The Federal Board of Revenue (FBR) has made significant changes in the Income Tax Ordinance 2001 through the Finance Act, 2020 for taxation of the capital gain on the disposal of immovable property.

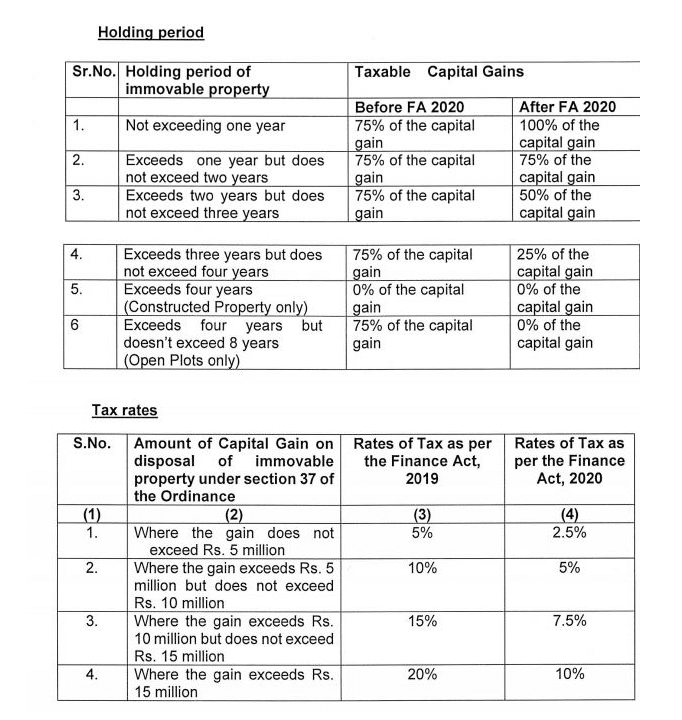

According to income tax circular 3 of 2020 issued by the FBR, the reduction has been made in holding period and tax rates for computation of capital gains on disposal of immovable property ‘Section 37, Section 236C and Division VIII of Part I of the First Schedule’

The following significant changes have been made in Section 37 by Finance Act, 2020 in respect of taxation of capital gains on disposal of immovable property.

In this regard, the bifurcation of immovable property into plots and constructed property has been done away with.

Secondly, the maximum holding period attracting taxation of capital gains on the disposal of immovable property has been restricted to 4 years and percentages of taxable capital gain have been rationalized with reference to the holding period. Tax rates for capital gains on the disposal of immovable property have been reduced. Corresponding changes in section 236C have been made in respect of the holding period, FBR added.

The FBR stated that under the Tenth Schedule to the Ordinance, persons not appearing on the Active Taxpayers List (ATL) are subjected to 100 percent increased rates of withholding taxes as compared to those appearing on the ATL.

Through the Finance Act, 2020 amendments have been made in sub-rule (b) of rule 10 of the Tenth Schedule to the Ordinance whereby payments made to non-residents under sections 152(1), (IAA) and (2) shall no longer be subject to 100% higher withholding tax rates for not being/ appearing on ATL.

However, the above concession shall not be applicable to permanent establishments of a non-resident person for sale of goods under section 152(2A) (a) of the Ordinance, 2001 in view of amendment made in sub-rule (b) of rule 10 of the Tenth Schedule, FBR added.

In order to promote ease of doing business, the Finance Act, 2020 has made certain amendments whereby, effective from 01-07-2020, the threshold of turnover for an individual or an AOP for categorization as a “prescribed person” in terms of sub-section (7) of section 153 of the Ordinance has been enhanced from “Rs. 50 Million and above” to “Rs. 100 million and above” in the preceding tax year.

Similarly, the obligation to withhold tax under section 153 of the Ordinance as a “prescribed person” under sub-section (7) of section 153 of the Ordinance w.e.f. 01.7.2020 shall be limited to persons registered under the Sales Tax Act,1990 having a turnover of Rs. 100 Million or above in any of the preceding tax years.

Prior to the change, all sales tax registered persons irrespective of annual turnover fell in the ambit of a prescribed person for the purpose of tax withholding u/s 153, FBR added.