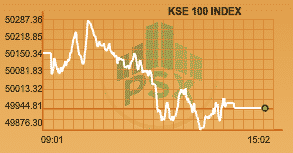

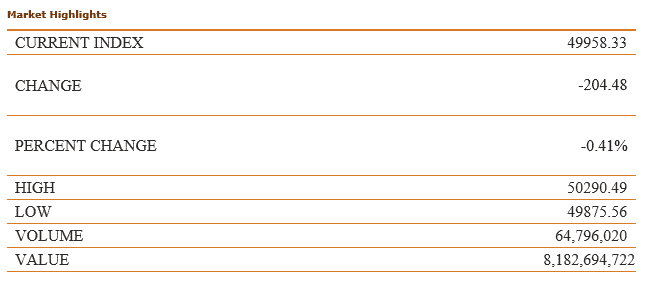

The index remained in range-bound again as it fluctuated between red and green zones. KSE-100 index fell by -204.4 points, or 0.41 pc, by the close of Thursday’s trading session to reach 49958.33.

The index tested the day’s high at 50,290 points. The day’s low of 49,875 came towards market close as the market reverted to profit taking.

Oil sector was down by -0.73% and distinguished names in were in red zone by end of the day due to a fall in crude prices worldwide. Currently crude oil is being traded at $46.16 per barrel.

Overall, volumes surged to 268 million shares, While in KSE 100 index 64.78 million shares changed hands with a total worth of nearly Rs 8.18 billion.

ENGINEERING was the top traded sector with total traded volume of 43,542,600 shares. It was followed by COMMERCIAL BANKS with a total traded volume of 42,416,200 shares and CEMENT sector with a total traded volume of 35,504,250.

Shares of 384 companies were traded. At the end of the day, 149 stocks closed higher, 224 declined while 14 remained unchanged.

Bank of Punjab (R) was the volume leader with 25.95 million shares, losing Rs 0.22 to close at Rs 1.00. It was followed by Power Cement (R) with 25.57 million shares, losing Rs 0.33 to close at Rs 1.59, Dost Steels Ltd with 22.47 million shares, gaining Rs 0.58 to close at Rs 14.76 and Azgard Nine Ltd with 12.99 million shares, losing Rs 0.13 to close at Rs 13.75.

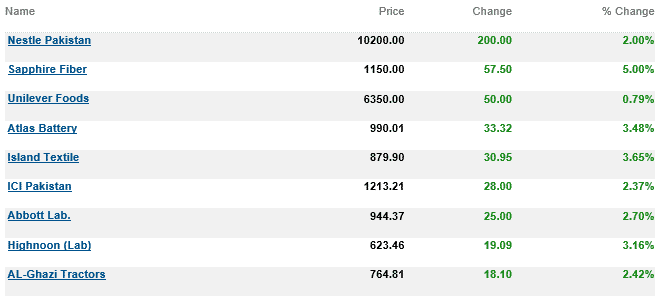

The top advancers of the market were:

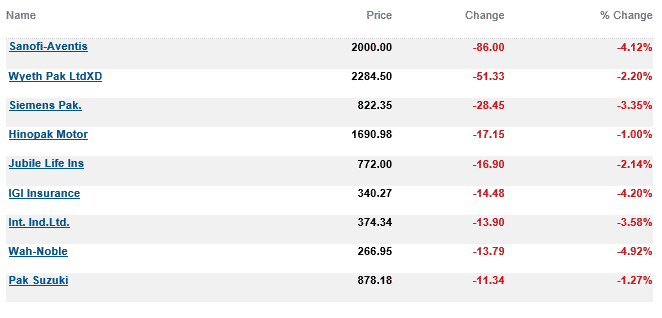

Top decliners of the market were:

The time for the book building process for sale of 20 per cent shares in Pakistan Stock Exchange (PSX) had been extended for another day.

In a statement released on Wednesday, PSX said the Securities and Exchange Commission of Pakistan had allowed extension in time for book building for another day, which was today. Originally, the bid books were to be kept open for two days, Tuesday and Wednesday.