Pakistan State Oil (PSO), the leading oil marketing company of the country, convened its Board of Management (BoM) meeting at the PSO House in Karachi to review the performance of the company during first half of the financial year 2019-20.

Despite unfavourable market conditions in the industry and many challenges, PSO remained focused on re-gaining market share and volumetric growth, and outperformed the industry by an enormous margin.

PSO Performance

POL Market Share and Sales volumes

PSO has reported a profit of Rs. 6.43 billion during the first half year, showing a growth of 51.65% as compared with the profit of Rs. 4.24 billion recorded in the same period last year. The company’s net sales increased by 12.20% to Rs. 642.33 billion as compared to Rs. 572.54 billion recorded in the same period last year.

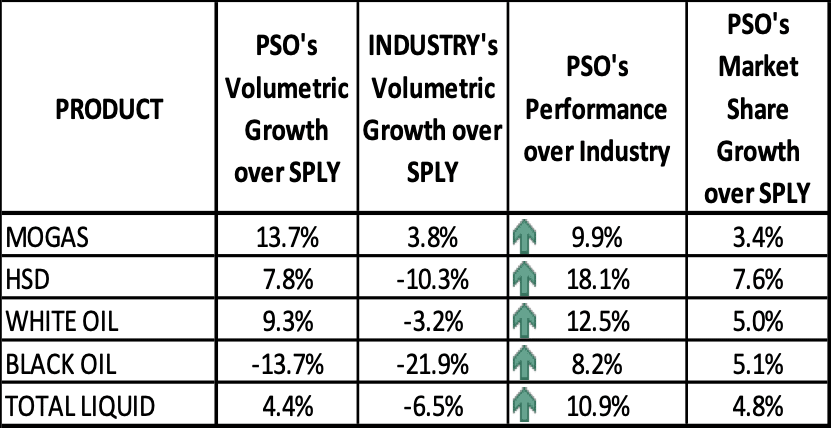

- In MOGAS, PSO’s volume growth over SPLY is 13.7% as compared to 3.8% of industry growth. PSO’s market share increased by 3.4% vs. SPLY.

- In HSD, PSO’s volume growth over SPLY is 7.8% as compared to 10.3% decline in the industry volumes. PSO’s market share grew by 7.6% vs. SPLY.

- In White Oil, PSO’s volume growth over SPLY is 9.3% as compared to 3.2% decline in the industry volumes. PSO’s market share growth over SPLY is 5%. In Black Oil, PSO’s market share growth over SPLY is 5.1%.

PSO managed to mitigate many of the negative economic impacts and strived to minimize the damage caused because of industry challenges.

PSO continued its focus on its strategic priorities and operational excellence in the current financial year through macro-economic challenges in the country, and successfully delivered strong profit after tax. (PAT) of Rs.6.4 billion in FY2019-20.

”These results were achieved through various customer-centric plans and by enhancing consumer experience and forecourt improvements,” said the company in a statement.

On 31st December 2019, outstanding receivables (inclusive of LPS) from IPPs, GENCOs, PIA and SNGPL stood Rs. 306 billion.

Other income of the company was reported at Rs. 6.97 billion, up by 163.02% as compared with Rs. 2.65 billion recorded in the same period last year. Whereas other expenses of the company were also down by 91.66% to Rs. 151 million as compared to Rs. 1.81 billion.

However, finance cost was increased by 70% to Rs. 6.54 billion from Rs. 3.85 billion.

Earnings per share of the company was reported at Rs. 13.71 as compared with Rs. 9.05 posted last year.

At the time of filing this report, PSO’s scrip was trading at Rs. 181, down by Rs. 10.72 or 5.59%, with a turnover of 4.60 million shares on Tuesday.