Despite a slowdown in the global economy owing to coronavirus, remittances to Pakistan have crossed the $15 billion mark during the first eight months of this fiscal year (Jul-Feb FY20).

Overseas Pakistani workers remitted $15.126 billion in July to February of FY20, up by 5.4% as compared to $14.355 billion received during the same period in the preceding year, according to the State Bank of Pakistan.

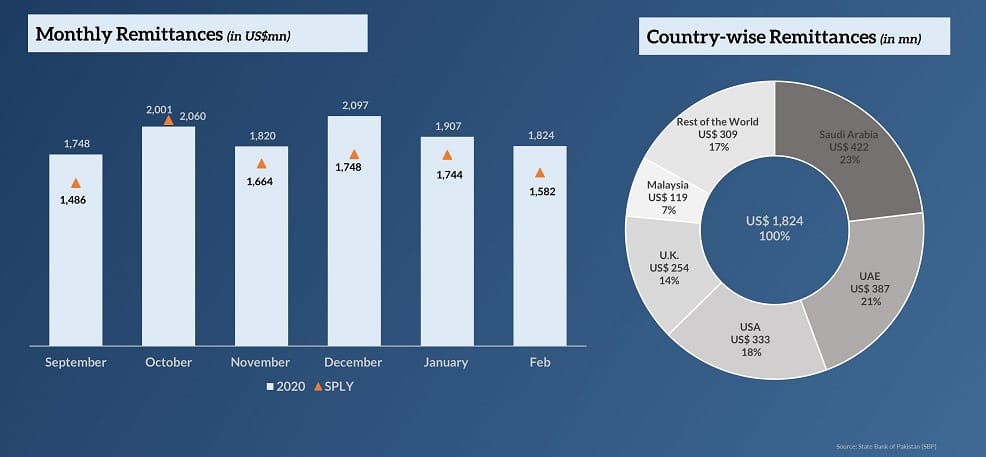

The remittance during February 2020 increased by $242.6 million or 15.3 percent to $1.824 billion as compared with $1.581 billion received during the corresponding month of FY19.

Saudi Arabia was still the largest contributor with a major share in overall remittances. $3.474 billion inflows were received from Saudi Arabia in the first eight months of this fiscal year compared to $3.341 billion in the last fiscal year.

The United Arab Emirates came in second, accounting for inflows worth $3.132 billion in 8MFY20, as compared to $3.034 billion in the previous year.

Remittances from the USA and UK also witnessed an upward trend during this period. Remittances from the United States increased to $2.558 billion. Similarly, the amount from the United Kingdom was reported at $2.306 billion, as compared with $2.195 billion in the corresponding period of last year.

However, remittances during February FY20 showed a decrease of $83 million or 4.4% as compared with the previous month, i.e. January 2020. The workers remitted $1.824 billion as compared with $1.907 billion during January FY20.

The country-wise details for the month of February 2020 show the inflows from the major countries and regions.

- Saudi Arabia: $421.96 million

- UAE: 387.1 million

- USA: 333.5 million

- UK $253.5 million

The present govt took various initiatives to enhance inflows of remittance from informal to banking channels including incentives to senders which is apparently successful.

Further, freelancers’ account limits were also increased recently which is also useful in attracting inflows from the banking channels. A significant part of the remittance is still coming from informal channels like Hawala and Hundi, which needs to be converted into the banking channel to provide benefits to the economy. The cooperation of overseas Pakistanis may help the government attract more remittances.