In a surprising move, Federal Board of Revenue (FBR) yesterday issued a notification according to which tax-rates on mobile phones were revised down-wards — with three slabs — along tax collection at time of sale of each new SIM was re-imposed.

On April 4, the FBR had issued a notification that the tax would be deducted at source from importers of mobile phones and would be passed on to the end consumers. Before April 4th, Rs. 250 were collected from cellular companies as phone-tax at the time of SIM activations.

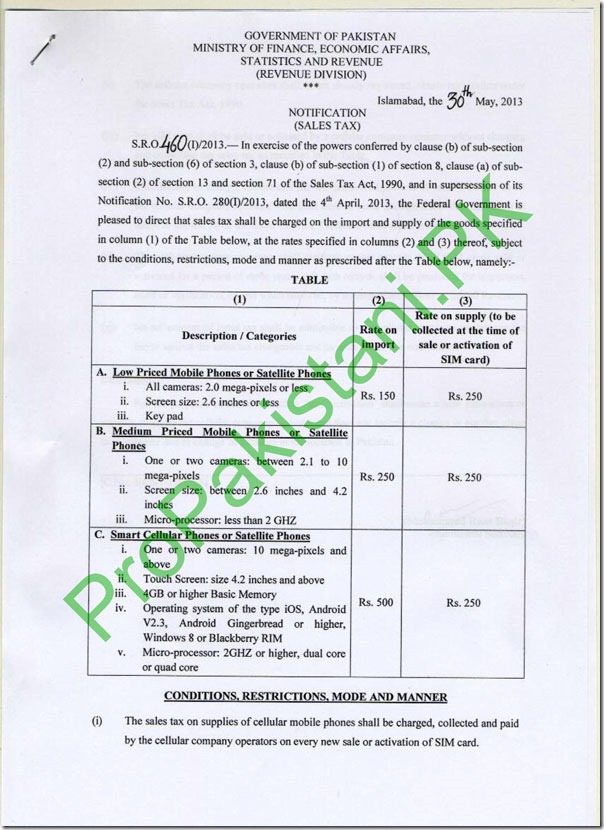

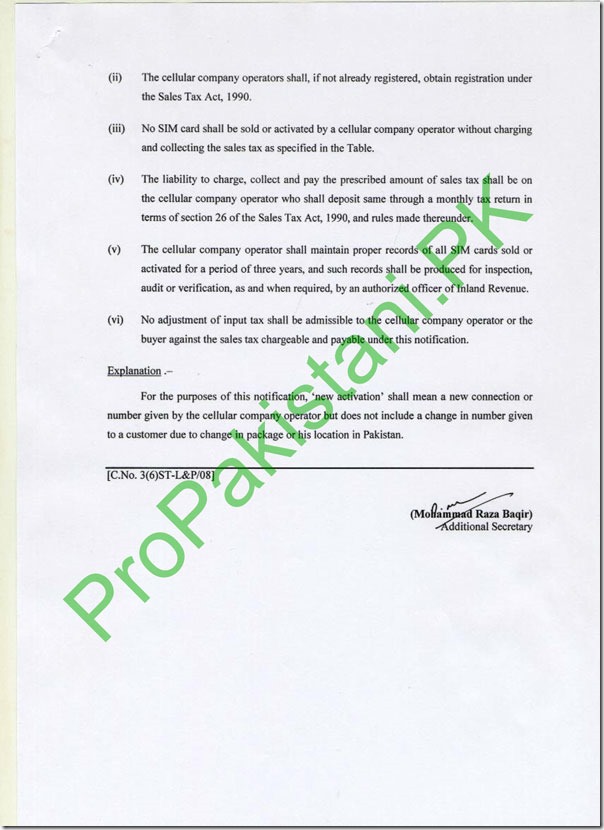

This new notification, SRO460 of sales tax, issued yesterday said that tax on mobile phones will be collected at two levels, one at source while another tax-collection will be made at the time of sale of each new SIM.

According to the SRO – produced below – Rs. 150 as sales tax is imposed on phones with 2.0 megapixel camera or less and or with the screen-size of 2.6 inches or less.

SRO said that a tax of Rs. 250 will be deducted at source for all dual camera phones (front and rear) of 2.1 to 10 megapixel camera, screen size of 2.6 inches to 4.2 inches or having processors lesser than 2.0 Ghz.

Rs. 500 tax will be deducted at source if phone has cameras of over 10 megapixel resolution, touch-screen with more than 4.2 inches, dual-core or higher processors.

Interestingly, all iOS phons, Android 2.3 or higher, Windows 8 or Backberry devices will qualify for Rs. 500 tax automatically.

Moreover, Rs. 250 as sales tax will be deducted from mobile phone operators on sale of each new SIM. With this, the activation tax on new SIMs, which was – according to April 4th SRO – transferred to mobile phone imports is now re-applied.

It merits mentioning here that sale of mobile phones were cut by half during April and May 2013 after imposition of tax of Rs. 1,000 and Rs. 500 on mobile phones.

Mobile phone manufacturers were lobbying hard to get this (April 4th SRO) tax reversed, and they got successful as tax collection has gone back to cellular companies (in shape of SIM activation charges) along with a nominal increase of Rs. 150 on low-end phones, the major chunk of mobile phones that are being sold in the market.

A copy of SRO460 of Sales tax – detailing the new tax mechanisms – is produced below:

Lagta hai FBR walon ke akal bhi ghas charnay chali gai hai, Luto tay Phutto . . jeay Bhutto Jeay Bhutto

(Y)

Jumm Ke Bajao Pakistanio Ki… Bohat Paisa ha hamarey pass :)

True, people buying cell phone in 50k-75k should also pay tax, they aren’t poor.

It’s called sarcasm genius

sim ka tax to theek ha but Ios or high end devices pay tax at least 1000 se above hona chahye 50000 ka phone or tax bs 500 not fair

Yar apni suggestion apne pas hi rakho.

Yar tax do gy to pak survive karygga

Very true, but kuch jahil sochtay hain ky bus inko sab kuch milay muft ma, corruption ka bahana bana kr (ky hamara paisa corrupt log kha jaey gy) …tax na dyna aik aur corruption ha.

I agree with your second part we cannot commit one criminal act by avoiding our taxes..

u r right Ali

and what glory our taxes has brought to Pak yet? For how long we will keep acting like lemmings and keep rendering everything to our corrupted gvt. seriously grow up…

chup kar!!

Very right, one who can give 50000 to Samsung/Sony/Nokia/Apple/HTC and others should spare 1000 for government as well which is already giving billions in subsidy to people irrespective of poor or rich. Here at least rich will pay tax in some form. No comment or objection can justify not paying this tax.

Tell one product in Pakistan on which their is not TAX direct or indirect tax,On an product.

If we give tax what benefit we get. I think nothing.

Yup buddy rich people tax pay karay gy to pak ka budget set ho ga wrna aid k saharay kab tak chaly ge country

and the crowed who uses smartfones represents the richest portion of Paki population. We will never get off aid till we open our eyes

but who made the 2.0 Ghz processor phones ???

PTA :D

Instead of 2.0 Mhz phones, they should have written single core, single core 1.9 is highest — so I would say they meant single core.

biggest idiots in fbr

Why? Because they don’t push you to pay 65% of your earing to government like in US & Europe ? Corruption in government isn’t an excuse, at least you should do your part and then cry if you find corruption.

when the govts of US and Europe take your 65% income the facilities the give you in return are unmatchable. So shut your bias hole.

@Aamir Atta, How you allow such cheap people to even have their post approved ?

@ffy if you run out of your arguments then shut up. First pay tax then demand anything. US & Europe first gets money out of pockets of their people & then they spend on their people. But people like you who cry all the time like a little girl, without even looking into your own corruption by not paying tax, utility bills, bribing in public offices demand rights without even knowing their responsibilities. I am saying this because I pay tax even when I am not in Pakistan, but lazy @$$ like you who are of no benefit to Pakistan have one thing to do…complaining..

US & Europe first gets money out of pockets of their people & then they spend on their people.

but …..

Pakistani Doggies first gets money out of pockets of their people & then f**k the @$$ hole of their people.

our part? by presenting our asses to them for high consumer based taxes. sorry its not possible. talking about 65%? we even don’t get what we pay for here in this country.

I think this is very good decision i appreciate that

The state of mobile services in Pakistan is getting pathetic every day, the call rates and money deduction is mind boggling, sometimes I dont make a single call in a day and 30 40 rupees are gone, and I am sick of calling the help lines everytime and waiting for 10 minutes to get hold of an operator.

Also the reception is getting very bad as well, even Telenor which was amazing for the past 3 years for me is dropping signals every now and then,

This tax wont do much good for our mobile industry.

i think good step :)

bakwas bakwas bakwas mar hi do pakistaiyon ko k zinda kiyon hon koi in crept & creep logo sy nhi bacha sakta FBR walo dosra kam kha raha hin pak min jo ap b khana shoro ho gy yeh gov kaha hy hmari koi action lyna wala nhi hy k itna tax kaha ja raha hin dail arbooo kama raha ho phir bolta ho k piysa nhi hy gov k pass jothaaaaaa