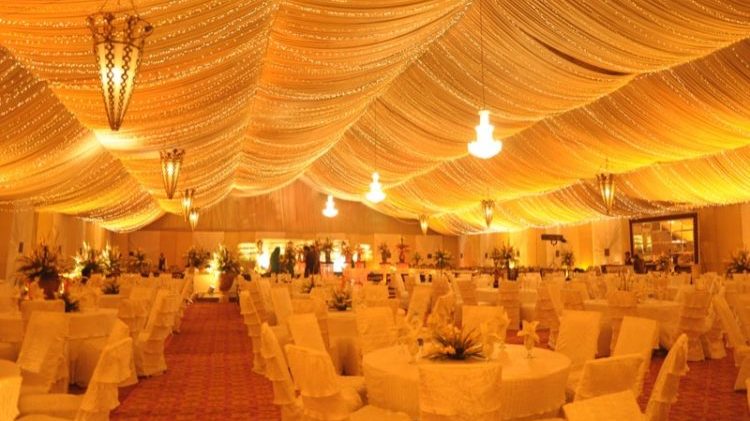

If you thought there was nothing left to be taxed, get ready to be surprised. The Federal Board of Revenue (FBR) has imposed a 5 percent Advance Tax on weddings and gatherings today. The Advance Tax has been imposed under Section 236D of the Income Tax Ordinance 2001.

According to the FBR notification, “Every prescribed person shall collect advance tax at the rate of five percent on the total amount of the bill”. The tax will be applicable on bills for holding any functions at the following places:

The list of events that will be taxed are:

To further clarify the application of the new tax, the notification states that any place where food is served, any similar service or facility is provided by a person or commercial entity, the service provider will collect a 5 percent advance tax on the total payment of such food, service or facility from the person conducting or organising the event/function.

ALSO READ

FBR Pakistan: Complete Guide to Online Registration for NTN & Filing Taxes

The point to be noted is that the government already charges a sales tax at all restaurants and similar service providers. By implementing this additional tax, the public will be even more burdened. Ever since the budget announcement earlier this year, we have been constantly getting mini budgets with more and more tax implementations on daily activities.