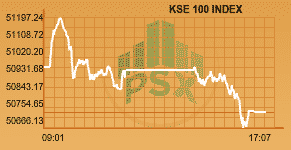

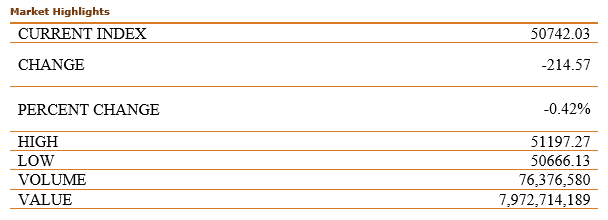

The KSE-100 index fell by 214.57 points or 0.42pc to close at 50,742.03 points level.

The index opened in green but remained volatile as it couldn’t sustain. The KSE-100 dipped by more than – 290 points on the intraday trading closing in red and gained a high of 240 points during the trading sessions.

In the start of the week MSCI had officially reclassified Pakistan as an Emerging Market from a Frontier Market in the much awaited May 2017 Semi-Annual Index Review. Few surprises were on offer where 6 constituents representing Pakistan in the EM space including HBL, UBL, MCB, OGDC, ENGRO and LUCK making it.

These combined, would have a weightage of 0.10% in the MSCI EM Index against generally expected range of 0.15%-0.18%. Moreover 27 stocks have made it to the MSCI Small Cap EM Index. The reclassification would be effective from June 1, 2017

Since the announcement of the upgrade, the KSE100 Index has rallied 42%. Despite the upgrade, foreign investors remained major sellers in the market during the whole week. The budget is also coming next week and it looks like a much more important event as it would set the direction of the market precisely.

Overall 345 million shares were traded in which 76.37 million shares were traded in KSE100 index during the Friday trading session.

COMMERCIAL BANKS was the top traded sector with total traded volume of 68,616,100 shares. It was followed by TEXTILE SPINNING with a total traded volume of 55,911,700 shares and TECHNOLOGY & COMMUNICATION sector with a total traded volume of 23,018,000.

Shares of 404 companies were traded. At the end of the day, 243 stocks closed higher, 153 declined while 8 remained unchanged.

Silk Bank Ltd was the volume leader with 24.30 million shares, gaining Rs 0.04 to close at 1.91. It was followed by Summit Bank with 21.45 million shares, gaining Rs 0.29 to close at Rs 6.63, Kohinoor Spinning with 16.24 million shares, gaining Rs 0.76 to close at Rs 7.22 and Dewan Salman Fibres Ltd with 13.67 million shares, gaining Rs 0.38 to close at Rs 5.69.

The top advancers of the market were:

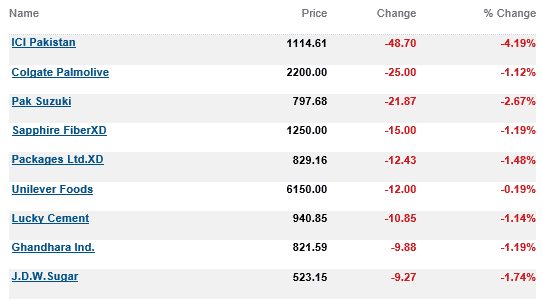

Top decliners of the market were:

Whereas Crude Oil was higher Friday after a seesaw session overnight as the market swayed between supply glut concerns and hopes for an extension of an output cut deal by major producers. It is currently trading at $50.00 per barrel or 1.30%.