The Federal Board of Revenue (FBR) has initiated Withholding Income tax audit of cellular mobile companies with the objective to professionally examine, analyze and verify the veracity of the income tax.

This was stated by an FBR official while briefing the Senate Standing Committee on Information Technology and Telecommunication. The committee met with Shahi Syed in the chair, where FBR briefed the panel on “Progress made so far on mechanism/ policy being devised by FBR and PTA regarding collection of Taxes i.e. GST & WHT from Cellular Operators”.

FBR official said that M/s Telenor Pakistan (Pvt.) Limited has uploaded its data to the software and it has been picked up for withholding income tax audit.

Details About the Audit

The audit will take around 8-10 weeks to reach a meaningful conclusion, said FBR official, adding that the software has now been developed to collect bi-weekly data of customers of telecom companies. The companies were initially reluctant to share this data terming huge customer base and confidentiality as the reasons for reluctance but the matter has been resolved after involving PTA.

Presently, four Mobile/Cellular Telephone Companies – M/s Telenor Pakistan (Pvt.) Limited, M/s. Pakistan Mobile Communication Limited (Mobilink), M/s. Telecom Mobile Ltd. (Ufone) and Ms. CM Pak Ltd. (Zong) – are operating in Pakistan.

As per requirements of the Income Tax Ordinance, 2001, the Telcos are withholding income tax from millions of customers, and in the process, generating a massive volume of customers’ transactions on daily basis.

Similarly, the Telcos are also required to collect Sales Tax (in case of provinces) under concerned provincial sales tax laws whereas Federal Excise Duty (in case of Islamabad Capital Territory) is being collected under Federal Excise Act, 2005.

Details on the Process

In order to professionally examine, analyze and verify the veracity of the income tax (withholding taxes), FBR has been able to develop a software utility portal with assistance from the Pakistan Revenue Automation (Pvt.) Ltd (PRAL/IT Wing).

All the four Telcos are required to upload their monthly customer wise income tax (withholding tax) data, using a prescribed format. For this purpose, Pakistan Telecommunication Authority (PTA) also provided active support in exhorting the Telcos to upload the requisite data on the electronic interface.

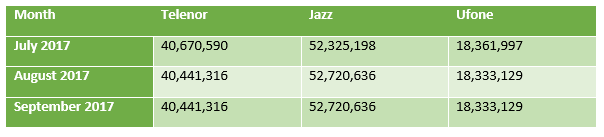

After extensive technical exchanges between Telcos and Pakistan Revenue Automation (Pvt.) Ltd (PRAL, I.T Wing, FBR), three Telecom Companies – M/s Telenor Pakistan (Pvt.) Limited, M/s. Pakistan Mobile Communication Limited (Mobilink) and M/s. Telecom Mobile Ltd. (Ufone) – have uploaded their income tax (withholding tax) data for the months of July, August and September 2017 through the online interface as provided by Pakistan Revenue Automation (Pvt.) Ltd (PRAL).

On the other hand, the fourth Telco, M/s. CM Pak Ltd. (Zong), is facing a number of technical issues in uploading the required data on the PRAL-utility portal which are in the process of being resolved.

An initial analysis based on the data received by PRAL from the three Telcos, shows that the size of customer base of the three Telcos, is as follows:

Customers of Telcos

To start with, the final data uploaded by M/s Telenor Pakistan (Pvt.) Limited, has been picked up for withholding income tax audit of the same company. The concerned field officers have already visited the company twice to cross check the data from the system used by the company.

In view of massive volume of transactions involved therein, the exercise of income tax (withholding taxes) is expected to be completed in 08-10 weeks’ time.

The Withholding Income Tax audit of other Telcos would also be carried out after taking into account the outcome and inference drawn from the case of M/s. Telenor Pakistan (Pvt.) Limited.

PTA’s Response

The FBR’s designated team has already had detailed meetings with all Cellular Mobile Operators (CMOs) with the help of PTA and all CMOs have shown their billing systems and made detailed presentations to FBR’s team.

It was requested by FBR that the CMOs be further directed to comply with the instructions of FBR and upload data on the portal of Pakistan Revenue Automation Limited (PRA).

M/S Jazz, Telenor and Ufone have completed the requirement, while Zong was in the process and instructed again in this respect. PTA has also provided all contacts of relevant persons in telcos to LTU FBR which is in contact with the relevant persons from the telcos.

FBR has not required any further assistance /intervention of PTA since writing to CMOs for compliance and LTU came in contact for any further assistance if required. However, if any further support is required at any time, the authority could intervene.

Good Work FBR Banks Ko Bhi Add Karo : Industry Ko Bhi Add Karo Audit K Liye