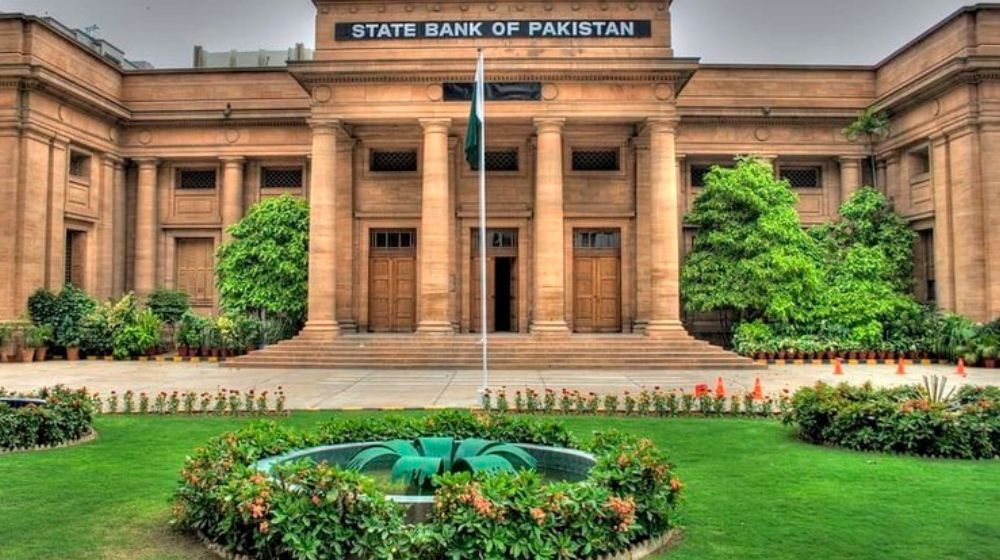

LAHORE: According to a decision by the Lahore High Court, the State Bank of Pakistan (SBP) is exempt from paying property taxes on its real estate located in cantonment regions.

A petition filed by the SBP challenging the Chaklala Cantonment Board of Rawalpindi’s assessment of property taxes and requesting an exemption under Section 99(2)(f) of the Cantonments Act, 1924, was approved by Justice Jawad Hassan.

As per the details, the SBP stated that it was a corporation rather than a business entity like the National Bank of Pakistan or any other scheduled/commercial bank or financial institution.

The counsel of the SBP also argued that the SBP was entirely owned by the federal government and carried out government-related duties because of its powers and functions.

The counsel added that SBP was also mentioned in the Fourth Schedule, Part I, Federal Legislative List at Item No. 28 of the Constitution, and these duties were given to the central bank through an amendment to the act and other relevant laws.

Justice Hassan stated in his 23-page ruling that SBP’s duties fell under the purview of the federal government since the SBP Act and other laws had granted it extensive regulatory authority over a variety of sectors that were crucial to the nation’s economy.

When examining the SBP’s share capital, the judge noticed that since the birth of the SBP Act in 1974, 49% of the shares were held by the general public; as a result, no exemption had previously been requested and the practice of paying property tax had remained.

“The petitioner (SBP) exercises sovereign powers and does public service on the premises possessed by it, and it sets up a perfect case for award of exemption from payment of property tax,” Justice Hassan remarked.

Furthermore, the judge determined that the federal government actually held title to the property that the SBP was occupying and that the cantonment board lacked the power to assess and demand payment of property taxes from the bank.

After granting the petition, the judge trashed the notices/challan forms demanding payment of property tax from the SBP since they lacked legal standing and had no bearing on the law.