleseller till Retailer

Hello Brother, I am thinking importing some mobile phones and reselling them, How would I be paying this duty and get it custom cleared when someone sends me parcel?

Great thanks if you reply

Rs. 1000 sale tax & Rs. 250 custom duty on 1 piece

can any body tell how much total tx one has to pay on each mobile phone import,i mean sales ,income, custom duty, import duty…or whatever???

Hi,

Please let me know did the mobile phone import is band in pakistan ? or there is some texs on customer clearness

And this revenue goes into government account or they gona spend on public?