The Federal Board of Revenue (FBR) has officially released its official mobile app, ‘Tax Asaan‘ which allows salaried persons to easily file their income tax returns. Not only this, the app allows sales tax registration, online payments, and online verification for active taxpayers list, exemptions, POS invoices, and whatnot.

The app offers an easy interface with multiple options for filing sales tax, income tax and making online payments without having to hire someone to do so on your behalf.

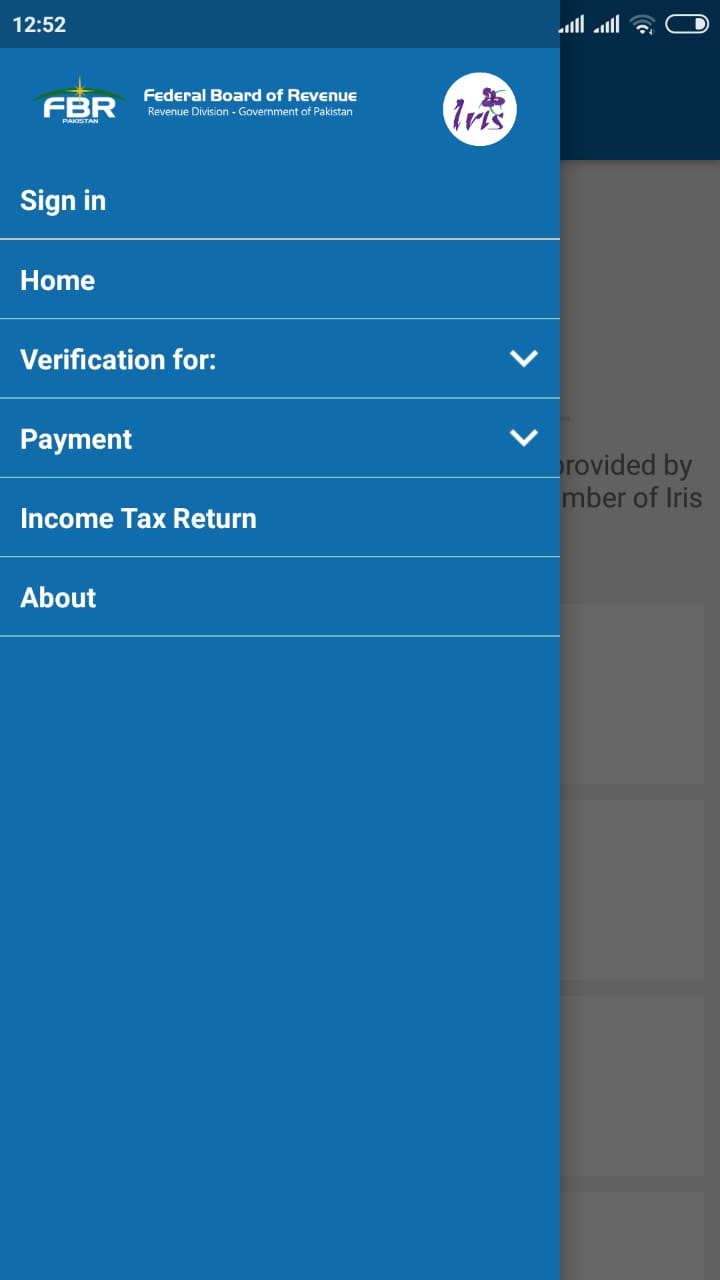

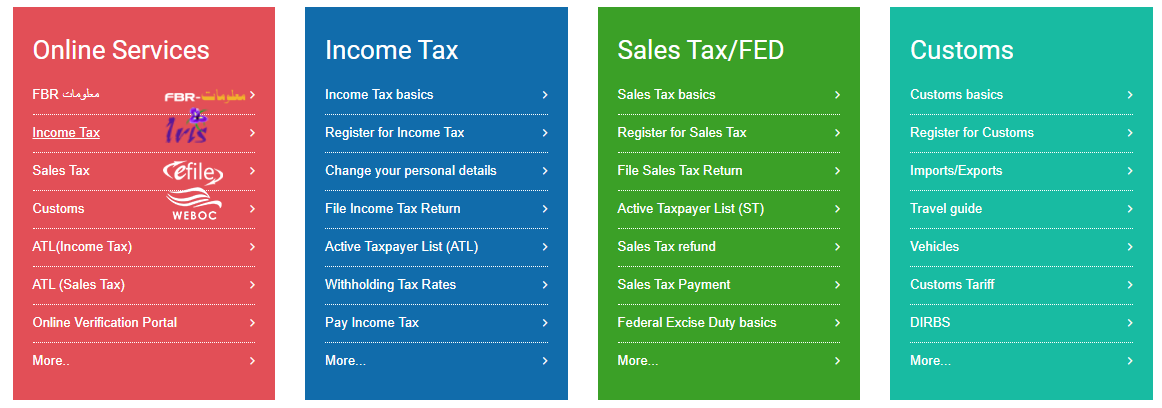

There is no option to directly sign up using the app, which is a very odd omission. The users have to register via FBR’s official website Iris. On the homepage, click the ‘Income Tax’ tab under the ‘Online Services’.

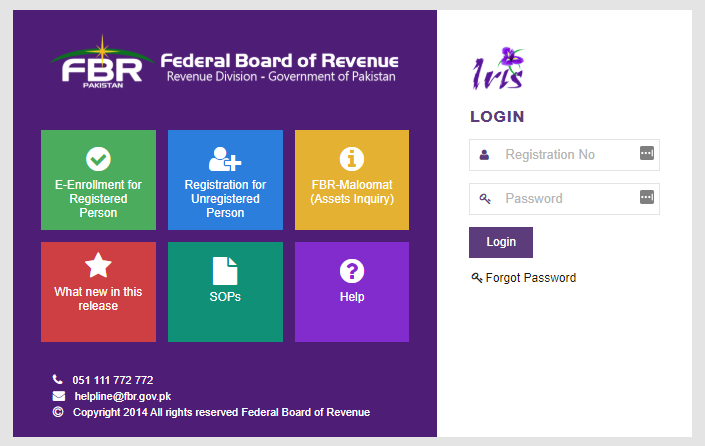

Clicking on Income Tax will take you to a new page, where you will see different options like E-enrollment for registered person, new registration for unregistered person, and assets inquiry, etc.

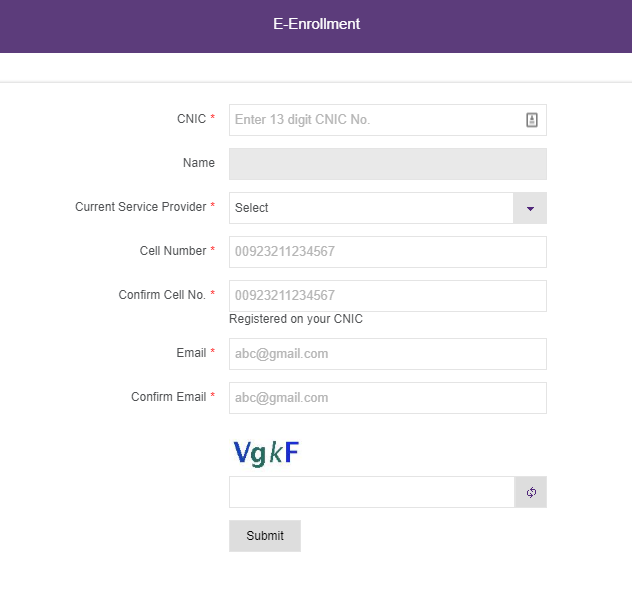

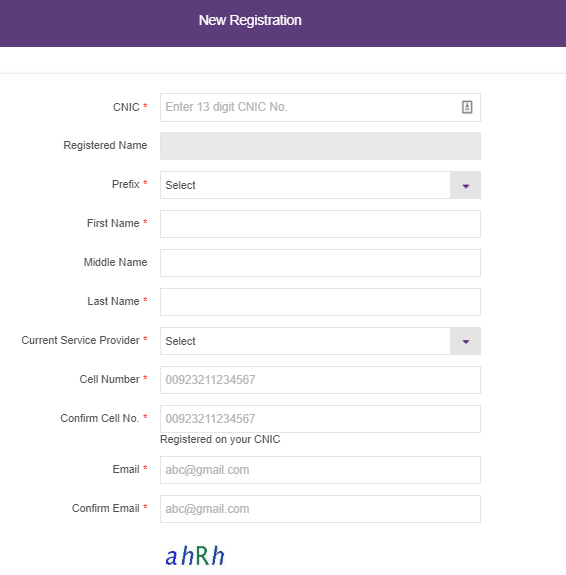

If you are already a tax-payer but haven’t done the e-enrolment, you can choose the first option. For new registrations, go for the second option. You will have to provide your details like CNIC, full name, mobile number, and email address etc.

Once you are done with the registration, you will get a confirmation email from FBR. The email will include your password, PIN and registration number.

You can use this registration number and password to sign in to the Tax Asaan app. You can only file your taxes or make payments from the app if you are registered with the FBR.

How to File Income Tax Returns Using Tax Asaan?

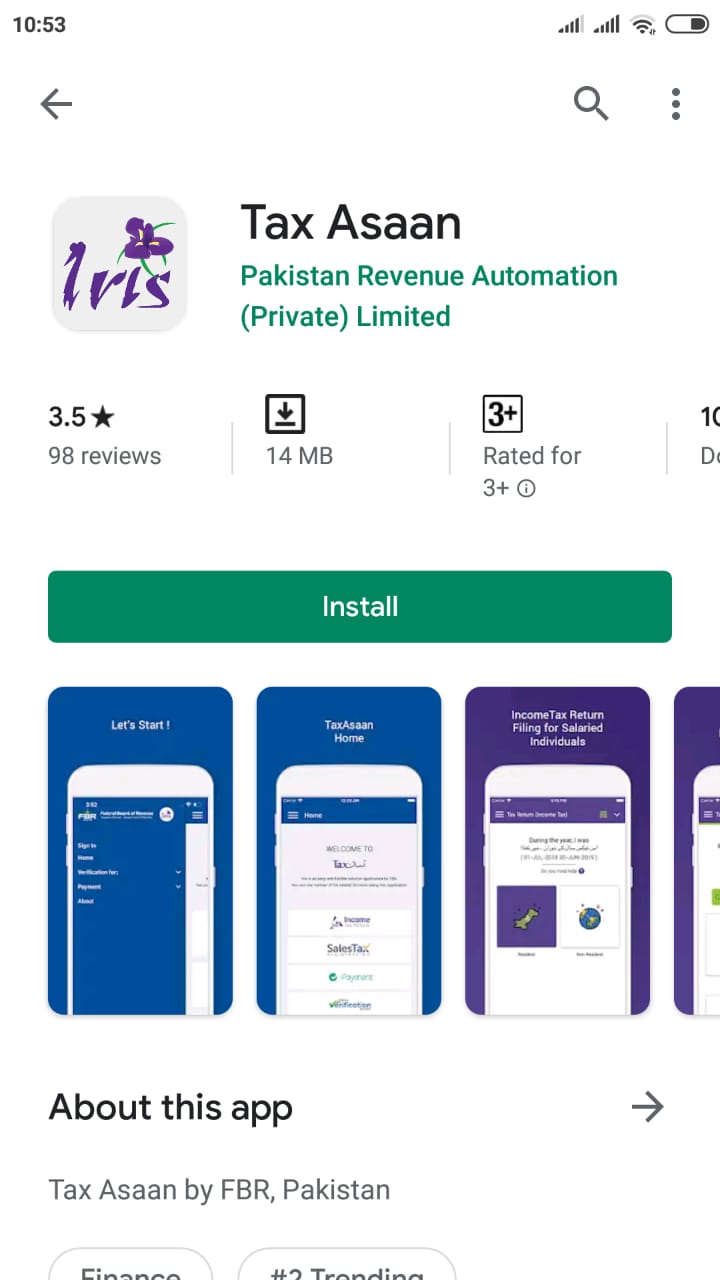

Coming back to the mobile app, let’s see how you can file income tax returns.

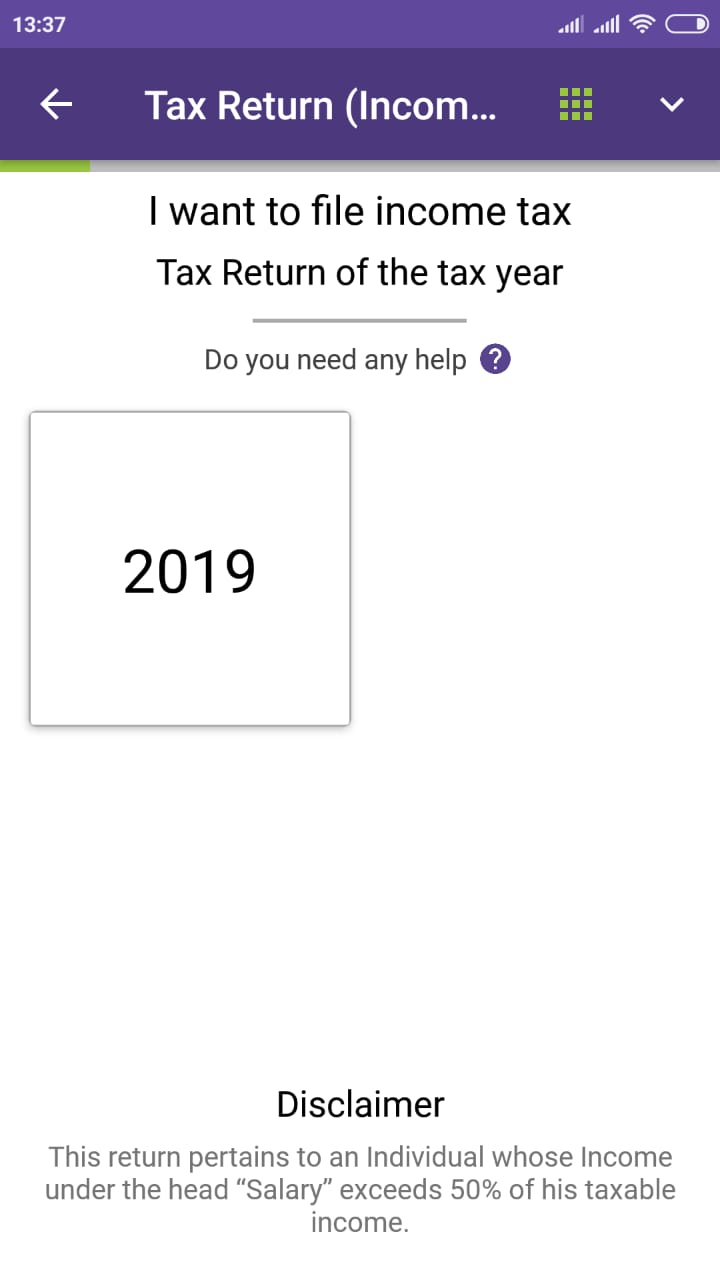

- Tap on Income Tax Return.

- Specify the year for which you want to file your returns.

- Specify whether you were a resident or non-resident during the period.

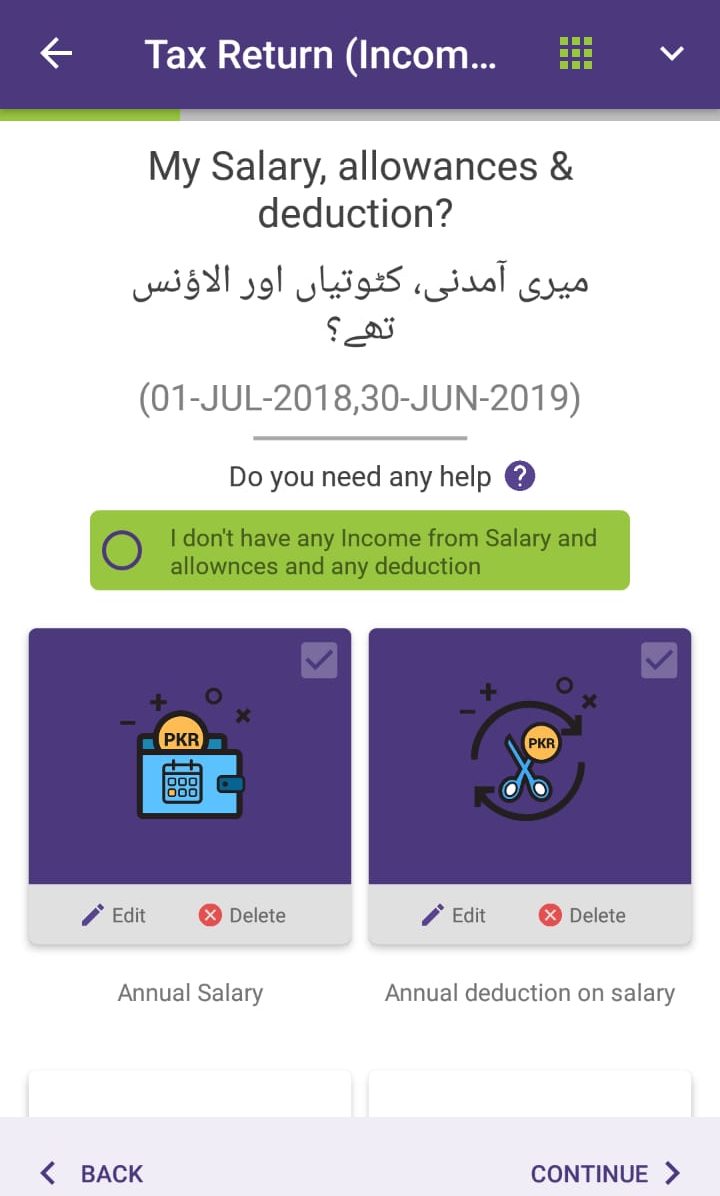

- Specify your annual salary and deduction on salary or other allowances/bonuses and press Continue.

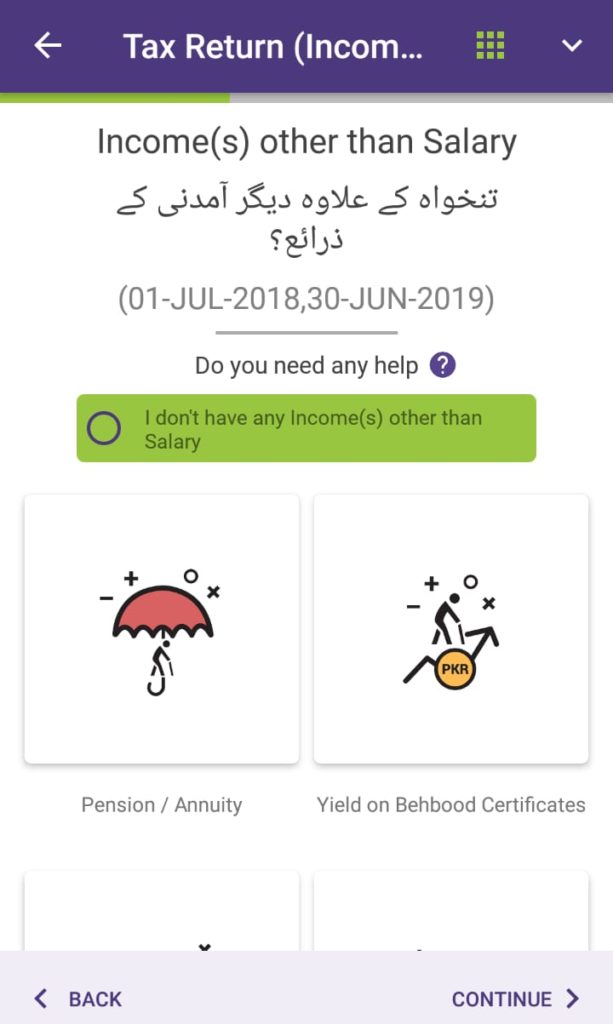

- Specify sources of income other than salary, if applicable. Otherwise, click on ‘I don’t have any income(s) other than salary.

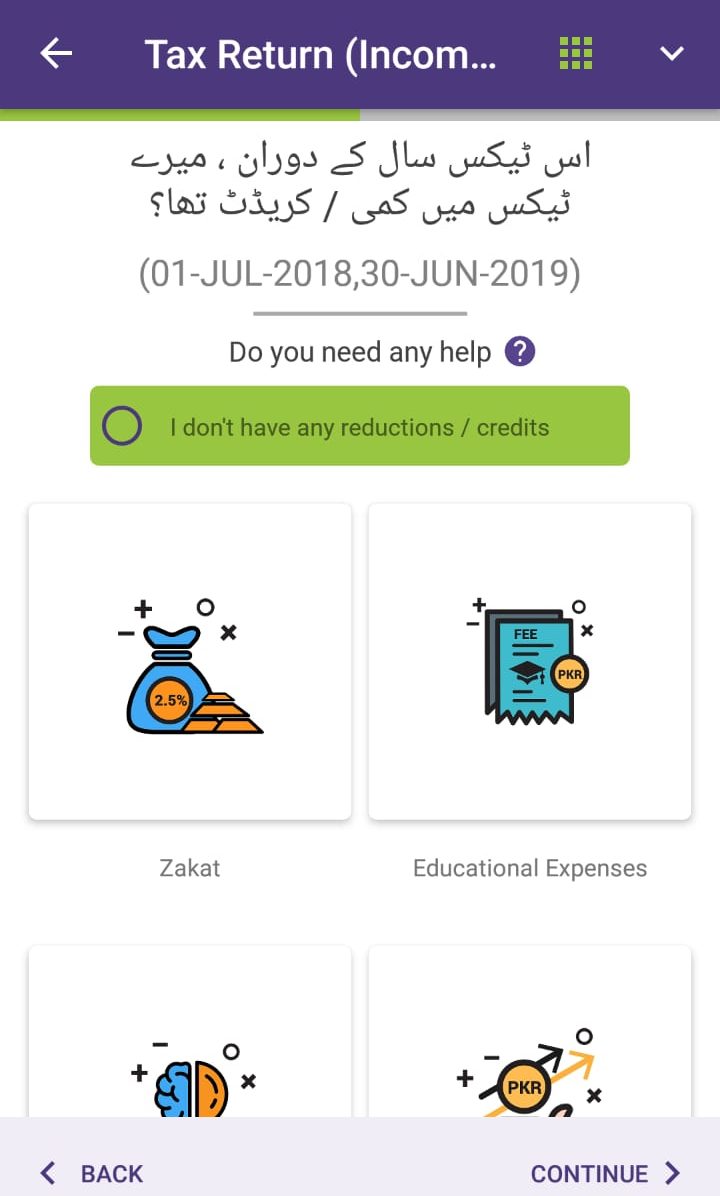

- Specify tax reduction/credit from Zakat, educational expenses, full-time teacher/researcher, profit on debt, insurance, charitable donations, approved pension fund, general tax credit or surrender of the tax credit.

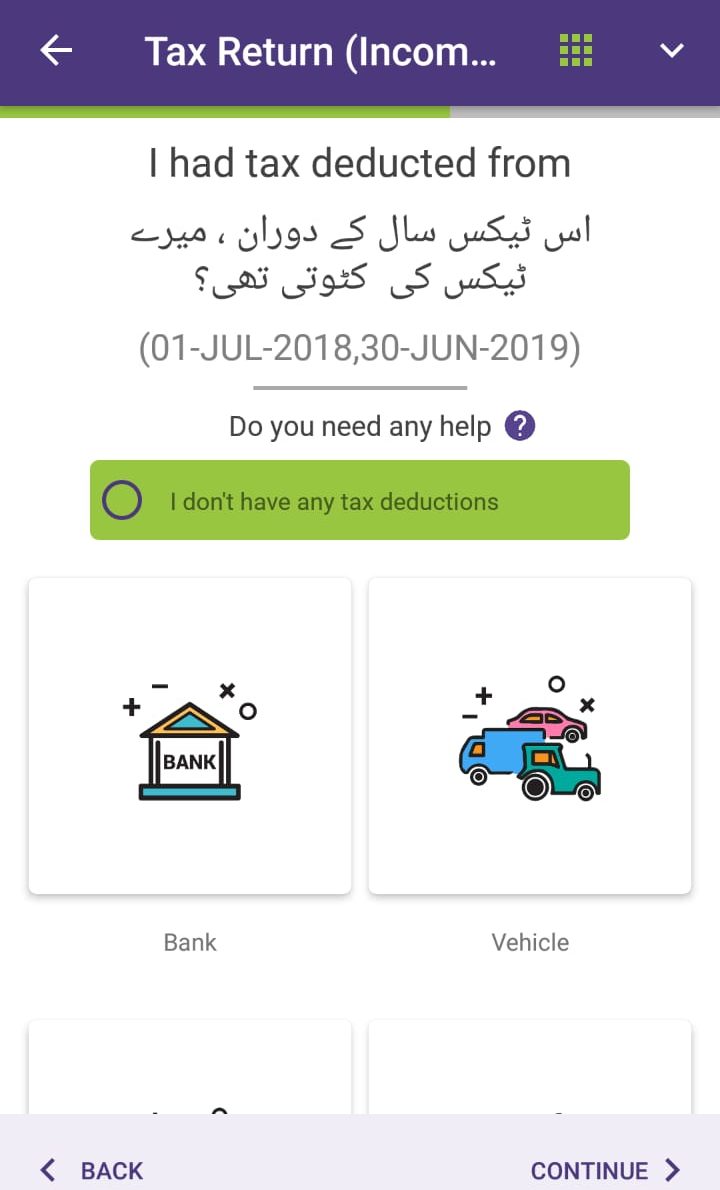

- Any other tax deducted from the bank, vehicle, utilities, property, education, winnings/prizes, insurance, dividend, pension fund, auction, air ticket, functions/gatherings etc, if applicable.

- Answer whether you pay Super Tax or not. Most people will skip this screen.

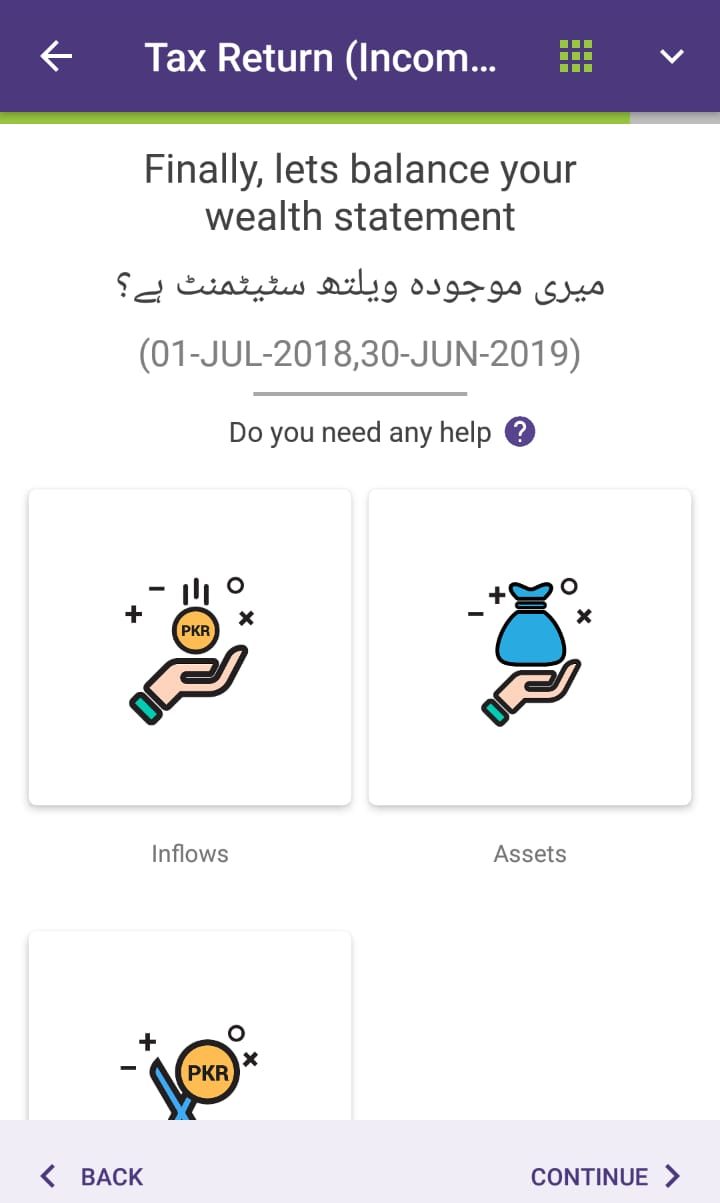

- Fill out the balance statement by declaring your assets, assets, and inflows. This is an important part so try to mention all your expenses, incomes (including gifts or support from family), your current assets (including cars, houses, other property etc.) and liabilities (including loans from banks or people).

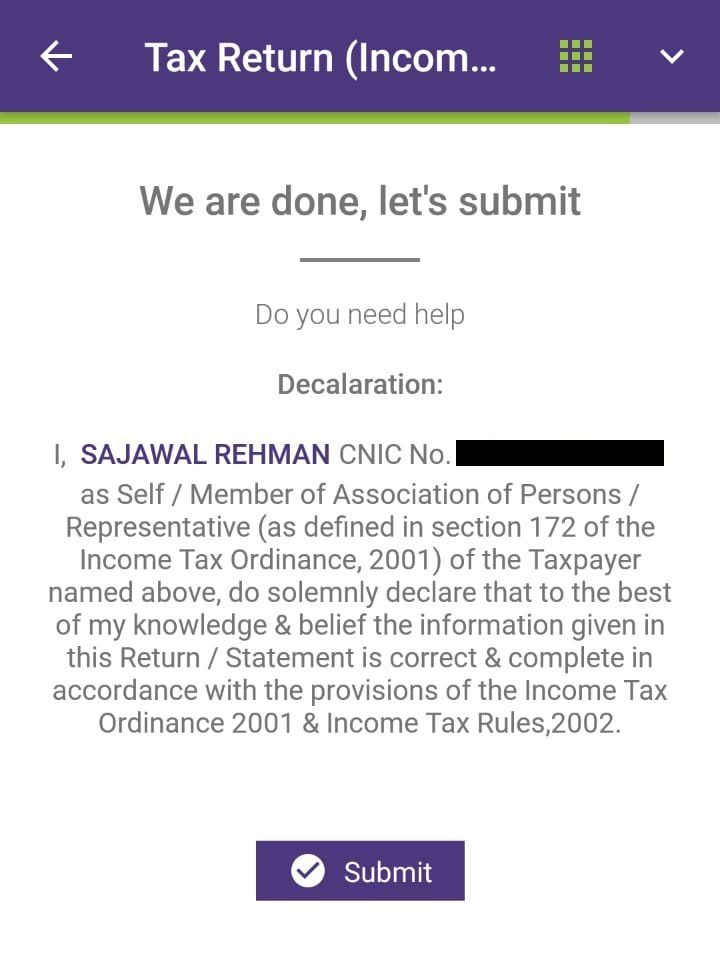

- Read the final declaration and press submit.

Most salaried people have their income tax deducted when their salaries are transferred. However, if you need to pay any remaining tax, you’ll need to refer to the e-Payments section detailed below. You can also make the payments manually by going to the FBR office.

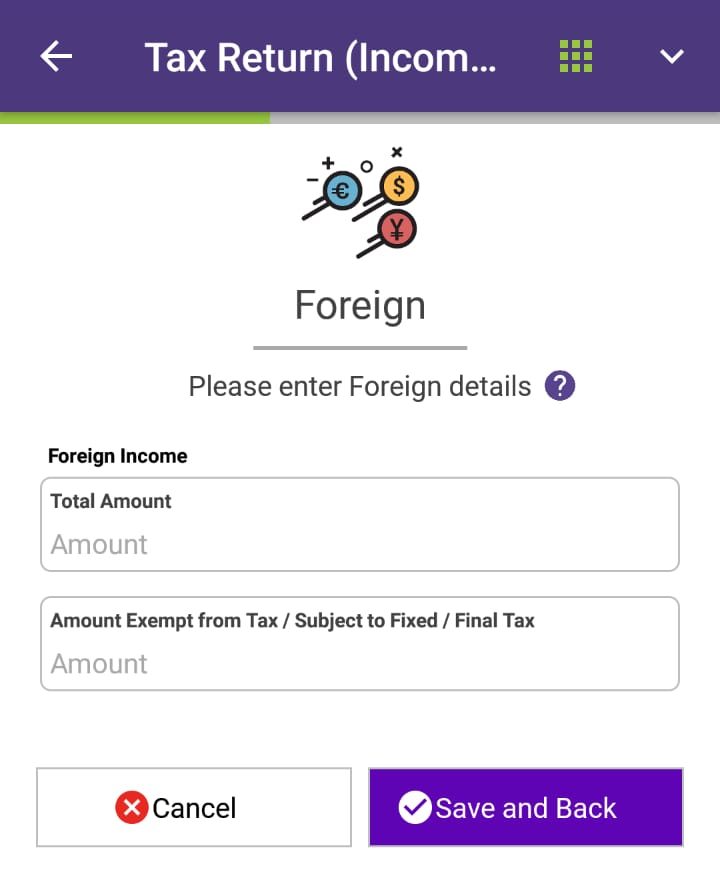

Freelancers can declare their earnings from freelance work in the foreign payments tab. Payments withdrawn to bank accounts through legal channels are not taxable.

Sales Tax Registration

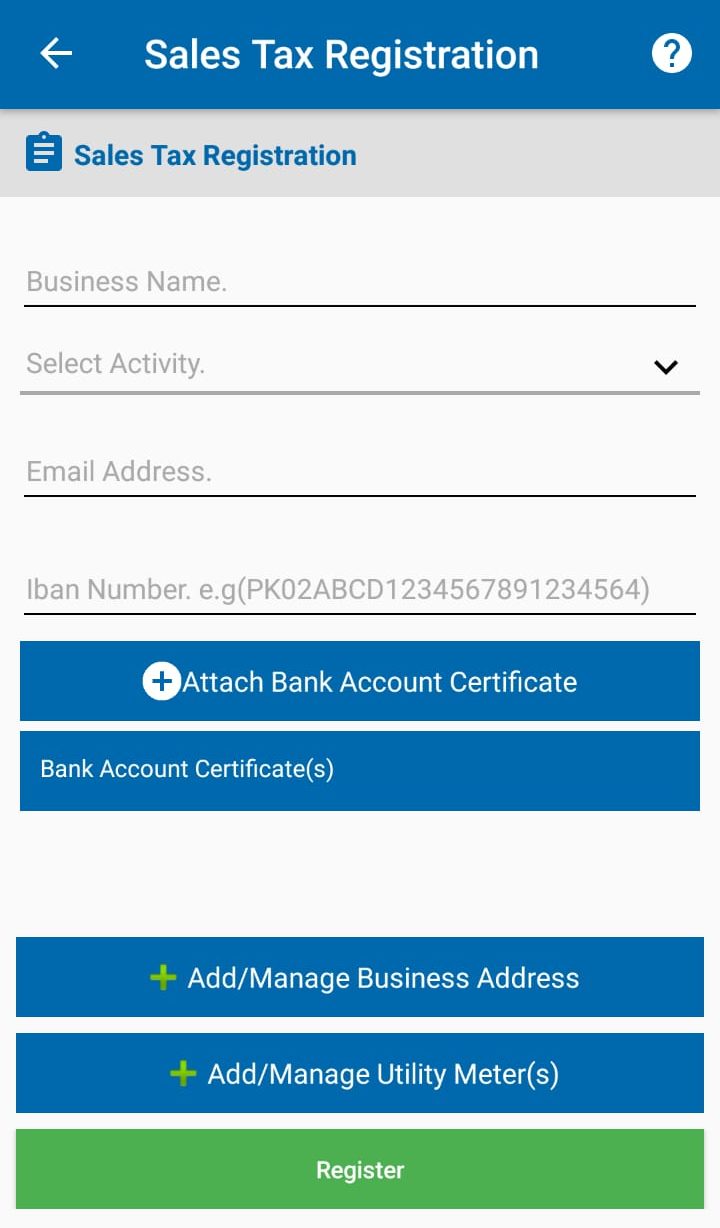

For sales tax registration, click on the relevant tab on the homepage.

- Specify the type of business: manufacturing or other than manufacturing.

- Enter your CNIC number.

- Fill out your full name, business name.

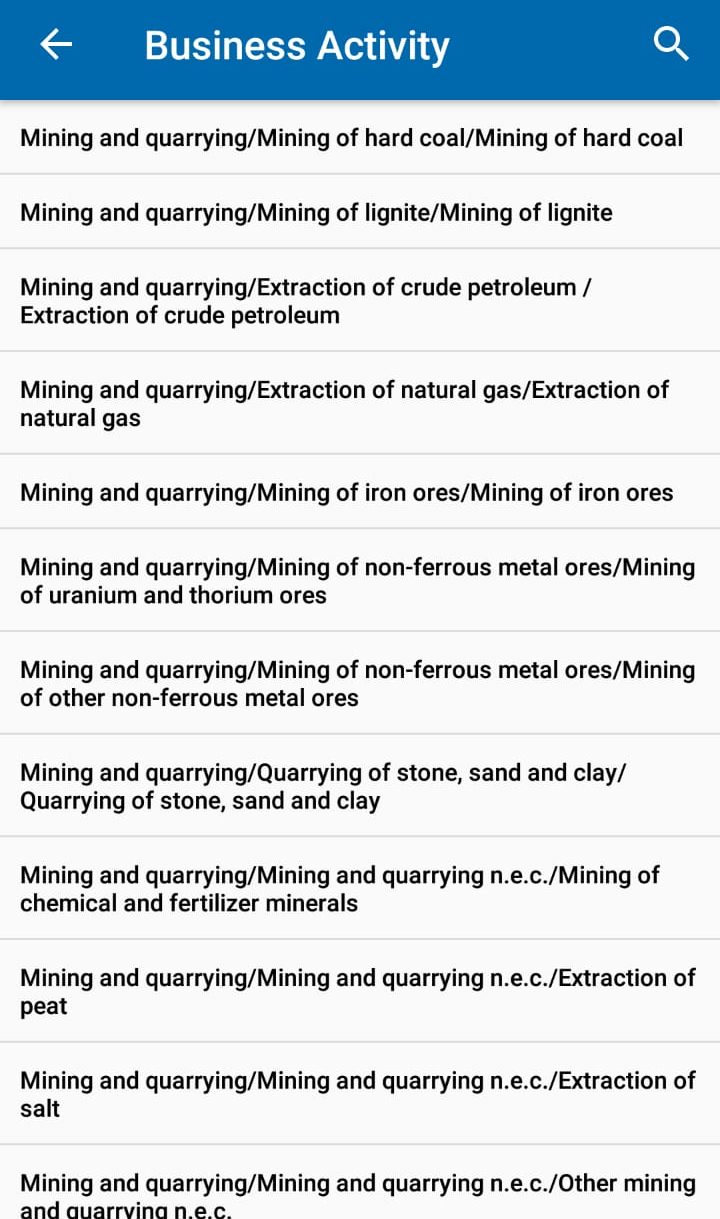

- Specify the type of activity your business performs

- Enter your email address and IBAN number.

- Attach bank account certificate, and add business address and utility meters.

- Click register.

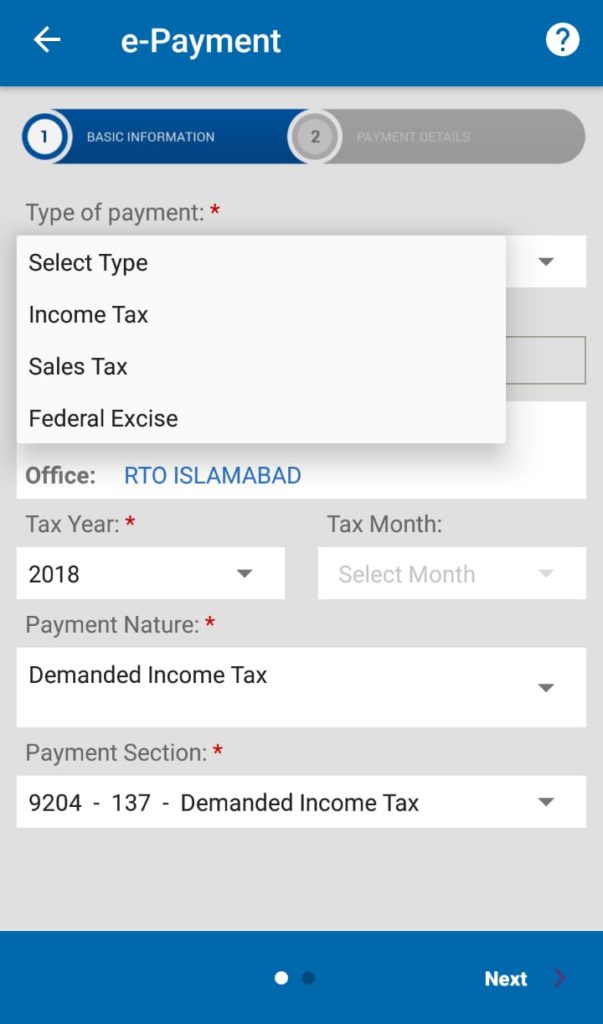

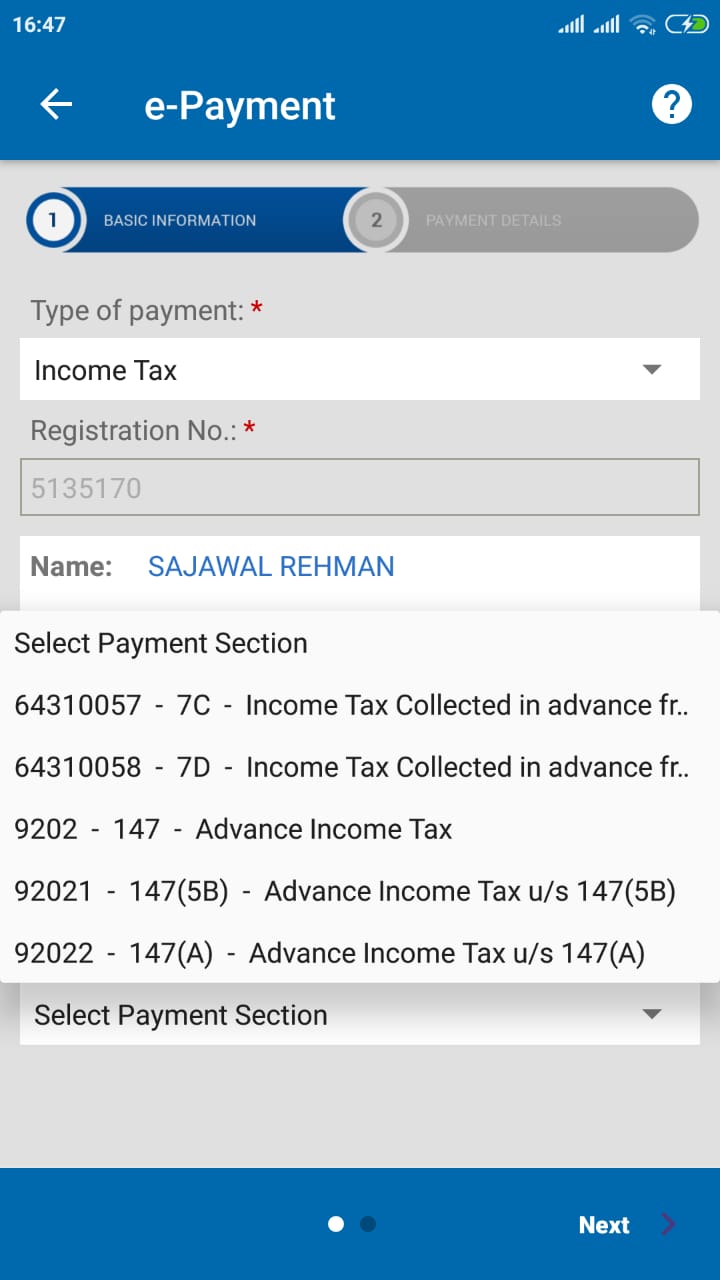

e-Payment

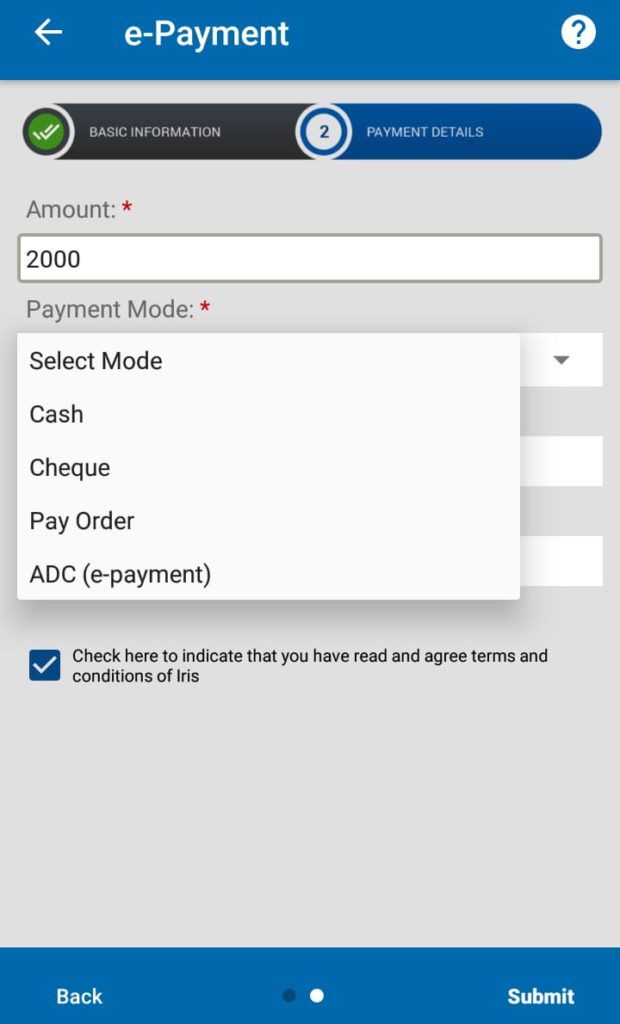

You can make different payments including income tax, sales tax, and federal excise duty from your app. The modes of payment integrated into the app include cash, cheque, pay order and ADC (e-payment).

The payment will be made against your registration number which has been assigned to you by the FBR. For income tax, you will have have to specify the nature of payment i,e, admitted income tax, advance income tax, misc, demanded income tax, WPPF, and WWF. The payment section also needs to be specified (will be mentioned in your income tax or sales tax statement).

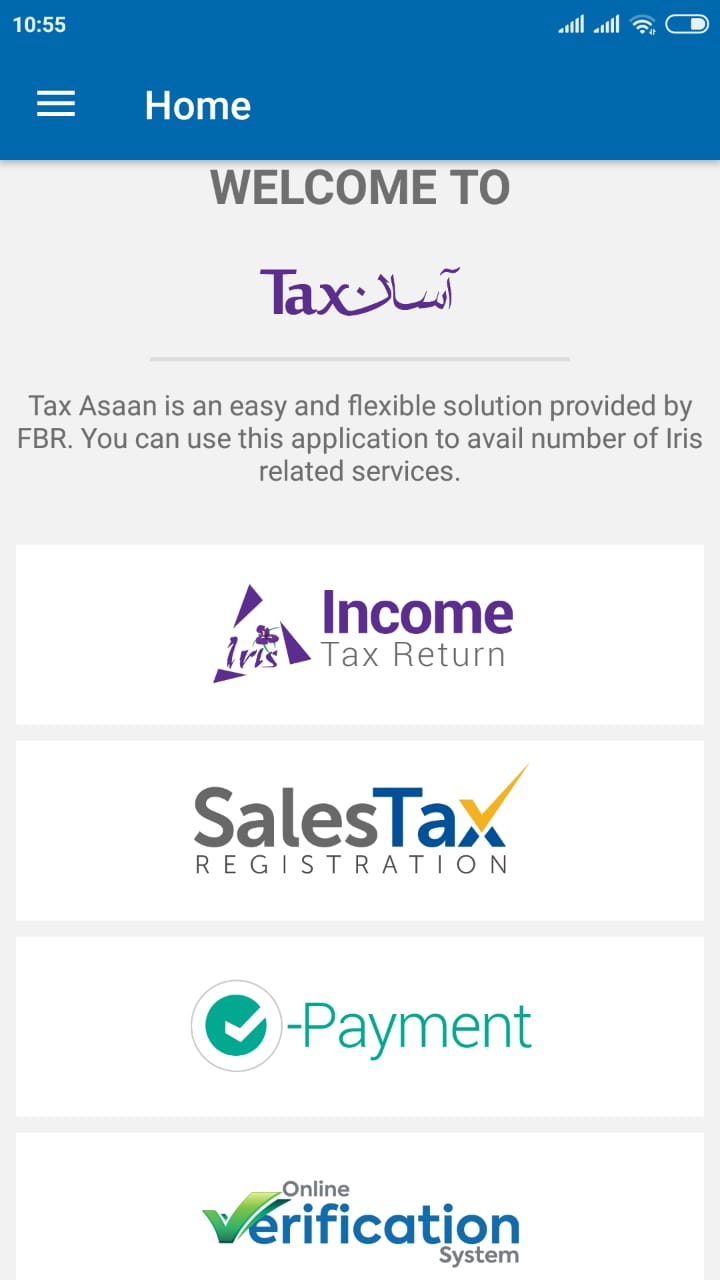

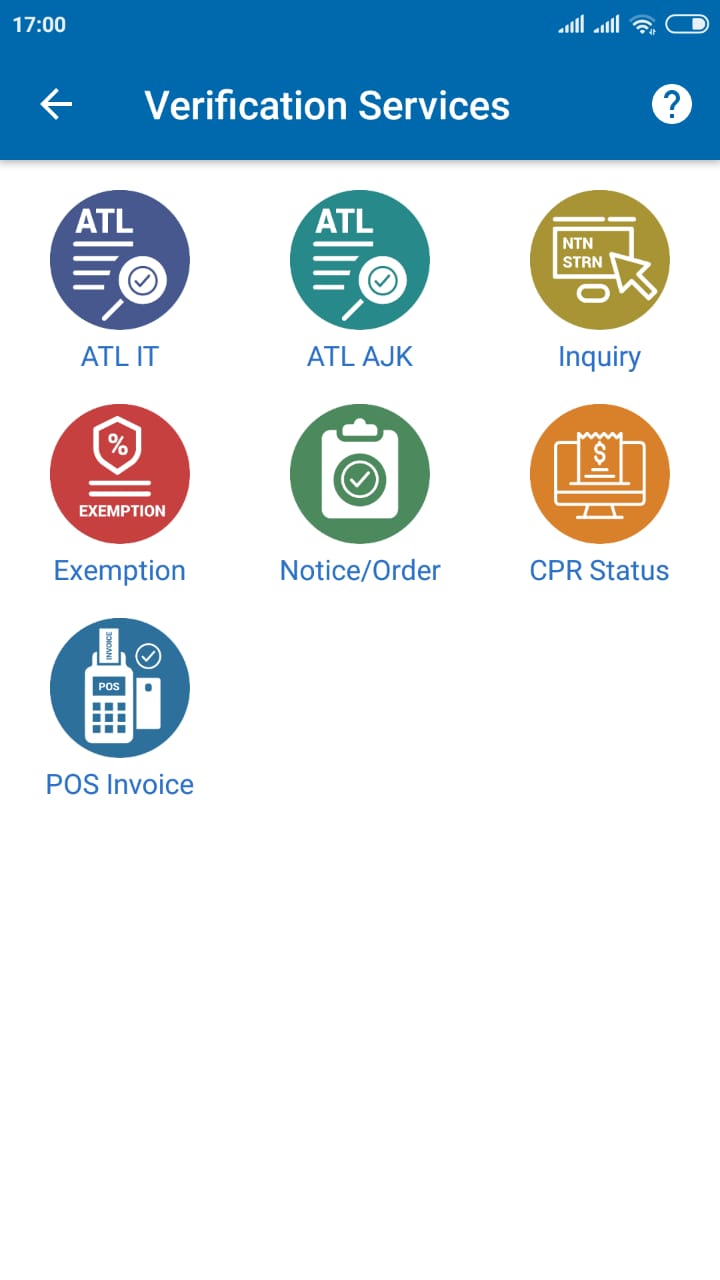

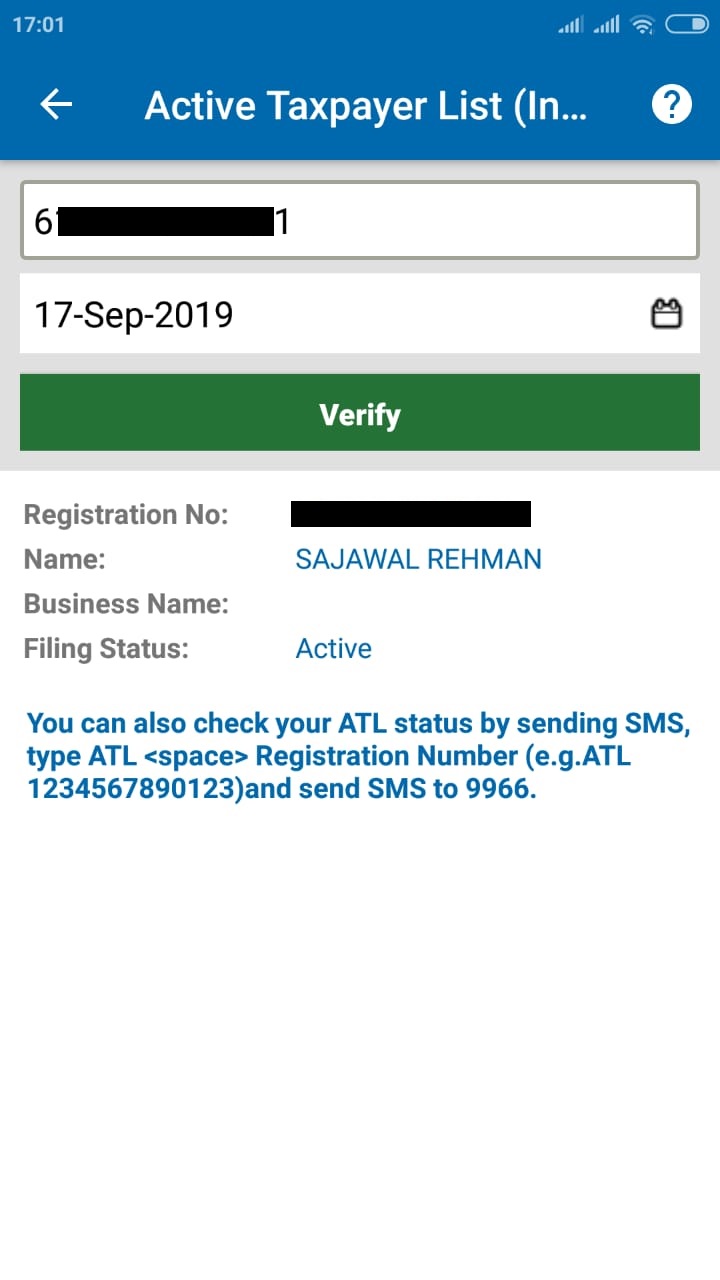

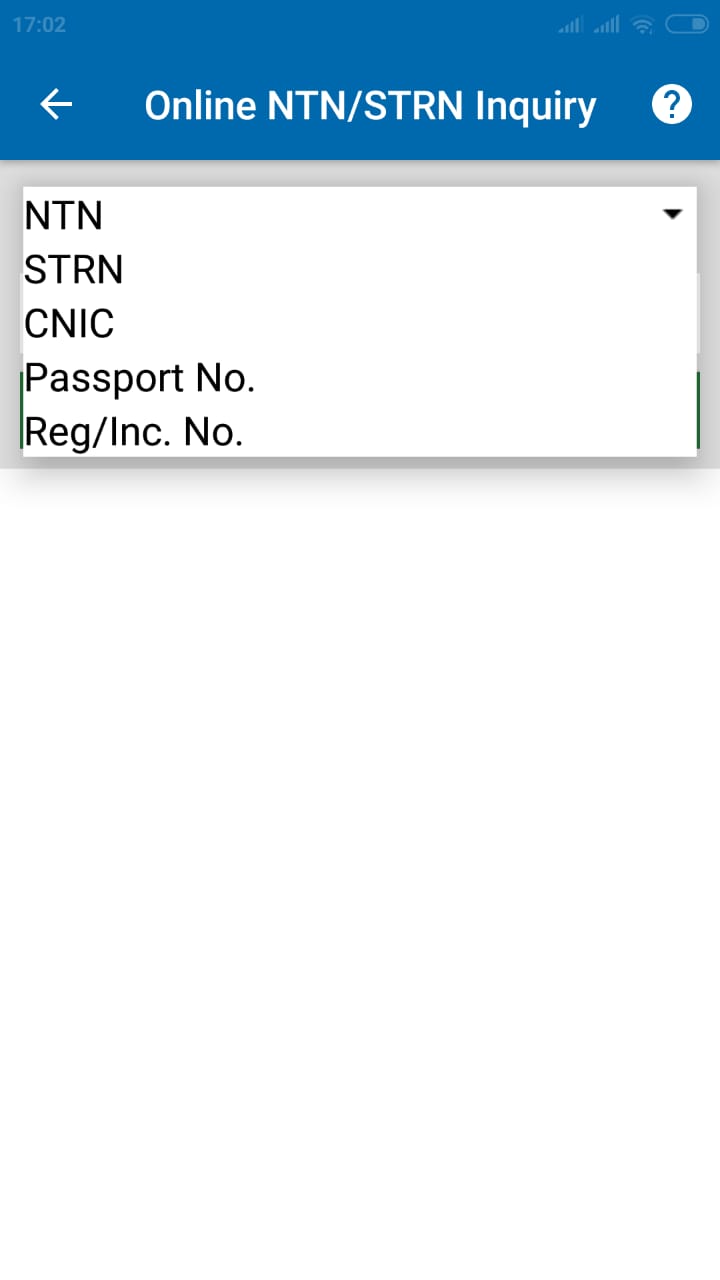

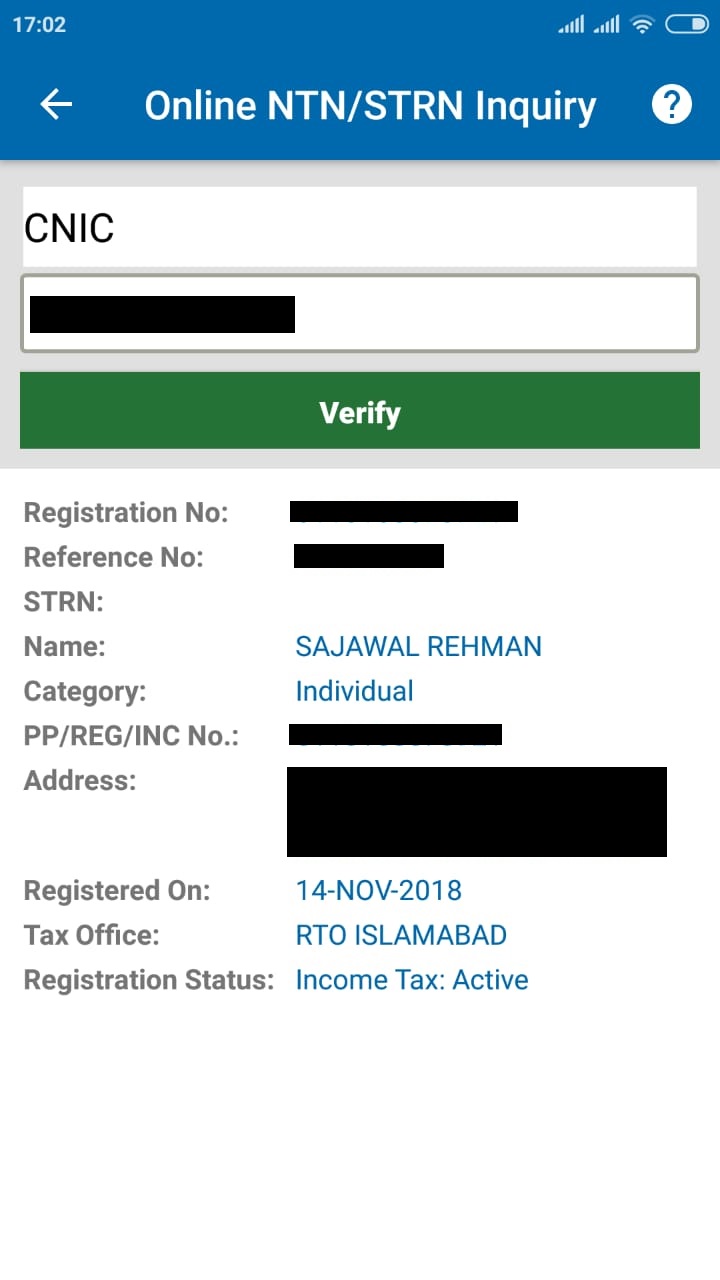

Verification Services

The app comes with various verification features i.e. you can check whether you are an active taxpayer or not, inquire about your NTN, SRTN, CNIC, Passport and Reg/Inc number, etc. This is also helpful if you need to verify someone else’s taxpayer status.

Exemption certificates, notices, orders, computerized payments, and POS invoice, etc. can also be verified by entering the bar code, reference or invoice number or by scanning the QR code.

What are your thoughts on the utility of the app? Ask your questions in the comment section.

Video Bana K Dekhate Ap : ProPk Par Bhi Aur Apk Employee Par Bhi Tax Lagta hai : Ap Log Apni Tax Filing Directly Q Nahi Shikate Hamae ?

Every one has to file returns either he pays tax or not. There should be no voice of filer or non filer. FBR should establish their office in every city and town to facilitate public like Pakistan post.

No Need Office : Just Advice the People How to Talk to the Customer & How to Advice to of all them easily in Just Call :

Customer Care Not Workable : Simple Jawab Ata hai Hame Nahi Pata Sir We Are Call Customer Only :

How can I get out completely from tax net, because till 2017 my earning was good so i become tax payer but now my monthly income is 15k only but i need to pay 5000/year to lawyer for income tax return.

Regards

Tax returns can be filed online too. No need to pay a lawyer to file your income tax returns.

there’s a difference between filer/ non filer and tax payment, understand this.

even if you have zero income you have to file as such.

Dear Sir as CNIC is your NTN so you only get out from Income tax if God-forbid you may expire. Kindly cross check with you all banks Credit amount as whatever is credit in your bank is your income (as per FBR view). ITO. 2001 have 241 Sections and five head of income

1) Income from Business

2) Income for Salary

3) Capital Gain

4) Income from Property

5) Income from Other Source

If you dont have any income from above heads please file NULL but you have to file a Wealth statement along with ITR it shall not be NULL. you shall be questioned how you spend you livelihood as your declaring annual income of 180,000/- (15K PM). So file a logical IT return so that in audits you shall answer with supporting documents.

Tax is complicated whatever you file you shall be responsible and which ever not declared its concealment. So File Wisely.