Pakistan Software Houses’ Association for IT and ITES demanded the government to retain the exemption of GST on computer software in order to maintain the growth of IT industry in the country.

In the Finance Bill for 2011-12, the exemption of GST on computer software has been removed and 16% GST will likely to be imposed on IT services by provincial government.

President PASHA, Jehan Ara said that proposed amendments in budget will have negative implications on IT and its related sectors, resulting in closure of business, increase in joblessness and erosion of capital.

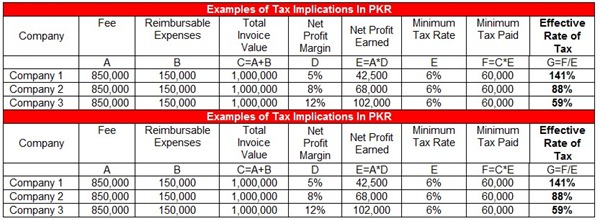

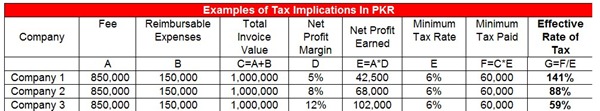

IT/BPO providers have been suffering from high cost of operations to perform back-office functions (such as software development or call center services) to their clients. This has reduced their net profit (NP) margins in Pakistan, which are inherently very low and typically between the region of 5% and 8% of gross sales/ turnover.

Therefore, if the proposed amendment is to be applied, the tax withheld at payment, that is, currently 6% will be deemed as minimum tax having the following impact on IT/BPO companies.

The loss making companies will still be liable to pay income tax at the minimum rate of 6%, which is both counter intuitive and against the basic principles underlying taxation.

In addition, while determining the value of invoice, reimbursable expenses must not be assumed as ‘Fee Earned’ since these expenses are not, in substance, an income and are merely pass-through items.

Impact of General Sales Tax

The imposition of General Sales Tax will increase the prices of the products and services offered by industry making it even more difficult to do business with clients in Pakistan.

The prevailing economic conditions have lead to a drastic decrease in discretionary spending (including investment in Information Technology) amongst companies in the country. The investments in Information Technology are usually seen in corporate sectors experiencing high-growth.

However the negative outlook amongst the corporate sector has decreased the scope of opportunities for many Pakistani IT companies. Some of these companies are moving their operations to other countries and others without the capital to do so are pressured for new opportunities.

The application of GST on computer software and IT services will be a major setback and will almost likely result in significant increase in software piracy.

Taxes previously deducted from payments (at the rate of 6%) to a service provider are to be deemed as Minimum Tax whereas previously these were deemed as advance tax and adjustable against final income tax liability.

The IT and BPO Industry, has been one of the fast growing industries in Pakistan. In 2010, Harvard University conducted an exercise under its All World Network initiative to identify the fastest growing 25 companies in Pakistan and out of these, 11 were from the IT and BPO Industries.

The IT/BPO sector in Pakistan continues to grow rapidly and can be a major contributor towards creating job opportunities as well as to the economic development of Pakistan.

The IT and BPO Industry is still in early developmental stages, has the potential to deliver these high growth rates on a consistent basis and over a period of a few years, which generates transformational impact to the economic fundamentals of the country including employment, balance of payments and exports.

we can say that this BUDGET IS ANTI-PAKISTAN

Where do these associations go when it comes to salaries of IT professionals or when they hire a software expert at mere 8 to 10 thousand per month

In this budget scenario how can growing Software Houses of Pakistan finds stability in their progress! this factor hurts the growth of IT culture in Pakistan

Happy are the people who outsource. BPO FTW, guys.