Banks are reluctant to lend the government for the long term. They are anticipating a higher interest rate as after the devaluation of Rupee, interest rates will increase. Currently, Market Treasury Bill (MTB) auction banks do not bid for 6 and 12 month maturity.

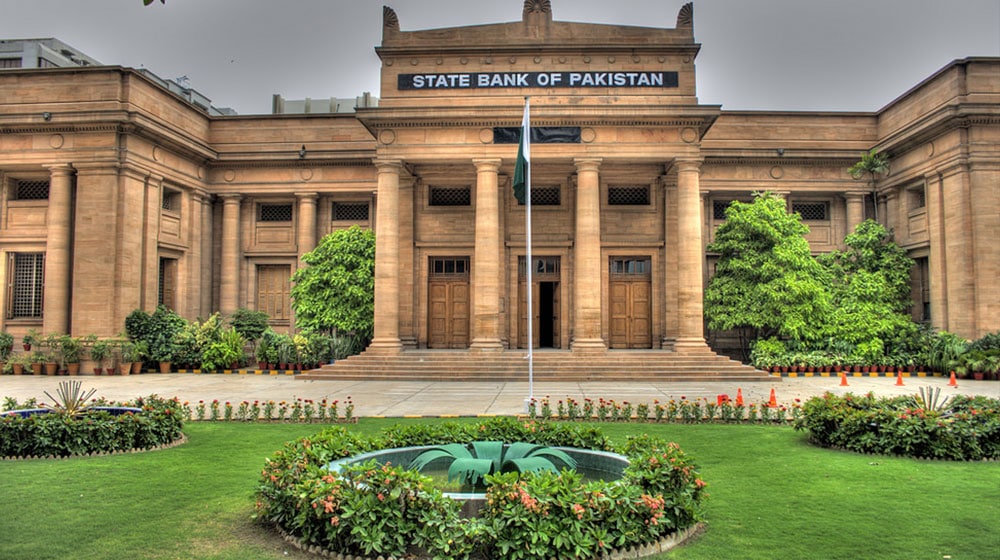

To fulfill Government of Pakistan’s loan requirement, State Bank of Pakistan conducted an MTB auction. In this auction, the government set a borrowing target of Rs. 550,000 million out of which Rs. 491,425 million was rollover and Rs. 58,575 million was additional requirement.

But in the auction, banks only bid for 3 month MTBs while none bid for 6 and 12 months of MTBs. For 3 month MTBs banks offered Rs. 195,500 million. This is much lower than the government’s auction target.

Out of the bids, the government accepted only Rs. 93,750.200 for 3 months on a 5.9910 percent rate of return .

Analyst says that the banks’ reluctance on bidding for 6 and 12 months MTBs shows that they are anticipating a rise in interest rates. But the government is also signalling that it is not considering the rise soon and it maintained a rate of return on 3 months MTB unchanged at 5.9910 percent.

“Banks are thinking that after the devaluation of Rupee, SBP is also reconsidering its Monetary Policy and increasing the interest rate. Giving no bids is a signal from the banks that they accepting more money in government investments.” the analyst added.

SBP policy rate is fixed at 5.75 percent since May 2016. Which is the lowest policy rate in SBP’s history.