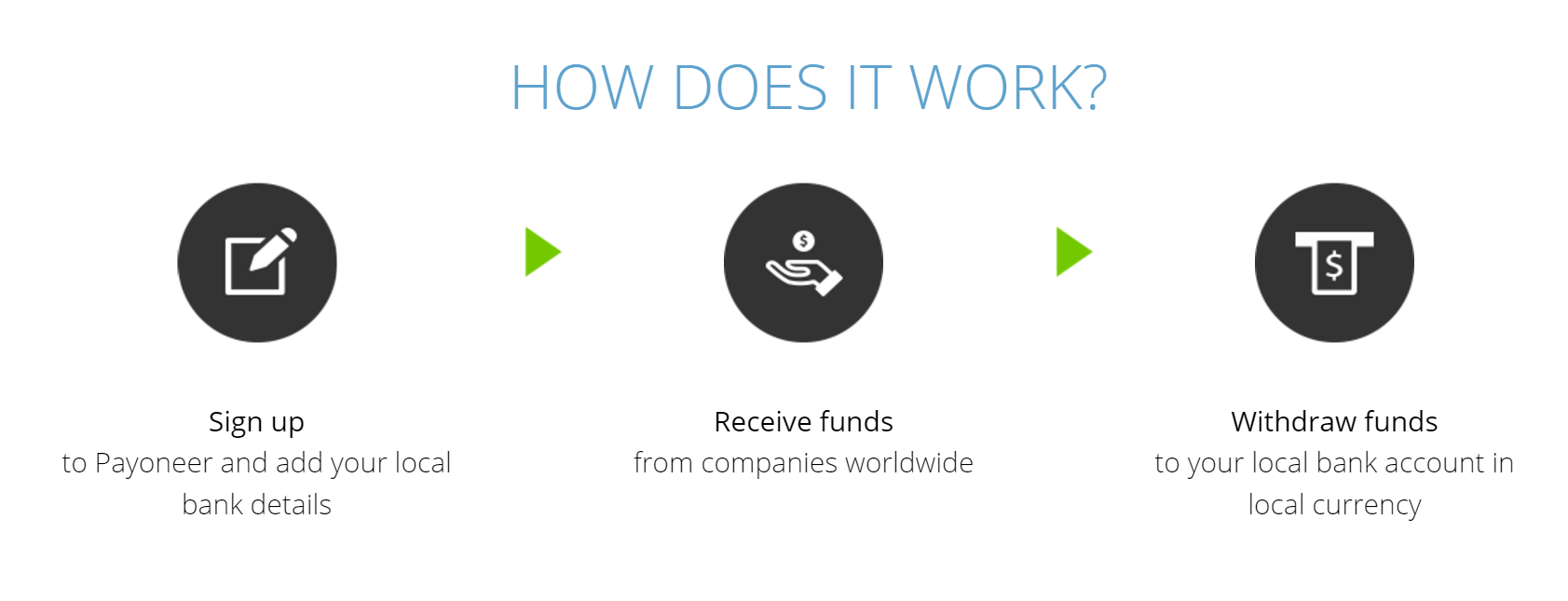

Paynoneer, the global payment processing system, has now opened its wire transfer services for banks in Pakistan, with which, anyone with a Payoneer account will be able to transfer funds from their Payoneer account to a local bank account in Pakistan.

This is essentially going to help Pakistani freelancers who face trouble in charging their foreign clients; especially when PayPal and other popular services don’t work in Pakistan.

Just in case if you don’t know, anyone with a Payoneer account can accept payments from anyone in the world.

Earlier Freelancers used to withdraw their funds through Payoneer ATMs, which was an expensive sport, since there’s notable transaction charge of PKR 750 attached with every transaction users do with Payoneer ATM withdrawals.

Now Payoneer users can simply add their Pakistani bank accounts and request for a withdrawal.

Currently the minimum limit for a bank withdrawal is set at US 200 dollars.

It must be noted that Payoneer currently doesn’t support Pakistani Rupee as a currency, which means your local bank in Pakistan will charge 3.5% currency exchange fee out of these funds as well.

It merits mentioning here that funds transfer from Payoneer into a bank account will be a usual wire transfer and may take 2-5 working days.

My first Payoneer Bank withdrawal is on its way.

For larger withdrawals, banks will ask what is payoneer and they will never recognize it as a “Source of income”. I don’t know why freelancers are treated this way.

you can withdraw in PKR accounts but no tin USD accounts which is a state bank policy .. well every foreign remittance you have to sign a document in bank

Payoneer only allows it in PKR, what is that document which we have to sign? You sure there wont be any problem in making them understand about the legitimacy of this payment.

Why would there be problem? I’ve been receiving for past few months. As long as your bank account is active there won’t be any issue!

If we get more than the given “Source of Income” i heard they question then

nhi krty bhai..ap k konsay crore aany hai account mein..

Open usd currency account with your current account and then transfer your money in that usd account so you will not face any problem.

I also want to work online Can you please guide me how to work and earn.

have u succeeded?

Yes its legal you just have to provide your company or service legal documents and policy terms conditions and there is no worries you can go smooth in any way as you wants.

Koi mujhe bata sakta hai kay agar main Payoneer par bank account mein withdraw karwaun funds, tu jiske naam par payoneer card hai usi ka bank account bhi daalna zaruri hai? Main aur meri dost aik saath kaam karte hain. Card uske naam par bana hua hai. Maine uska bank account daala hai. Likin mujhe apna bhi saath daalna hai. Payoneer wale verify karlenge ya woh reject kardenge mera bank account?

no they will not accept that :(

best is that you open up a joint account with your freinds and your name.

I am assuming the revenue collected on Payoneer is for IT services. Have that amount remitted to your joint account will let you enjoy the tax credit too for exempt income.

IF the payment only comes to your partner’s account, he will be able to get tax benefit but you won’t.

hi

don’t worry.

wo accept kr lenge. mere bhi couzn ka account tha or card bhi us k nam pr tha lekin me ne unhen apna bank account dia to unhon ne verification mangi thi.

unhon ne pocha tha k ye jo bank account ap ne add kia hae ye kis ka hae.

neche bht se options then.

jis me ye bhi ek option thi k kea ye apke employ ka hae to mene us pe clik kr dia.

or ab me us bnk account se paisay withdraw krwata hn.

don’t worry. just do it.

If you open a joint account, the account will be able to accept online transactions and swift transfers made in the name of either of the account holder. Thus you will be able to use the joint account number and YOUR NAME in payoneer and it will work just fine. I know for sure that it works with Dubai Islamic Bank!

yes you can do it. no matter same name . mera khud ka add hai bank account alag name se.

just open an Foreign Currency account to save conversion charges :)

Payoneer only offers it in PKR, they do the conversion and 2% less to mid market rate.

Bhai khola tha Dollar account bhi, but kuch months chalane ke baad bank walon ne khud hi keh dia close kardo warna is main kafi lambi phateekain hogayi hain ab, buhat sare documents sign karne parainge and yeh and woh.

So usko close kar ke phir PKR khol lia. waise Bank Al Habib ke conversion rates itne bude bhi nahi hain. Baki banks ke muqable tu mujhe behtar lage.

Payoneer conversion ker k bhejy ga in PKR, only PKR is supported as of now for Pakistan

Matlab transaction hogi hi PKR main? USD show hi nahi karega aapke bank statement main?

Yes, try adding a bank account into payoneer and it will be clear to you.

Boss maine use nahi kia Payoneer kabhi, Skrill use karta tha kisi zamane main woh bhi band hogaya PK main.

I use skrill and transfer funds from payoneer to skrill and then withdraw to my bank

acha, aap kab se use kar rahe hain yeh? Maine kafi arsa pehle use karta tha aur 1-2 saal pehle Skrill walon ne Pakistan ki support khatam kardi thi, ab kia dobara shuro hogaye hai?

Mein tu kafi arsay say use kar raha hon. Skrill is good.

I know boss Skrill is really good, magar mere pas tu emails aai then support band hone ki. Chalo thanks for informing phir se check karonga main usko.

Han Skrill main ek mushkil yeh thi ke Skrill se aap USD withdraw karo tu woh pehle pound se dollar main convert karte hian aur phir send karte hain. So most of the times $25 ki fee lagti thi mujhe. Aur bank wale kehte they yeh hum nahi deduct karte yeh jo UK se aata hai dollar main covert hoke unki fees hai something

boss ap bhe freelancer hain? dev?

Janab bas koshish kar lete hain thodi buhat.

Bhai , AAp is baray me kafi information rakhtay hain Mashallah say, I am fahad from Lahore, Ager aap mujay whatsapp pay contact ker lete hain to meri kafi pareshaniyan door ho sakti hain, skrill k baray me kafi discuss kerna chahta hun, ager aap bura na manaen to,

+923138421725

Boss skrill main kafi arsa pehle use karta tha, but yes jitna mujhe pata hai utna zarror bata sakta hon. You can contact me on KMQKHATRI @ GMAIL

nahi ab $25 fees nahi lagti. $3-5 dollar lagtay hain. aur bank walay na honay kay baraber paisay kattay hain.

Mery sath bhi yehi masla hwa tha silk bank walon ny €25 kat ly thy .but agar ap NIB ya standard chartered men mangwao gy to pory ayen gy

what was the last time you did that? what else is charged along with 3.95 eur? have you tried receiving in eur currency account in pakistan.

I use SCB and they auto convert euro to rupees

Hi Junaid, I recently make a transaction using skrill and they deduct USD 23.16 as receive money fee, do you know what its about? have they ever charged this sort of amount to you?

Hi I withdraw $100 to $150 and they not deduct as much amount. Usually $3 to $5

Your account is probably now a MERCHANT account! Skrill automatically convert an account to a MERCHANT account once you have crossed a certain transaction limit. Then the incoming/receiving charges of 2.5% to 3.5% come into effect! Thats why skrill is only good until a certain limit. After that the charges for incoming transactions become high and you have to switch to WIRE 2USD or WIRE 2PKR (assuming you are using upwork/odesk) or any similar online marketplace site.

online sell kar dia karain ,,,,,

good idea

who told you, its not working???

Kab se? Mein nai 1-2 months pehlay withdraw kiya tha.

I think I got you, jab aap withdraw karoge usi waqt aapko bata dega ke you gonna recieve X amount in PKR, just like western union and money grams right?

Sohail Bhia Plz give me your mobile number . I need Information.. Text me 03247100020

likha acha ha ap na par lagta ha ap yeh tu india ma rehta ha yeh bollywood itna chaya hova ha bude ma da ka use kia ha agar r use ker deta tu acha tha

Gustakhi ki mazrat Khalid bhai magar mujhe aapka message samajh nahi aaya, agar aap wazahat kar dain tu shayad meri islah hojae. Shukriya…

Same here…

Ma na bhi $ account last month close karwa deya ha. Ab Standard Chartered open market sa around 4 to 5 rupees per dollar kam da raha ha.

Bhai try bank al habib inke rates are way better, abhi 2 din pehle hi 104.45 pe convert hue hain mere pas aur market rate 105.25 tha

Thanks Bro.

So, the conversion rate they provide is around Rs.104 for $1 and what is the transaction fees associated!!!

no transaction fee, transaction fee is beard by the person who is sending the remittance. So no charges on Bank Al Habib’s End

You mean from Payonner to Bank there’s no charges at all! And How much do you got in terms of Rupees against $1 ???

No I meant when someone sends amount through their bank to Al Habib then there are no charges on Al Habib’s end, because the transactions charges would be paid by the one who sends the money.

Regarding Payoneeer charges, a lot of other users have commented on this thread which might be helpful for you.

No I was talking about normal remittance not sure about Payonner charges. I guess you can see other people comments here in this thread as alot of users have shared their experience.

Best exchange rate is offered by Dubai Islamic Bank for incoming USD transfers. There rate 2-4 Rs lower than the market rate. Sometimes there rate is higher than the market rate. Only the following problems:

1. You must get a rate from treasury before 4:00PM bank timings.

2. Your branch manager has to manually approve the transfer/conversion. He gets an email for that and if he is on holidays or forgets that specific email, the transaction is not committed (but this is a problem with all banks)

3. You will probably need to submit an invoice beforehand for seamless commit.

4. 20 USD will be deducte by SCM NOSTRO when DIB receieves the SWIFT message from SCB. DIB does not have their own NOSTRO branch. SO they use the SCB Nostro and SCB Nostro charges them 20USD per transaction.

there are better alternate option than paypal. As Pakistani we should kick paypal butt and focus on alternate especially stripe plugin woocommerce gives option to setup the stripe.

http://ecommerce-platforms.com/articles/paypal-alternatives

https://memberful.com/blog/stripe-vs-paypal/

https://85ideas.com/reviews/paypal-vs-stripe-vs-authorize-net-vs-amazon-payments/

https://www.reddit.com/r/startups/comments/3k3rrr/braintree_vs_stripe_vs_paymill_vs_amazon_payments/?st=iri7fdvm&sh=d3b709e4

Here is another geniue solution open account in Faysal bank get unionpay logo card and join with paypal as they are partner with paypal http://www.unionpayintl.com/MainServlet

https://www.paypal.com/c2/webapps/mpp/faqs-china-unionpay-payments?locale.x=en_C2

Most of the Pakistani banks don’t even allow freelancers to open their accounts. Sorry to say but some treat like criminals… :(

I agree that is why im curious what will happen when it comes to bank.

nothing will happen. B +

100% agree with my brother ahsen i day i visit standard chartered bank in Peshawar i say to the manager that i am a student and i need an account for freelancing and he says did you have 1 lac cash know i said no he reply me so then you are not able to creat an account very rude reply. i try all banks like ubl,hbl,mezaan,standard chartered,fysal,khyber,alfala and many others i try it but they even not giving me a time when i say i am a student and just ignore me so said for that that i am using Payoneer rely help i just apply online and after 1 week i got my payoneer card

Meezan has a basic account option that does not require proof of income. Just ID card for opening bank. Try that. I think it’s called Aasaan Account

Thanks for your advise my brother i ask 1 question did i buy or sell any thing online from that basic account

Brother almost har bank me aik account aisa hai job sirf 1000 Rs se khulta hai. Usay Basic Banking Account kehtay hain. Ap bank jayen (HBL, SCB, UBL or any other) or kahen mujhe BBA account kholna hai

thanks brother i try this time again appreciate you thanks

try to make a group,, let me know if you can talk with even 10 freelancers. I’ll help for bank ac

Plz post here what exchange rate you get when you receive your amount. This service is not new, I have used it around a year ago, but the exchange rate was terrible. I got PKR 80 per dollar whereas the inter-bank rate was over 100 those days. They also have a pathetic customer support, when I reached them to investigate this issue, they simply replied back to me that they have no control over the intermediate banks. My bank, however, denied any extra charges or fee charged by them. Since then, I never tried this service again.

Because freelancers don’t pay taxes. If you incorporate your business, get an NTN on its name and pay taxes, banks will facilitate and government will recognise you as legitimate business.

It services were excepted during musharraf era and I heard it is extended til 2018.

you should better moved to transferwise. i used it twice and without any problem. check their fees and currency rates here https://transferwise.com/u/569b9d

Hello dear i want some help about account…

Best of luck with the payment then man, I made a small withdrawl of about 280 USD a year from now and they made me wait for more than 2 months, I kept calling payoneer and they said the funds are already sent, I called the bank and they kept saying we don’t know!

When it did come after I used some friends at HBL who checked, the Bank wala kept calling and making rude arguments on who sent the money and why, that IDIOT made it fucking miserable for me to freelance.

In my opinion the card is best, yes it cuts alot especially when you need to make a transaction more than 20,000 Pkr but the bank transfer is just not worth it….!

Please keep me posted when you hear from this.

That might be the case but not now.

I have made successful withdrawal and it landed in my account in 3 days. Only 2% less rate than market.

Which bank service do you use? And does this money transfer add up to the tax setup?

I received exact Rs 20841.22 for $203 as Payoneer quoted. No fees or tax deduction. Money received as home remittance in HBL in 3 days.

I used hbl as well man, you have no idea what they made me go through :(

A month late service…!

I don’t know, I have made another withdrawal. I’ll see if I it land in my account in 3 days or in a month.

Hey Abid. Does HBL deduct any money when you transfer money from Payoneer to their bank account?

No, you’ll receive full amount without any deduction.

Are you still usin HBL?. I have a couple of questions, hope you can help me;

1. If you have used fiverr then can you tell me how much money they deduct in transferring amount to payoneer card?

2. Also do you have any experience in doing ATM withdrawals through HBL ATM?

3. For bank transfers, does UBL deduct any charges? Any idea?

Great, its my 3rd day and im also nervous anxiously waiting for the cash to arrive. its confusing how there is no sign of the money except in payoneer transactions to some where in newyork! wire transfer is confusing for me.

Please share your experience when it is arrived

Sure, i transferred $244 to my bank from payoneer and after three days payoneer sent me an email saying that now my dollars have been to converted into PKR and it will be available in pakistani account within 3 working days. I am glad because payoneer only deducted 500 PKR. i donot know much about dollar exchange rates so i use google for dollar conversion. 500pkr is nothing as compared to what i was paying to three different financial institutions

Please let us know the conversion rate of USD to PKR

It has arrived and it is the same money as payoneer told me. payoneer only deducted $5 for the whole process. instead of 25563.88 i received 25,037.05.

Which is the best because previously i was paying $3 to Fiverr, $3 to payoneer and 1100pkr to standard chartered! So now you can do your judgement which one is a better option?

Can you please tell me that in which bank you transferred the amount? I have my account in Standard Chartered and i’m not sure if they will charge me anything for this wire transfer or not. Appreciate your help. Thanks.

Things seem to have changed now. I withdrew $230, from my Payoneer account, on 21st June and received PKR 23076.14 in my Faysal Bank account today, i.e. 25th June.

Yar still like a 1000 Pkr ka difference… .2% bohot ziada lagta hai mujhay dont you think?

Hi, did you receive your payment? it is my third day and no sign of it.. i am a bit nervous i have never used wire transfer before

Compared to withdrawing from an atm which is more cost effective? e.g. If I withdraw $2000 an atm total deducts I believe $200-250 altogether. How much will the bank deduct on a total of $2000 withdrawn?

no from atm withdrawing $2000 deducts only $124 from the total amount I believe. I take out Rs. 20,000 and it shows $203.20 deducted. Rs. 1,245 deducted from each withdrawal x 10 withdrawals is Rs. 12,450

It must be noted that Payoneer currently doesn’t support Pakistani Rupee as a currency, which means your local bank in Pakistan will charge 3.5% currency exchange fee out of these funds as well.

Yeh point samajh nahi aaya, 3.5% currency exchange fee kia?

Wait for some one to withdraw and you’ll see it. All withdrawals will go through by Tuesday at least.

woh tu theek hai magar is post main aisa likha hua hai ke jaise har bar $ recieve karne par 3% charges lagte hain. Halanke aisa kuch meray sath tu nahi. Is liye confirming…

Maine $203 transfer kiya. Mujhay exact Rs. 20,841.22 milay HBL me. Much better than ATM.

Kitna time lagata hai bank transfer ma.

Mere transfer me 3 business days lagay. Rs 102.67 ka rate mila.

Dollars jab PKR account main ayain gay tu exchange fee katati hay 3.5 percent

Aacha strange, mere pas account main jo remittance aati hai $ main us par tu aisi koi exchange fee deduct nahi hoti…

They dont deduct, exchange rate hi Kam milta hay.

Aamir bhai rozo mey baray chittay huay vey ho bara noor aya va hy MASHALLAH :P :P

Agreed but, how did you came to that 3.5% mark?

I just got a remittance 2 days back and the rate I got was 104.48 where as the market rate is around 105.25. My point is how you got to the calculation of 3.5%, I think that is misleading.

So, they gave good rates, better than ATM withdrawals. I just request withdrawal to my Bank.

Please respond here after 3 days how much you got in your bank account along with bank name.

I just got the exact amount in my HBL account. It took only 2 days for the funds to reach my account. Rs. 102.67/dollar.

does it show rate before final withdrawal request? or on request it displays the rate? I mean can we see rate before confirming withdrawal?

Payoneer does support PKR. I just received a confirmation email and that they are transferring PKR to my account

What conversation rate you have got?

Yep, I added my bank account few days ago. You can withdraw minimum of $200. I think it will be better than ATM withdrawals which today costs $201.13 for Rs. 20K.

aare is main tu buhat nuksaan hai around 100 ka para ek dollar. Where as market rate is around 105.

201.13 dollar for Rs 20k …. ?? you mean one has to pay 201.13 dollar to withdraw 20k per ???? common $201= 20100 Rs …. pls check ur post.

Some recent withdrawals

Got you matlab withdrawal main aap PKR hi daloge, thanks for sharing. aur $2.15 Withdrawal fee is really really reasonable. I hope banks don’t deduct any money in between.

Han ek cheez Sohail bhai is main bhi dollar around 100 ka hi par raha hai, jo ke ek bhai ke mutabiq Payoneer ke ATM withdrawal par bhi around itne ka hi parta tha.

meray Payoneer mein sirf 26 dollars hian kia yeh atm say nikal saktay hian

kdr sa atnaa kamay hamy be batao na please

The above is almost a month old transaction.

See a week ago these were the rates for ATM withdrawals. I’m sure Bank transfer will have better rates.

Bank alfalah is mamle me best ha. atm me. :) aur sohail bhai knsi branch se withdraw kia h atm ke?

Everyone can exchange Payoneer dollars and get cash in Bank by me.

are you a sattay baaz?

Online Marketer

ok good to know.

Bro what is the exchange rate that you will give? I have payments of $300+ every month. Let me know how much you will pay me for $100 just for reference purpose

sir ager ma apna acc link kroon payoneer ka sath,to kia koi automatic charges cut toh nhi honga?

help me :(

and what is swift code.

thanks in advance

Bhai aapke pehle sawal ka tu mujhe pata nahi. Baki swift code ki definition neeche likhi hai jo Google bhai ne batai hai.

A SWIFT code is an international bank code that identifies particular banks worldwide. It’s also known as a Bank Identifier Code (BIC). CommBank uses SWIFT codes to send money to overseas banks. A SWIFT code consists of 8 or 11 characters.

Ab rahi baat ke aap apne bank ka swift code kaise maloom karainge tu woh aapko following link se pata chal jaega. But mera mashwara hoga ke aap apne bank ja kar ya call kar ke ek dafah confirm zarror kar lijye ga swift code.

www . theswiftcodes . com/pakistan/

meray Payoneer mein sirf 26 dollars hian kia yeh atm say nikal saktay hian , meray paas Payoneer ka card hia plz help

Pakistanis are wasting their exchange they payoneer either thru atm it wire transfer. Atm withdrawal in pak rs. 750 + exchange difference of 5%. You get $ @ pkr 99 while open market is 105.

Its waste unless you also spend payoneer $ in foreign purchase like server payment , domain etc

We get Rs. 101 on ATM withdrawals. Use your maths, yesterday they charged $201.15, $3.15 is Payoneer fees. So you withdrew $198. So 20,000/198= Rs.101.

I don’t know if this is relevant, but I have a question.

When I need to buy some services from WordPress, or I have to pay someone through Fiverr, they don’t accept, because Pakistan is not in their list. Can Payoneer help me in this regard? Can I pay them through Payoneer? How?

what services are you getting from fiverr? may be ur country fellow can provide to you on better price…

A few clarifications for you guys. Payoneer is expensive, they Charge 30 USD annual maintenance fee and then 1.5 percent for every transaction you receive. When you withdraw from ATM they charge 2.75% Currency Conversion (they charge local banks have nothing to do with it) of mid-market currency, if you do a wire transfer they will charge 2% of the mid market currency rate now in pakistan if you withdraw money through standard chartered, Standard Chartered will charge 300 extra. Bank Alflah won’t charge that extra 300. let me sum it up with you for example if you received a 1000 dollars in a year if you withdraw it through ATM you will pay ( 30 Dollars Annual Fee, 15 Dollars Transaction Fee, 27.5 Dollars Currency Conversion Fee and ATM fee 300/Transaction) so you will end up paying around 84, for wire transfer you will pay (30 + 15 + 20 ) 65 USD – Of course if you are receiving more money than this cost gets lower – I use them because it gives you a US bank account number and your client can ACH like a local bank in USA :)

They charge 1% on Receiving payments from companies. Only 3% if you request payments from individuals. These rates are way better than any other platform.

And Rs.20K limit is of Pakistan ATMs not of Payoneer. If Pakistani bank allow more than Rs.20K we could have saved a lot more in withdrawal fees.

There is no ATM fee if you withdraw from Bank Alflah. Standard chartered and MCB charge fees. Though Payoneer charge $3.15 from every ATM withdrawal.

how much are you charged for ACH?

1%

Contact me if anyone want to exchange payoneer credit with PKR. Thank !

how can I contact you

email me please at [email protected] will share my no there. Thanks !

First of all Payoneer doesn’t support USD account in Pakistan. Currency goes straight into your PKR account. There is a 2% fee attached with every transaction through bank wire. I’m not sure about 3.5% currency conversion charges which is mostly compulsory in cross border money transactions. But Payoneer support write me back with more details and no currency conversion charges discussed. See Attached Image.

When the comment section is way more informative than the actual article :)

I never had a Pakistani bank account and will never have in future! :P I use ATM always for Payoneer Withdrawals.

I tried this feature a year ago and I got very low dollar rate + conversion charges. I think ATM would be better.

Freelancer should use Transferwise now. Check them https://transferwise.com/u/569b9d

I used them 2 time till now. They gave me exchange rate of 104.7. On Payment of 1000 dollor they only deducted approx. 9.90$ in total and money came straign to bank as “Home Remittence” in pak rupees. First transfer took one day. Next transfer was instant and in my account within few hours.

If you have long term clients then get payment through this. Really easy and neat.

chalo kuch to improvement hoi

PayPal is best. Cheap and Fast. I am using it for more then 2 years. I even get working capital of 3000Gbp

What you’re trying to say bro?

We are talking about Payoneer and it withdrawal to banks in Pakistan. You’re commenting as if you’re withdrawing from PayPal to Pakistani banks.

I am sorry. I think my comment was not appropriate here. Reading about the problem people face with Payooner. I was trying to say get PayPal if you can as it a lot better then any other solution

How can you withdraw PayPal to Pakistani Bank? You can’t I’m sure.

Well in my particular case I have a buddy in Uk & Usa who do that for me. But there is a work around. Zoom by PayPal let you directly deposit money to Pakistan bank account in mins

And you can withdraw to Xoom from Paypal? So Paypal to Xoom and then Local Bank Possible?

Kya Bank of Punjab ka koi bi account add kia ja skta hy Payoneer mn?

Yes. Almost all banks can be added.

Thanks brother

Can I deposit money in payoneer card via my local bank as well ?

You can deposit by international credit card using a feature “Request a Payment”

oh I wanted to use that card on google play store.. agar credit card hota tu directly wohi use kr layta lol

It’s really amazing to see that Payoneer now allows people in Pakistan to withdraw their funds from the Payoneer account directly to their banks. I would like to know are they giving the exact rates of $1 = Rs.107 other than the fees of 3.5%.

Kahan se milta hai Rs 107?

Maine withdraw kiye hain $203. 4 Din tak pata chal jayega k kitnay miltay hain.

Good Bro. I am saying current dollar rates are $1 = 104.53 Pakistani Rupee so is hisab se ana chahiye…

Actually this isnt any new feature

I’ve been using it on freelancer.com for a couple of years.

Its actually slower and costs more, so not recommended

Which bank offers lowest withdrawal fee with payoneer bank transfer?

Read about Payoneer and its shareholders:

https://en.wikipedia.org/wiki/Payoneer

Never received Payoneer car,d registered for it months ago.. Guess they are real busy

Can I use transferwise with Payoneer card? For example, I pay from my Payoneer card for the transfer online to save fees and conversion charges?

Best of luck with the payment then man, I made a small withdrawl of about 280 USD a year from now and they made me wait for more than 2 months, I kept calling payoneer and they said the funds are already sent, I called the bank and they kept saying we don’t know!

When it did come after I used some friends at HBL who checked, the Bank wala kept calling and making rude arguments on who sent the money and why, that IDIOT made it fucking miserable for me to freelance.

In my opinion the card is best, yes it cuts alot especially when you need to make a transaction more than 20,000 Pkr but the bank transfer is just not worth it….!

Please keep me posted when you hear from this.

What you’re trying to say is a year ago. Situation is different as of now. It is way better than ATM withdrawals. It barely takes 3 business days.

Requested a withdrawal of $234 from my Payoneer account to my bank account on Tuesday, i.e. 21st June, and received the funds in my bank account earlier in the afternoon yesterday. Took 4 days for the whole process and the exchange rate was PKR98.6/dollar.

which bank you used ?

what what the transfer fees? I dont understand what they will charge per withdrawal

There are no transfer fees, it’s ‘$0’ as mentioned in the picture above.

Which bank.?

In which Bank.?

kindly tell which bank you use

Good News for all the freelancer.

Bank withdrawal option for Pakistan is best I did a transaction of amount $365.76 and got converted amount 37568.94 PKR. Very fast transaction got money within 24 hours after requested. I used Sindh Bank Limited and bank did not cut any fees and I received same amount i.e 37568.94 PKR.

So what is the rate for transaction from your Payoneer account to your local bank account along with associated fees/charges!!!

I have few questions i really really need help with.

1. I am upwork freelancer so if i go with the wire transfers option for getting my payment, does all the bank accept upwork transactions?

2. If all banks accept upwork funds then which bank is most recommend, with good rates and fast transfer?

can anyone tell me the best ATM to use and the maximum limit for Payoneer? And if you guys use a pakistani debit card then which one is the best to use?

bro mugha summint bank ma payment send karni ha kia transaction charge ha or payoneer rate kia data ha

Hello brother is time mary payoneer account main 320$ hain or agr main koe bank account attach krta hoon pakistan main to kitna charges hoga means mujhe kitna baki mila ga. transection free or exchange fee nikal ka. is sa pahly main kisi bandy ko 1$=97Rs ka rate pa sale krta tha, par mujha lagta hai ka main thora nuksan kr rha hoon. agr ab bh main sale krta hoon 97Rs ka rate main to mujha 31040Rs milain ga. or agr main yah payment kis bank account ko attack kr ka nikalwaoun to kitna amount mujja mila ge. koe help kro please. thanks

Can i withdraw my payoneer’s card money to my bank account through Skrill. please let me know as early as possible.

Does payoneer support paypal now????

Koi mujhe bata sakta hai kay agar main Payoneer par bank account mein withdraw karwaun funds, tu jiske naam par payoneer card hai usi ka bank account bhi daalna zaruri hai? Main aur meri dost aik saath kaam karte hain. Card uske naam par bana hua hai. Maine uska bank account daala hai. Likin mujhe apna bhi saath daalna hai. Payoneer wale verify karlenge ya woh reject kardenge mera bank account?

you can sell your payoneer , skrill , BTC , PM $ and get pkr in your bank,,, Use USD currency in Skrill if you are working in upwork or freelancer ,,,

I made a transaction from my pakistani bank account to my payoneer account but the payment was cancelled because my account was blocked permanently IDK why. But they sent me an email which daid that you’ll get the refund but it has been 5 days and I haven’t yet recieved the refund.

Any help would be appreciated.

Is it recommended to use the PayPal accounts from Auction Essistance? Are they safe?

What are the charges to transfer money on bank account? & also it will convert money to pkr. Will they give like original rate 105pkr for a dollar?

As’salam O Alaikum,

I am working as a freelancer for last three years, I have got a permanent online job in a company from UK, They pay me directly in my Bank here in Pakistan using Money Corp service of UK but that takes many days & delays as they required kind of verification proofs etc on large amount so my client as asked me to get a Paypal account where they can pay me within minutes. Now my questions are;

1. Kya may Dubai verified PayPal Account Pakistan may smoothly use kr sakti hon?

2. Kya Paypal se Pakistan k bank may amount transfer ho sakta hy?

3. Meri payment $1000 se kuch zyada ki hoti hy kaheen aisa tu nahi k Paypal block kr dy ga?

4. Paypal k rates kya hote hyn pr dollar.?

5. Kya aap k khayal may mere liye paypal ka risk layna sahi hoga ya bank ko hi use krti rahon?

Regards

Its been a long time than the conversation. but just to include

I withdrawn money from StanChart ATM using

Maximum amount = 20,000.

Dollar rate was 100 rupee. and 600 for transaction Charges. 100 rupees by Payoneer and 500 by StanChart

I want to know about the annual fees of master card that payoneer gave us and is it possible? that they can deduct annual fees from our local bank account that we gave them when we sign up???

doston mene 2 mahine pehle payoneer master card k liye apply kiya tha lakin abhi tak caard mere address per nahi aaya me kese compelain karo. email aati hai “please activate your payoneer master card” samajh nahi aata me kya karu. igaar apne yeh parah to mary help karna. shukria

XL

I want to inform all that HBL has started to mark Payoneer Money transfer as local funds transfer and therefore they are now deducting service charges. Their new criminal method work like this

Your payoneer amount will arrive in HBL Foreign exchange karachi they will create a check and deposit it in your account now this transaction will be taken as LFFT intercity transfer (in case you are living outside karachi)

Bro will they ask for ‘Source of Income’ on amount of 200$ also , I am not 18 yet ‘ can I use my fathers or brother’s bank account for withdrawls ???? Is there still a minimum withdrawl amount of 200$???