The Pakistani Rupee (PKR) has continued its blistering run against the US Dollar (USD) and posted gains in the interbank market today. It gained Rs. 1.03 against the greenback after hitting an intra-day high of Rs. 174.25 against the USD during today’s open market session.

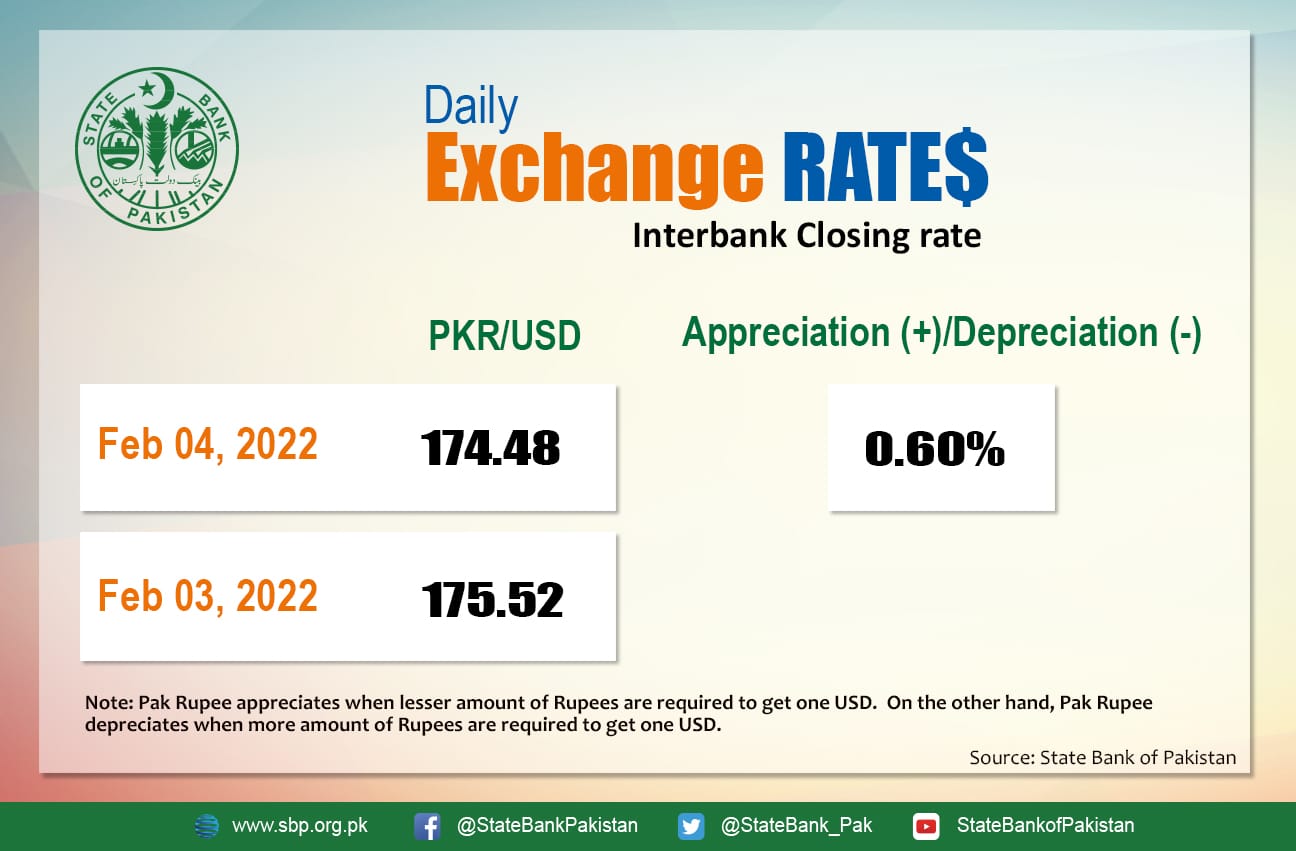

It appreciated by 0.60 percent against the USD and closed at Rs. 174.48 today after gaining 89 paisas and closing at 175.52 in the interbank market on Thursday, 3 February.

According to Arif Habib Limited (AHL), the PKR posted its highest Day-over-Day (DoD) recovery after 17 November 2021. On a Calendar Year-to-Date (CYTD) basis, it has appreciated by 1.16 percent while it is still down by 9.71 percent on a Fiscal Year To Date (FYTD) basis.

PKR recovers 0.59% DoD; this is the highest DoD recovery after 17-Nov-21. PKR closed at 174.48, the highest level after 23-Nov-21

Today’s Closing: 174.48, +0.59% DoD

+1.16% CYTD

-12.73% since its CY21’s high (on 14-May-21)

-9.71% FYTD@StateBank_Pak#SBP #Pakistan #Economy #AHL pic.twitter.com/2WcBnmswEQ— Arif Habib Limited (@ArifHabibLtd) February 4, 2022

Economic analyst, A. A. H. Soomro, told ProPakistani,

PKR’s Rs. 4 appreciation is a direct outcome of the improving Trade Deficit, IMF’s revival and the $1 billion Sukuk issue. The PKR may not revert back to Rs. 165, given the stubborn commodity prices, but Rs. 180 looks distant now, unless Oil prices cross triple digits and sustain.

The rupee closed in the green against the dollar for the seventh consecutive day due to various factors which have converged onto the scene within three days.

First, the International Monetary Fund (IMF) agreed to resume its $6 billion Extended Fund Facility (EFF) program for Pakistan, making available about 1.059 billion for the state treasury. Secondly, the Kingdom of Saudi Arabia agreed to operationalize its oil facility for Pakistan on Thursday. As per the financing agreement, the Saudi Fund for Development (SFD) will extend the financing facility to $100 million per month for one year for the purchase of petroleum products on a deferred payment basis.

Moreover, renowned experts in the game suggest that Prime Minister (PM) Imran Khan’s ongoing visit to the People’s Republic of China is most likely aiding exchange rate consolidation. It has been determined that Chinese corporate leaders want to funnel their Yuans into Pakistan by moving into the country’s state-of-the-art Special Economic Zones (STZs) that were developed as flagship initiatives under the China Pakistan Economic Corridor (CPEC).

Discussing the rupee’s near-term outlook earlier in the day, the former Treasury Head of Chase Manhattan Bank, Asad Rizvi, acknowledged on Twitter that a number of factors are favoring the local unit, and a strong opening is expected for it to grow. He suggested that PM Imran Khan’s visit to China “should help”.

INTER BANK

STRONG OPENING of #PKR is expected,as several factors are supporting Rupee. PM Imran Khan’s China visit should help.

But it is too early to tell if the trend is sustainable beyond near term or not.

In a tv talk, FM Tarin said IMF PROGRM SHOULD BE ENOUGH.

I DISAGREE

— Asad Rizvi (@asadcmka) February 4, 2022

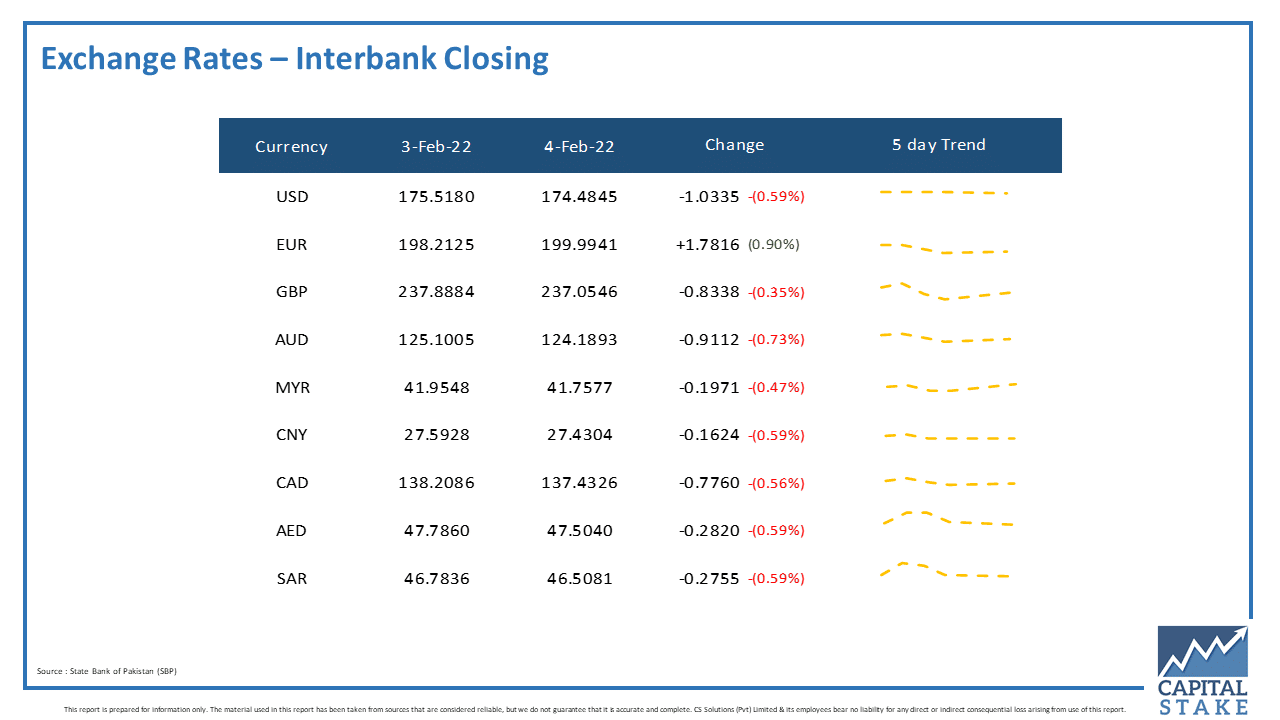

The PKR continued its good run against most of the other major currencies and reported gains in the interbank currency market today. It gained 91 paisas against the Australian Dollar (AUD), 83 paisas against the Pound Sterling (GBP), 77 paisas against the Canadian Dollar (CAD), 27 paisas against the Saudi Riyal (SAR), and 28 paisas against the UAE Dirham (AED)

Conversely, it lost Rs. 1.78 against the Euro (EUR) in today’s interbank currency market.