Jazz today announced its financial results for the year 2016 while incorporating Warid’s numbers for the first time after merger.

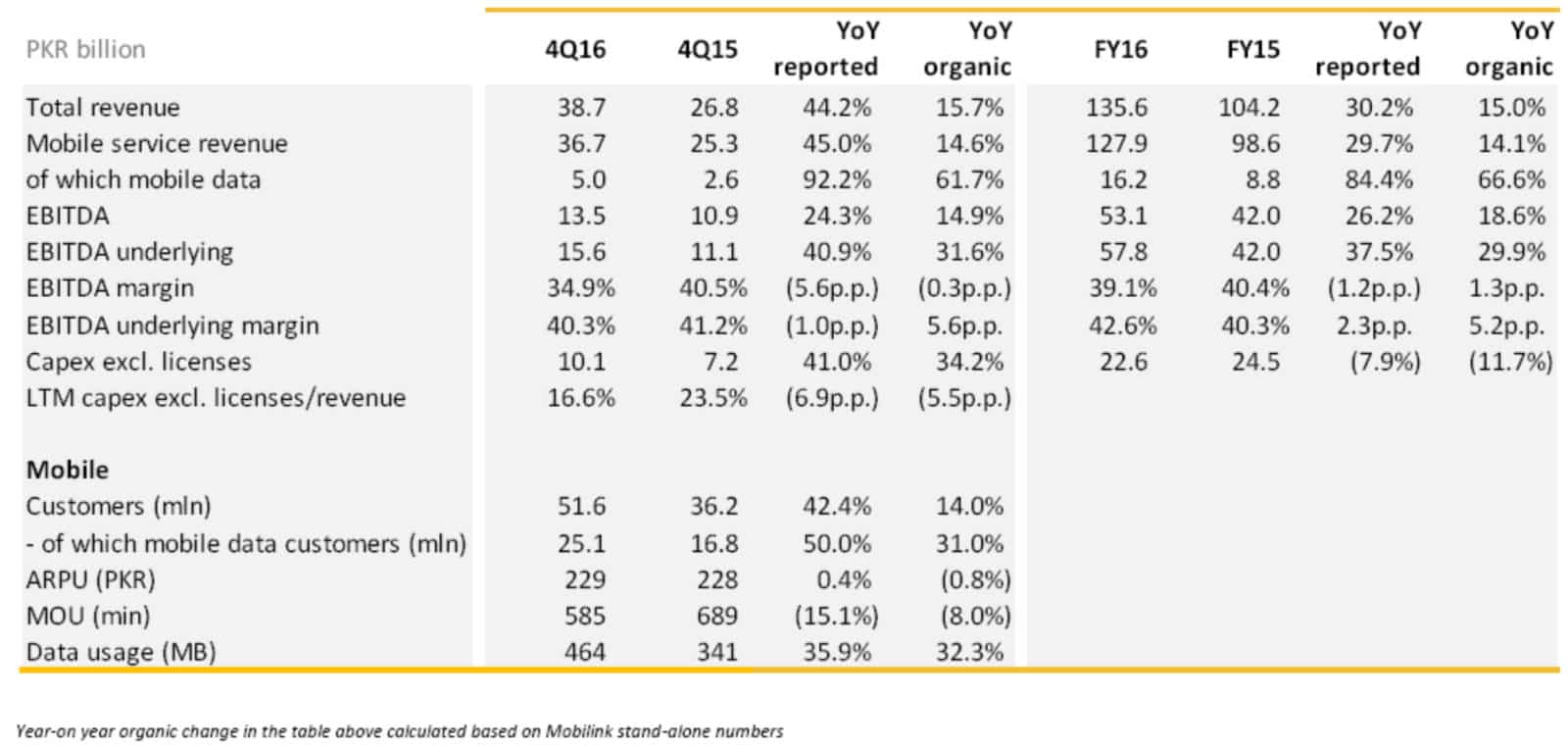

Merged company generated a total of Rs. 38.7 billion in revenues during Q4 2016, up from Rs. 26.8 billion during same period last year.

For the entire fiscal year 2016, Jazz posted a revenue of Rs. 135.6 billion, up from Rs. 104.2 billion during previous year.

Reported service revenue increased by 43% during the quarter, while organically, excluding Warid, it increased by 16%.

Mobile Financial Services revenue continued to show robust growth at 34%.

Data revenue, excluding Warid, organically increased by 62%, mainly due to successful data monetization initiatives, including attractive bundle offers and the unification of the tariff portfolio, together with continued 3G network expansion.

Statement said that Warid’s data was consolidated starting July 1st, 2016.

Underlying EBITDA margin, excluding both restructuring costs related to the performance transformation programme and integration costs related to the Warid transaction, was 40.3% in Q4 2016, slightly lower year-on-year due to the consolidation of Warid during 2016.

Capex increased to PKR 10.1 billion in Q4 2016 while the full year capex to revenue ratio decreased to 16.6% and full year operating cash flow margin was 26%.

Jazz said that it offered 3G to Warid customers in 30 cities while 4G was offered to Mobilink customers in 17 cities.

Interconnect, site sharing activities and marketing synergies reached PKR 8.2 billion of run-rate of synergies in Q4 2016.

Mobilink’s customer base increased 14% YoY in Q4 2016.

Jazz revealed that in November 2016, the company declared, for the first time after 11 years, a gross dividend of PKR 5 billion (approximately USD 50 million) to its shareholders.

More in below chart:

JAZZ Vs WARID 50 – 50 (Profit Equally Distributed ???)

No Warid is purchased by Jazz.

100% Shares agar if they buy why still using name JAZZ WARID ??? why not one & another some new

they have changed name , previously it was mobilink now its Jazz

JAZZ WARID Still using WARID Name :

Aapko larnae ki adat ha . Go get laid with a girl marry and argue with your wife for rest of ur life

Bus Bus Bus Ab Kiya Rulaogy !

Old Warid owners are 15 percent share holders of Jazz. And will get dividend accordingly.