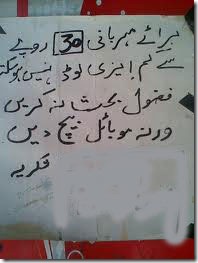

Retailors charge this money (usually Rs. 1 or Rs. 2) as transaction fee for lesser recharges, in fact they boldly communicate this to customers through notices dispatched to their shop walls.

Now this deduction from retailors isn’t allowed by cellular companies, as a matter of fact, cellular companies pay these retailors a fixed commission or margin (which is usually 3 to 3.5 percent) for all the balance transfer they make.

According to market sources, majority of retailors deduct this small money of Rs. 1 or Rs. 2 for small balance recharges. For instance if a customer asks the retailor to load Rs. 40 then retailer will recharge only Rs. 39, which is unauthorized by the cellular companies.

Cellular companies, being the responsible for their sales and distribution network should take necessary action and implement proper check on these retail transactions.

Not only this, few retailors, who enjoy monopoly in far flung areas of the country, force customers to recharge only higher value of money. They define a lower limit, which is usually far higher than the official lower limit defined by the cellular companies.

A ProPakistani reader, who wanted his name to remain unidentified, wrote to us:

Every where in Pakistan, retailers think that these deductions are their right, but fact is that telecom companies pay them well apart as their commissions.

astonishing matter lies at telecom operators’ end because they have this thing in notice but companies don’t take any step to eradicate this menace.

I forwarded them suggestions on multiple instances in this aspect, but looks that my emails and requests end up on deaf ears.