A big majority of the Pakistani public holds an account in one or more banks. Naturally, many of the bank customers also often get credit cards from the same banks.

Irrespective of whether you have a credit card or not, banks usually keep sending you some pretty “insane” offers where you can get the smartphone (or any other gadget) of your choice at 0% markup if you pay back within a fixed amount of time – usually 3 to 6 months.

While it may seem like a pretty good deal for you to buy your favorite handset on installments without paying any interest on it, it is actually a deceiving tactic employed by almost all banking institutions.

Lets take a look whats going on here.

Banks Charging Extra? Or Providing A Service?

While the banks claim that they do not charge you anything extra and you even get to payback in installments without any markup, there’s a high probability that they are misleading you.

For starters, most banks often have a transaction fee ranging from Rs. 1,000 to 3,000 you have to pay before you start on an installment plan.

But that’s the small part, the major part where they rip you off is with regards to the actual price of a product they offer, in this case a handset that you are set on buying on installments.

Protip: Whenever you get a flyer in your mail, find an installment plan shared on social media or read a news article about some new installment offer, just compare the bank’s price of the handset to the normal market price.

It is common sense but you’d be surprised how many people just don’t check up on prices.

Banks can charge as high as 150% of the normal market rates. It’s unfortunate the unknowing banking customers are tricked using such tactics. Rarely can you find an actual market price with such installment plans. On the other hand, banks which do not have the 0% markup options, employ similar tricks as well.

Some Recent Examples

Let us give you some examples here:

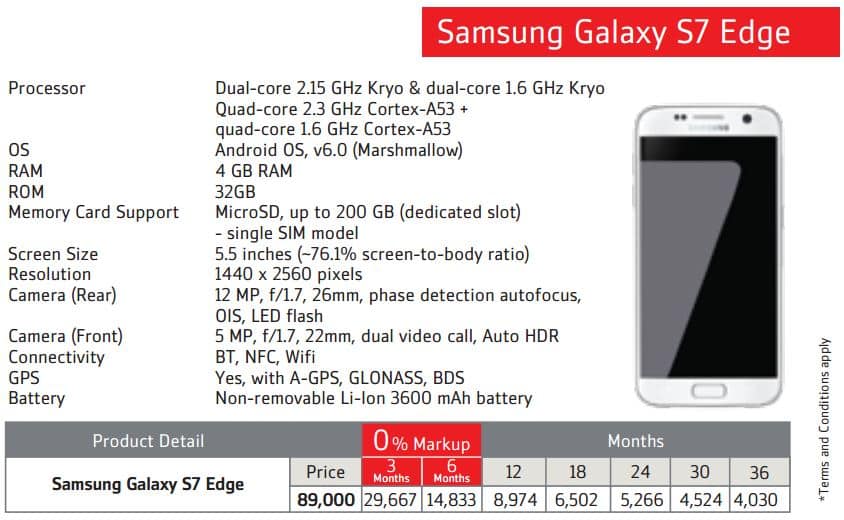

Bank Alfalah has a Step-by-Step (SBS) Installment plan which allows you to pay with 0% markup if you opt for 3 or 6 month installment plans. Take a look at one of their offerings below:

While the bank is offering 0% markup, it is charging 89,000 for a phone which didn’t even cost this much when it was first launched in Pakistan officially. The phone can easily be bought for around 63,000 if you buy it from one of the online retailers. An astounding 141% of the market price is being charged here.

Most Pakistani banks do not offer proper warranty services as they claim it’s a third party product. So in most cases, you end up with whoever third-party reseller they chose to contract if you want to claim a warranty. Sometimes, you don’t even get any warranty service at all. You can get the same phone with proper Samsung warranty from the retailer of your choice for around 63k-64k. Given how stringent they are with offering installment plans, one could’ve thought they cover warranties as a standard.

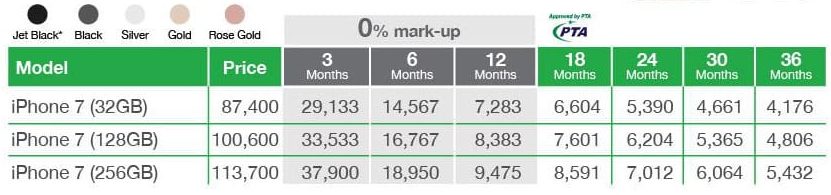

Let’s take a look at some more examples to prove that this is a common practice these days. Take a look at Standard Chartered’s Asaan Installment plan below:

Where iPhone 7 starts at 87,000 when you buy one from SCB, you can get one for about 78,000 online. Some stores offer the device for even less, Rs. 72,600, when you pay via a card online (Yes ironically even the SCB cards work).

Similarly the higher storage versions come with even more premium price while you can get the 128GB version for about 91,000 and the 256GB variant goes for nearly 95,000. You can clearly see a surcharge of 12%-37% in SCB installment prices over standard market rates.

What we’re essentially saying here is, these are not plans with 0% markup as the banks have advertised themselves. They have incorporated the interest in their monthly payments and hidden it in plain sight.

Do Islamic Banks Fare Better?

Now take a look at the halal installment plans which come with zero interest, zero fees, no hidden charges.

Meezan Bank is selling Huawei P9 for Rs. 59,357 if you pay in three installments or Rs. 61,568 if you pay back in 6 months as seen in the image below:

However, the bank is already overcharging its customers since the phone can easily be bought online for Rs. 48,500 with local warranty. Meezan is clearly overcharging by about 22% when you pay back in 3 months and even more when you pay back after a longer duration.

In short, there’s no change whatsoever and the bank is charging an inflated price for the same product.

Final Words

We are not saying that banks do not have the right to earn profits but at the very least they should be clear about this with their customers and act as a re-seller/retailer rather than just a lending institution.

In any case, setting profits of over 50% is still unjustified when they say there’s zero markup involved.

While researching these examples, we came across several more offerings for lots of other phones but we chose to mention the most popular flagships in the country as samples for our investigation.

Several other banks were also found to be offering similar products at high prices. All of these prices can be found at the respective bank’s loans, personal finance or credit rewards sections. You can compare these yourself as well and you will find that each and every device on the lists is overpriced by huge margins deceiving their own banking customers.

We would like the authorities to take a look at this malpractice which has been going on in this country for well over a decade. As for the banks themselves, they should take corrective steps and be more clear with their customers about what they’re offering them.

DISCLAIMER: Phone prices are sourced from local retailers which can change with time. The post mentions currently advertised prices only.

“Some stores offer the device for even less, Rs. 72,600”, which store please?

i bought it 2300Dh x 29Rs. =66700Rs. If you have firends in dubai ask them to bring one.

Well . pk has it for that price when you pay with a credit card.

Very useful information, even eye-opener.

Islamic banks finance under Musamwah principle under which they are not bound to provide buying cost to buyer.

Further, banks works to earn profit. Consumer financing (15-40%) is always costlier than Corporate financing (7-12%).

@Author Do you even know the meaning of markup?

Secondly, take a look at your marketing techniques first like how you people caption your articles and then earn a right to blame others.

Mark up is a common term which is calculated by Extra paid divided by finance amount in terms of percentage. Its IRR (Internal Rate of Return) which is actual RATE used in long term loans.

For calculation of IRR you should use use Microsoft Excel by opening MS Excel -> New File -> Templates on my computer -> Loan amortization Sheet.

You can calculate IRR in this sheet very easily which is actual mark up charged.

Well you may caption this method as “Calculation which Bankers would not Tell You”.

Such markup is for reporting purposes only if the entity is following IFRS.

For example: Akhuwat foundation is well known for providing interest free loans. But if Akhuwat foundation is following IFRS it will have to recognize some amount as markup or finance income because according to IFRS the loan shall be carried at present value.

From a customer’s point of view, if a person sells an item today, for 100,000 cash today or 10,000 per month for 10 months, there will be zero markup charged regardless of whatever the market price is currently today. And that is also in accordance with Shariah rules. But if you follow IFRS 9, you will have to record the amount of 100,000 at some discounted present value.

True but these matters nothing to common person. He is much interested in rate which is actually charged from him. I am trying to keep things simple here since its not a Banker’s forum.

Simplest Fact is:

If bank offer things free,how they are gonna bank?

A bank my offer you something free and earn from alternate sources from your business. For example free cheque books by earning from deposits. Free online since its actually isn’t a cost for bank. Free financial guarantees by earning from deposits held against such guarantees… etc

Com’on. it’s not a rocket science to know on what price the bank is offering you an interest free package. They list their price openly and customer can compare them easily. Example is the most recent iPhone 7 offering for which banks only charged a little over price.

Now talk about official price and retailer’s price. Both are different and you loose when it comes to warranty. There are only specified distributors who offer official warranty and they take responsibility for any damages. Banks offering those devices are affiliated with the official partners as they mention on their offerings. This is exactly the same as you buy a smartphone from a mobile shop, that shop is not responsible for after sales service. It’s you who’s responsible to take care of what you are you buying. Shopkeeper will ask you to go warranty service provider if there is any.

Banks might have offered with a huge difference of prices earlier but most recent the iPhone 7 offerings by those banks were on slight difference with official prices. Take me as an example, I am the person who never buys anything on installments. Even the credit cards I use, are only for the facility to not have big cash in pockets and I pay full payment at once. Even 0.1% Markup on installments is a “NO” from my side (It’s forbidden in Islam anyway, I won’t recommend that). But if I has to give a FIXED amount of Rs. 2000 on for Rs. 87000 in 12 months, that’s no harm – no religiously, no financially. A sensible person would have gone for it as they were on official warranties with official Apple partner in Pakistan. Sure if anyone who had to give 20,000/- additional over 80,000/- that will be a stupid idea and seriously you are not the only one who needs to tell it to others. People know what’s better for them.

So titling this post as “Don’t fall for something specific” is wrong. It applies to everything you buy without looking at it. Please stop making false attribution trying to be so clever.

Banks claim market rates for items on installments, so overcharging at 150% is completely insane plus not everyone knows that bank rates are so much higher than market rates, people need to know this

Yes. 100% correct. The other thing many banks offers so superseded nodle in the price when launch some years ago.

was waiting for such article since long.

Asking for such profits has conditions attached to it in the sharia. Not everyone can buy whatever they like and sell for whichever price they like. For example that item shouldn’t be stocked by the seller in way that it not available easily in lower price in the market.

Question is, if something is available freely in the market at a much lower price, why would anyone buy from someone charging too high at the first place?

Islamic banks do not offer warranty and clearly say that the item is from a third party seller so they are not responsible for any claims. If they are reselling, they would be the ones dealing with the claims not the original seller. Plus there’s a reasonable profit limit in Islam you can’t just keep increasing it, simply renaming it to to Islamic doesn’t mean it is not there,

if they are reselling then it is pure and simple interest, for this to be a islamic transaction they have to own the stock before selling it and acting as shopkeepers rather than providing a window for another shopkeeper while they pocket the interest.

True. That is what I meant. They have to be the owners and claim to be one.

Its a lot better in UAE. Banks also offer 0% payment plan there but with different approch. You go to store you think offer better price. Buy any item and then ask bank to make it 0% payment plan. And there is no bank service fee etc etc. Even here bank should partner with big stores so customer can buy whatever he want and from where ever he wants.

Even though I despise interest and those who deal in it this is the islamic method even under conventional banking. Whereby bank acts as seller of a product and when you agree to buy that product at the price mentioned you willfully enter into a transaction to purchase the product at it’s stated price. Islamically speaking the bank does have a responsibility I think to provide transparency but if it does not both parties in today’s world know the prices of these products. It is just like the case of any product seller whereby his buying cost and selling cost usually always has such a difference.

is se acha to uae men hy, 0% installment, purchase from wherever you want, just call ur bank and they will make installment.

you guys are talking about smuggled phones. Compare prices from genuine / authorized mobile sellers with official warranty. it is a baseless report.