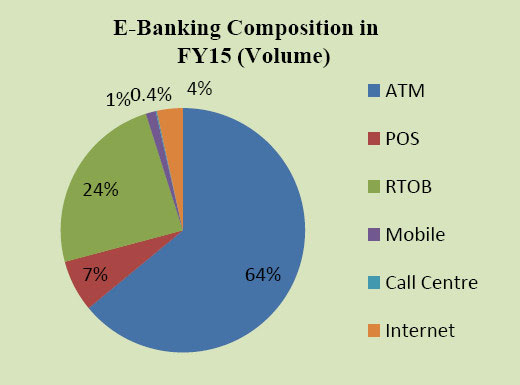

Pakistan has witnessed a huge surge in retail banking transactions over last few years with ATM cards accounting for 64% of entire e-banking transactions in terms of volume during FY 2014-15. RTOB (Real Time Online Banking) or transactions carried out by banks’ core system remained second in terms of volume with 24% of total transactions carried out by retailed banking.

According to State Bank of Pakistan, POS transactions stood at 7% of total transactions while internet banking transactions increased to 4% of all retail banking transactions.

Over the past 5 years, e-banking transactions witnessed a phenomenal growth. Volume of e-banking transactions increased by 100% i.e. from 235 Million to 470 Million over the last 5 years while value of e-banking transactions has increased 62% from Rs. 22.1 Trillion to Rs.35.8 Trillion from FY 2010-11 to FY 2014-15.

Last year alone has witnessed a growth rate of 16% and over 6% in volume and value respectively.

Retail Banking Statistics

There are currently 11,937 branches of 35 commercial banks operating across the country, out of which 11,315 branches are online branches.

The total number of ATMs installed across the country has now reached 9,597 and it includes both On-site (at branch) and Off-site (away from branch) ATMs.

As of FY2014-15, there are 28 banks offering ATM services in Pakistan. ATMs per 100,000 population have increased from 4.5 to 5 in FY 2014-15.

There are 6 banks managing POS services in Pakistan. In FY 2014-15, the number of POS machines have increased by 20% reaching to 41,183 as compared to FY 2013-14.

Number of Credit and Debit Cards in Pakistan

The number of Debit Cards have crossed 25 Million at year end FY 2014-15 with 91% share in total number of Plastic Cards.

Number of Credit Cards has reached to 1.40 Million at year end FY 2014-15 whereas ATM Only cards are just over 0.90 Million.

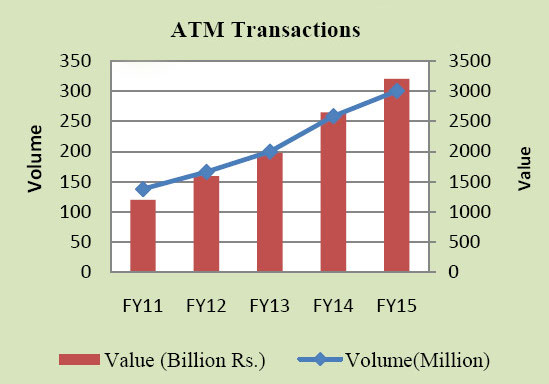

ATM Transactions

ATM Transactions during the FY 2014-15 were recorded at 300 million, valuing around Rs. 3.2 trillion, up from 250 million transactions of Rs. 2.7 trillion during same duration last year; showing a growth rate of 16% in volume and 21% in value.

Cash withdrawal remained the major contributor for ATM transactions over the year contributing around 96% in volume and 83% in value.

Utility Bill Payments have shown a significant increase both in volume and value whereby the volume has increased by 39% from 626 to 869 Thousands while value has increased by 79% from Rs.1,641 Million to Rs.2,934 Million as compared to FY 2013-14.

During Q4 of FY 2014-15, 84.20 Million transactions amounting to Rs. 892.60 Billion were executed through ATM network showing an increase of 14% in volume and 11% in value as compared to Q3 of FY 2013-14.

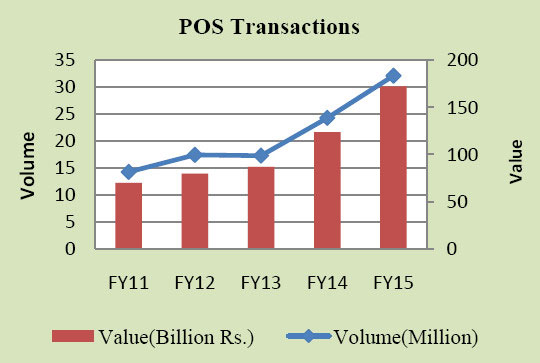

POS Transactions

The volume of POS transactions during FY 2014-15 reached over 32 million, amounting to Rs. 171 Billion, depicting a growth rate of 32% in volume and 38% in value as compared to the previous year.

During Q4 of FY 2014-15, approximately 9.1 Million transactions amounting to Rs. 47.1 Billion were executed through POS machines showing an increase of 20% in volume and 17% in value as compared to third quarter of FY 2014-15.

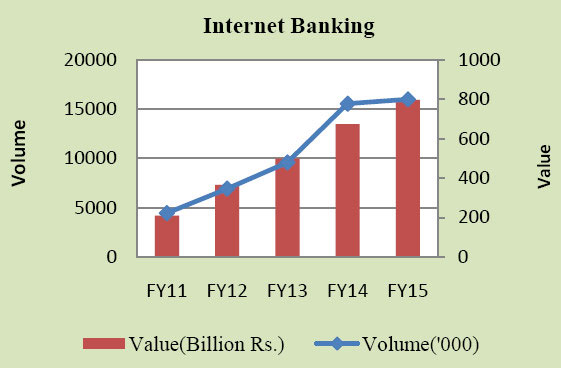

Internet Banking

During FY 2014-15, volume of Internet Banking increased by 3% and transaction value increased by 18% reaching 798 Billion as compared to FY 2013-14.

During Q4 of FY 2014-15, approximately 4.50 Million transactions amounting to Rs. 219.50 Billion were executed through Internet Banking showing an increase of 11% in volume and 10% in value as compared to Q3 of FY 2013-14.

The number of users of Internet Banking increased by 23% reaching over 1.8 Million as compared to the previous year.

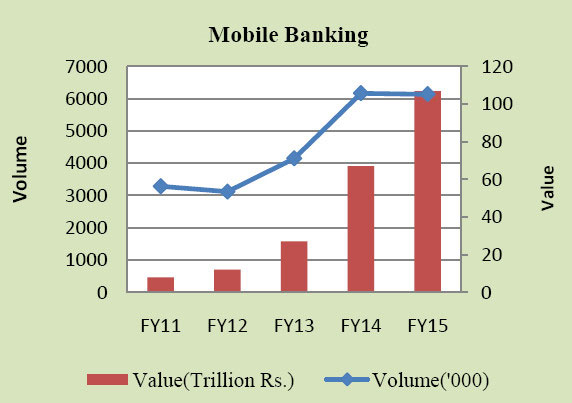

Mobile Banking

During FY 2014-15, the volume of Mobile Banking transactions showed a slight decline reaching to 6.14 Million from 6.16 Million. However, the value increased by 59% reaching Rs.107 Billion as compared to FY 2013-14.

During the FY 2014-15, the largest share in Mobile Banking in terms of volume is of Utility Bills Payment which is 52% while in terms of value, the largest share has been contributed by third party Account to Account Funds Transfer having 53% share.

As compared to FY 2013-14, Mobile Banking Registered users have increased by 36% reaching to 2.27 Million by the end of FY 2014-15. During Q4 of FY 2014-15, 1.47 Million transactions amounting to Rs. 32 Billion were executed through Mobile Banking showing an increase of 14% in volume 16% in value as compared to Q3 of FY 2013-14.

This data includes conventional banking transactions carried through mobile phones and does not include branch-less banking data.

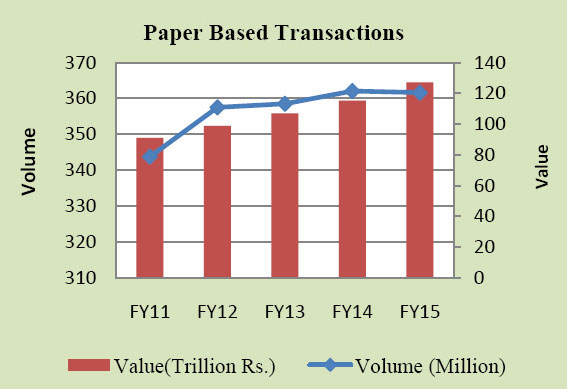

Paper Based Transactions

During FY 2014-15, the volume of Paper Based transactions nominally decreased by 0.12% from 362.04 Million in FY 2013-14 to 361.56 Million. In terms of value these transactions have increased by 10% from 115.16 Trillion in FY 2013-14 to 127.16 Trillion this year.

Paper Based transactions are approximately 34% of total retail payments.

During Q4 of FY 2014-15, approximately 92.50 Million transactions amounting to Rs. 34.60 Trillion were executed using paper instruments showing an increase of 8% in volume and 18% in value as compared to Q3 of FY 2014-15.

And when the banks crash, good-bye to your hard earned paper currency.

Welcome to Real World.

Living in fear is no living at all..

It’s gonna happen.

Death is gonna come sooner or later..doesnt mean I shouldnt live in the meanwhile and make grand plans of conquering the Galaxy..hehehe

Can you please share with us a detailed analysis of different credit cards from different banks and their prerequisites and their annual charges and transaction charges their credit limit and explain Apr and some other technicalities.. it would be a great help to guys like me who are already thinking about getting a credit card and good for the banking sector too..

Stay away from “credit cards”.

Love your articles Mr Attaa..

I too would like to read a very detailed article about credit cards from different Banks to decide which one I should get..it’s about time we start reaping the benefits of the 21st century..

These shitty banks in Pakistan mostly do not accept foreign bank cards. There are 3 or 4 banks which are accepting them currently. They will never come out of their cocoon and bloom with full spirits.

You seem like a decent guy brother… But you need to come out of your cocoon too.. There is nothing to fear from credit card.. It’s a bit tricky if you don’t know how and when to use it…

Still Islamic point of view.. Interest is bad and banks should change how they operate..

But until then.. let’s use them

Give me one good benefit of this credit card. Do not give me lame justification that you can buy anything you want on credit.

You should understand that when you have credit card, you go crazy and needlessly keep buying things you do not need desperately which ends up piling up credit and interest.

But if you also fall in the category of those imbeciles who prefer credit buying, then I do not give a damn about you. Go ahead. Doors are opened.